A Year of COVID: The Economy

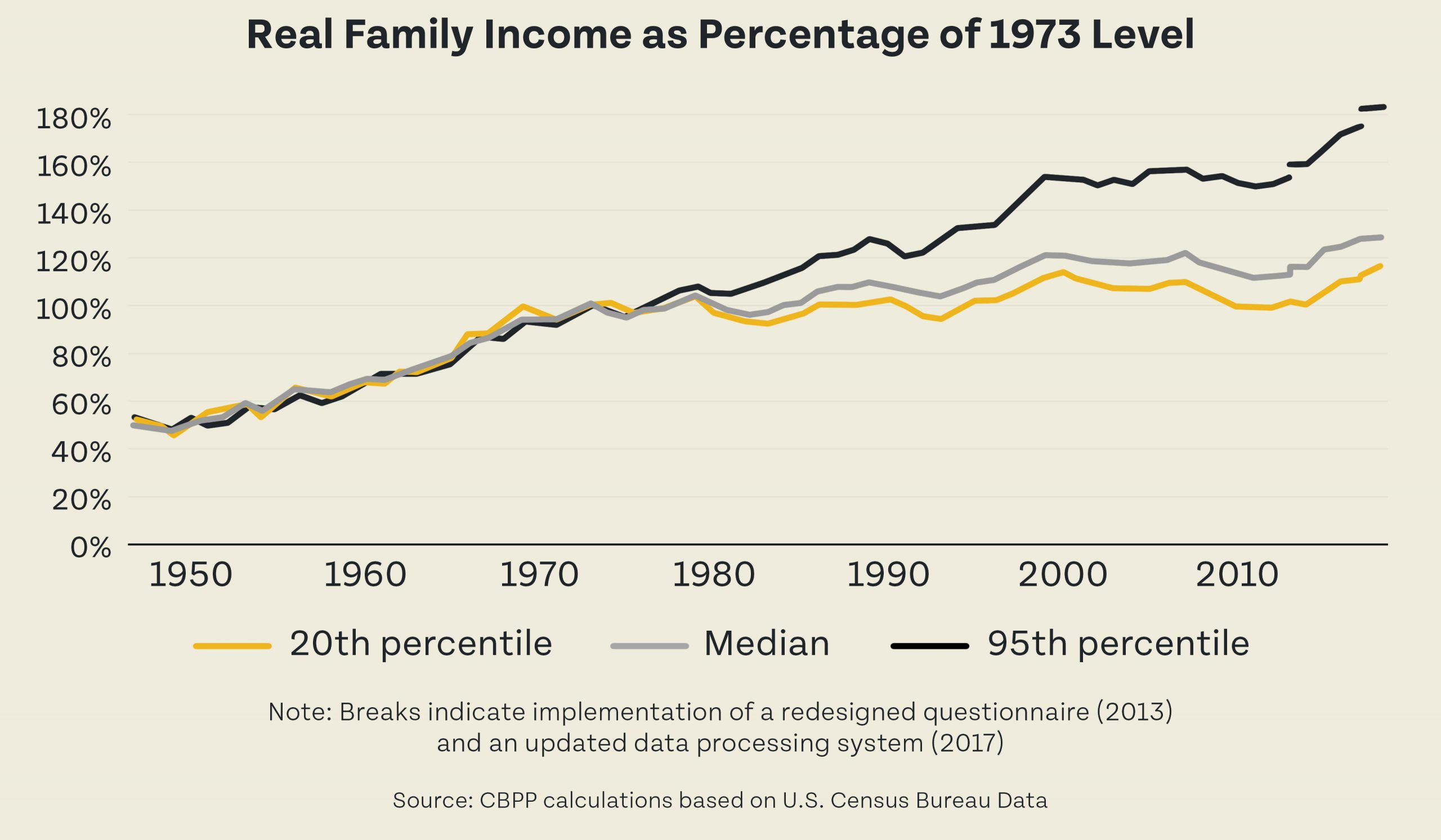

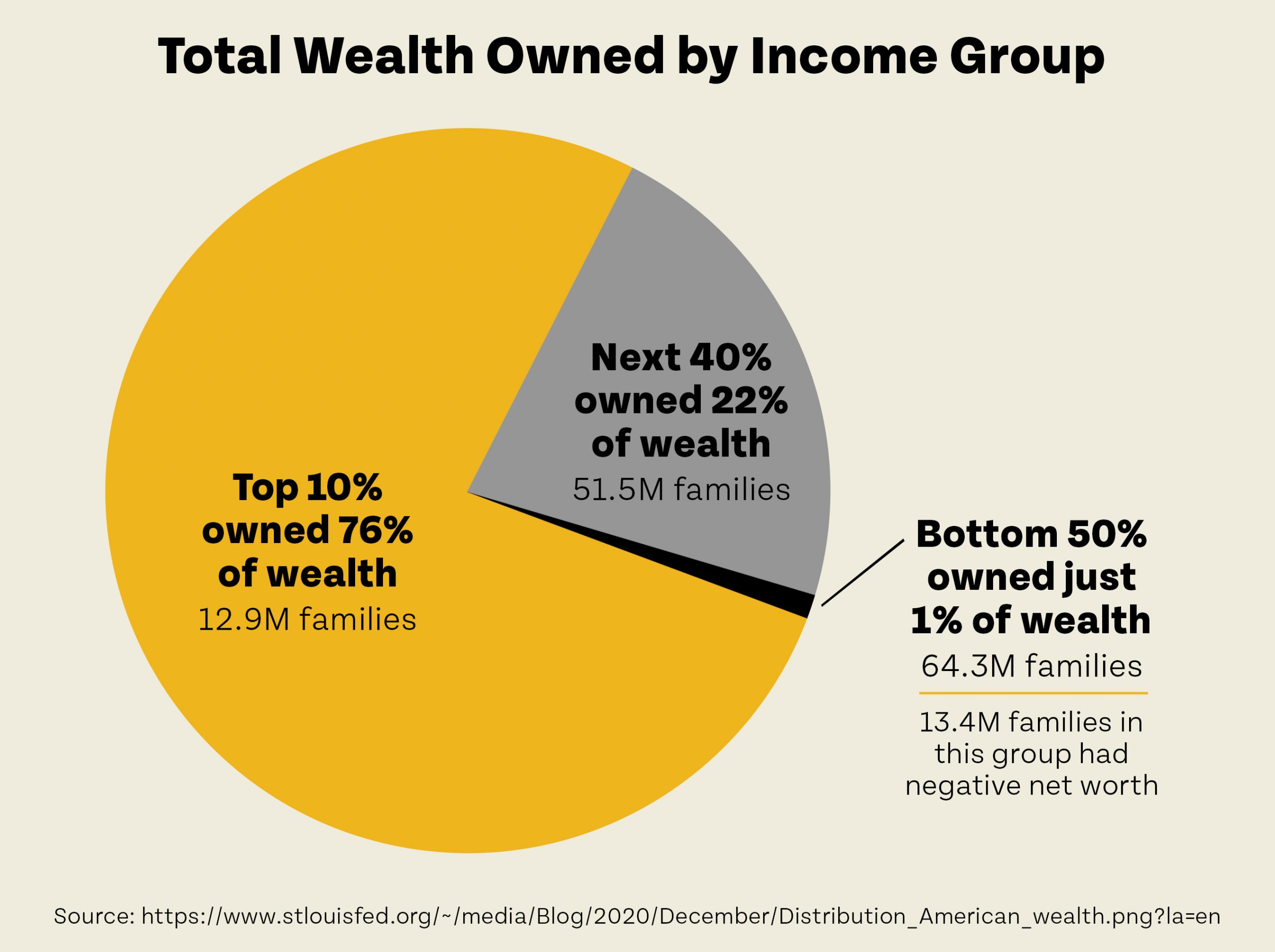

Wealth and income inequality have been growing for decades, as wages have stagnated for low- and middle-income earners and wages and wealth have grown at the top. What the last year of the pandemic — and the associated economic disruption — has shown is that these trends can be exacerbated in times of crisis, as those with wealth are insulated from many of the shocks that those without have to absorb.

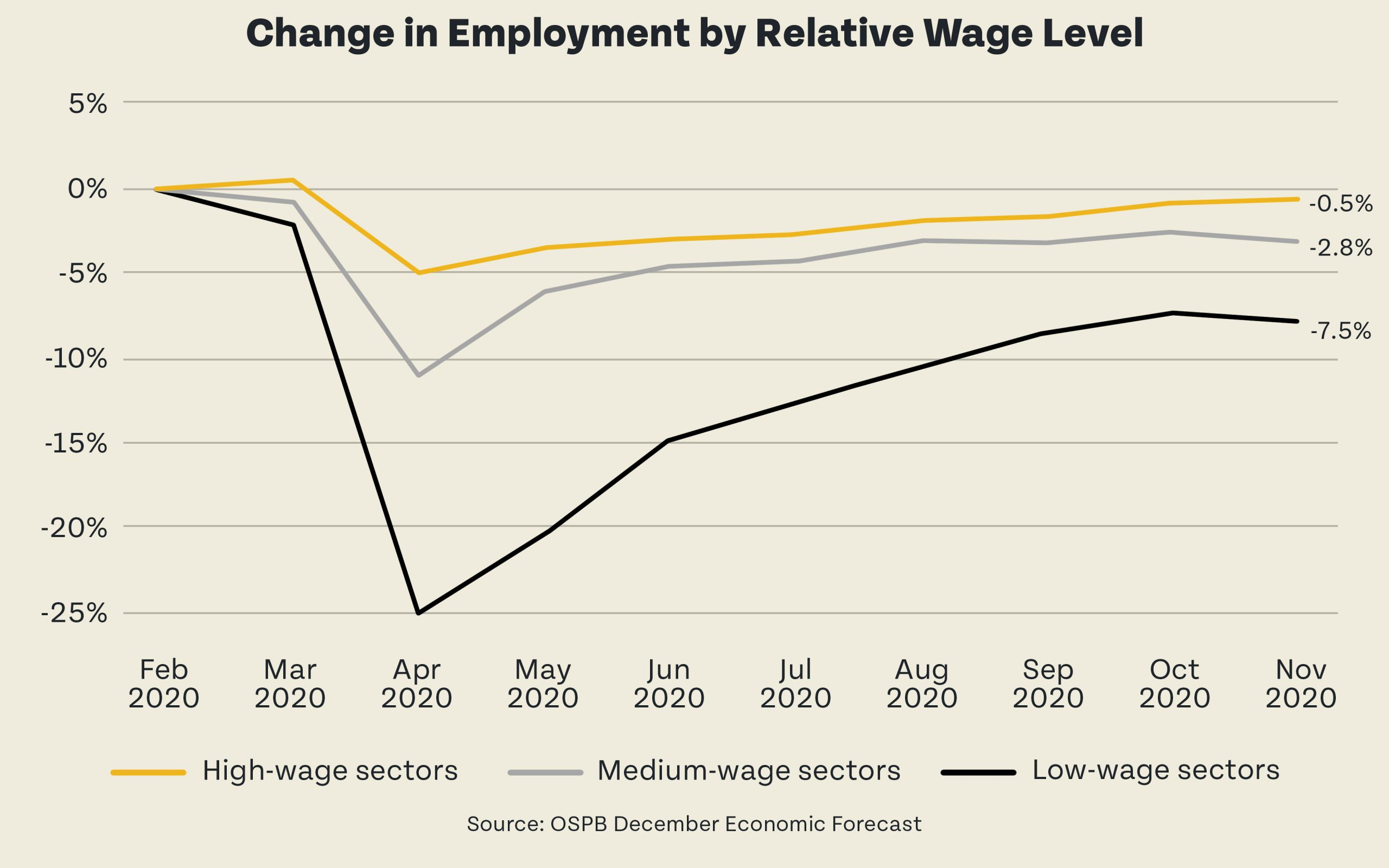

One of the greatest examples of the disparate impact the pandemic has had on the economy can be seen in unemployment charts broken down by income levels. As the chart below shows, unemployment has hit low-income Americans (and Coloradans) much worse than others. While many are celebrating the resilient economy through the pandemic, that just has not been the case for many families.

The stock market has also been a case study in dissimilar economic consequences of the pandemic depending on wealth and income. And while 55 percent of Americans own stocks, most of that is through retirement accounts. According to the Federal Reserve, as of 2016, only 14 percent of the country-owned individual stocks. Those 14 percent have seen significant wealth gains due to stock market increases. For the many people who don’t own stocks, this increase in wealth is out of reach and only seems unfair due to the economic crisis many are feeling. These systems, both seen and unseen, are propping up income and wealth for some, while not helping the many people and families who are not invested in the white-collar world, are proving we have two different economies for the haves and the hope-to-haves.

How Public Investment Can Help to Fix Growing Inequity

An important aspect of the crisis response to the pandemic has been the crucial part the federal government plays. Obviously, state and local governments are not irrelevant, but there are so many ways the federal government can help that cannot be matched by other governmental entities. Colorado, in particular, is ill-equipped to handle the relief efforts that the federal government can. Because of the Taxpayer’s Bill of Rights (TABOR), Colorado cannot have a rainy-day fund within its budget unlike other states. And while Colorado has some reserves, those are unable to function the same way as a rainy-day fund. Furthermore, Colorado cannot keep revenues over an arbitrary limit to save for times of budget crisis. This makes federal fiscal intervention absolutely vital for our state. Finally, like every state, Colorado cannot spend into a deficit, meaning that the federal government is the only entity that can do that.

While the federal government has been slow to enact needed stimulus, what they have done has propped up our economy. These include:

- Infusions of money to small businesses

- Increased unemployment benefits

- Money to state and local governments

- And stimulus checks to millions of families

All of these have all helped to boost people and the broader economy in a way that has helped the macro economy stave off the worst effects that were foreseen last March. But many people are still suffering, even with that stimulus.

Colorado can do more. Colorado has an upside-down tax code — the wealthiest pay a smaller share of their income in taxes, while low-income families pay the highest share. Furthermore, Colorado’s reliance on regressive local taxes, like sales taxes and fines and fees, hamper our state’s ability to respond in a robust way to crises that can be mitigated with public funding. Fixing these two issues would go a long way towards Colorado being able to help people in need during times of crisis. Colorado can make progress towards those goals by extending support to low- and middle-income families through targeted tax credits and pay for them by repealing or reducing certain tax expenditures that go to the wealthy and large corporations.

One specific stimulus idea is the Child Tax Credit. Pushed by Sen. Michael Bennet at the federal level for many years, it was significantly expanded in the American Rescue Plan that was recently signed into law by President Biden. The Child Tax Credit has been proven to cut child poverty substantially, as payments help parents offset rising costs of child care and other child-related spending. In Colorado, the state has had its own version of the Child Tax Credit since 2013, based on a percentage of the federal credit, but it has never been funded. There is an opportunity to fund it this year for the first time ever that would really help Colorado parents.

A year into a nearly unprecedented pandemic has taught us a lot about the cracks and crevices in our society that were too easy to miss when times were broadly going well. But this time has woken many of us up to the problems that were lurking just below the surface. The income and wealth inequality that has been present for so long can no longer be dismissed. Not with millions of people out of work and struggling, while many at the top see their wealth increase in exponential ways. We cannot let an opportunity to fix this pass us by again.