6 Things to Know When Talking About Colorado Taxes

Colorado Taxes Are Regressive

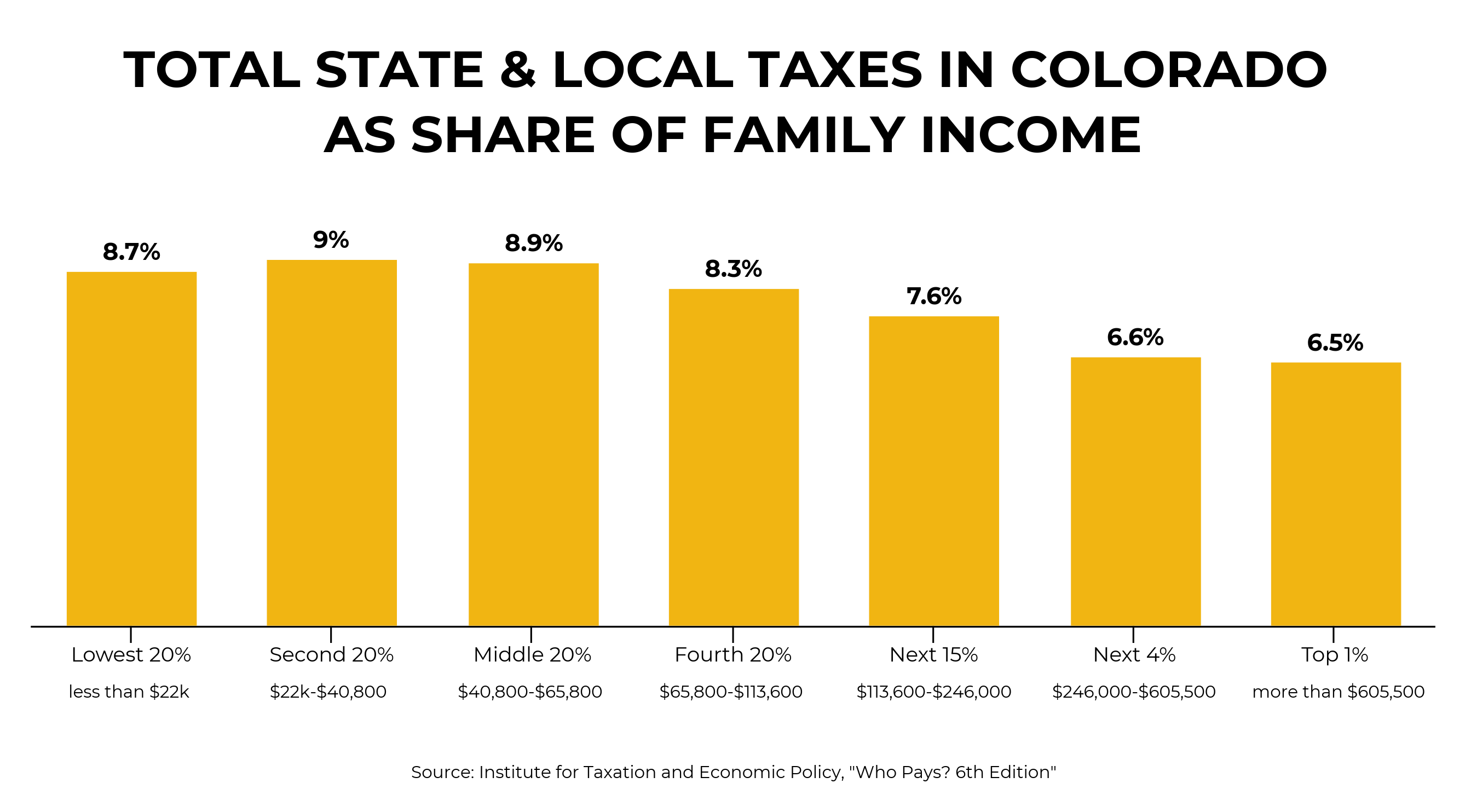

When we combine our state and local tax burden, we see the wealthy pay less of their income in taxes than middle class Coloradans. As you hear more about this issue, be sure to keep the following things in mind about Colorado taxes.

TABOR Prohibits a Graduated Income Tax

Our state’s constitution currently prevents changes that make the wealthy pay more in taxes without similarly burdening everyone else. Until 1987, Colorado taxes were graduated, but today we are one of only nine states that have a flat income tax. We can only change this by making a constitutional change. Several states have been able to use graduated income taxes to reduce the taxes on the vast majority of residents while also generating new revenue for critical state needs.

An Income Tax Cut Overwhelmingly Benefits the Wealthy

According to Colorado Fiscal Institute, any income tax cut would give 40 percent of the benefit to the top 5 percent of Colorado taxpayers.

Colorado Has Significant Needs That Can Only Be Solved Through More Revenue or Significant Budget Cuts

Even with its booming economy, Colorado is significantly below the national average in per-pupil funding for K-12 education, has over $9 billion in needed transportation repairs, rising tuition rates at colleges and universities, and a multitude of other programs that need investments. There is very little room in the budget to boost needed investments without greatly slashing services to other Coloradans.

When State Revenue is Over the TABOR Limit, Colorado Can’t Use Savings From Closed Tax Loopholes on Budget Needs

Loopholes can distort the economy, make taxes inequitable, and force either large budget cuts or higher taxes on those who can least afford them. Because of these and other factors, both political parties have been known to find agreement when it comes to closing loopholes, while many people would like to see a solution to a problem that allows the wealthy to pay less than their fair share in Colorado taxes. However, because of the TABOR revenue cap, we are only left with two options: tax rebates that overwhelmingly benefit the same wealthy Coloradans benefited by the loophole, or create new targeted tax credits that meet the needs of Coloradans.

There Are Ways to Help Coloradans Within Our Existing Tax Code

The Earned Income Tax Credit (EITC) — a very successful nationwide initiative to lift families out of poverty — is one way states, including Colorado, have chosen to help low- and middle-income families. Expanding EITC (something a number of states have done) and fully funding the Child Tax Credit can help Colorado families afford the state’s growing costs of living. Doing this by closing loopholes for those at the top can help achieve some meaningful tax reform that helps families.