Cut Taxes, Raise Revenue: Can Illinois’ Tax Plan Work for Colorado?

Colorado has been grappling with fiscal issues for over two decades. For many, the question is how can we be such an economically successful state — with low unemployment, a booming population, and a high median income — but have so little ability to plug the holes in our system, be it more funding for education, for roads, or for affordable health care? The answer is complicated. If it wasn’t, the problem would be solved.

When it comes to fiscal and tax policy, Colorado is a unique state in many ways. The Taxpayer Bill of Rights (TABOR) has put many roadblocks and obstacles in place that have made it difficult to invest in programs that help Colorado families. But TABOR does not make these things impossible.

Related: Perils, Pitfalls, & Processes of Prioritizing a Limited Colorado Budget

An important aspect of TABOR, is a mandated flat tax rate. That means the personal and corporate tax rates cannot differ depending on the amount of income one takes in. Of course, that model creates inequities in the system, as 4.63 percent of $25,000 in taxes hurts more than the same percentage of $250,000.

Colorado is currently one of nine states that has a flat tax, but one state is working on breaking out of this box, and in turn opening up opportunities to invest in needed public infrastructure.

Illinois’ Tax Plan

Illinois is one of the nine states with a flat tax. It has also put itself in a significant fiscal hole with past choices, including a $133.5 billion unfunded pension liability. The state is in such dire straits, their credit rating is near junk status. That is why Governor JB Pritzker, a wealthy man elected in 2018, put forward a bold new tax plan.

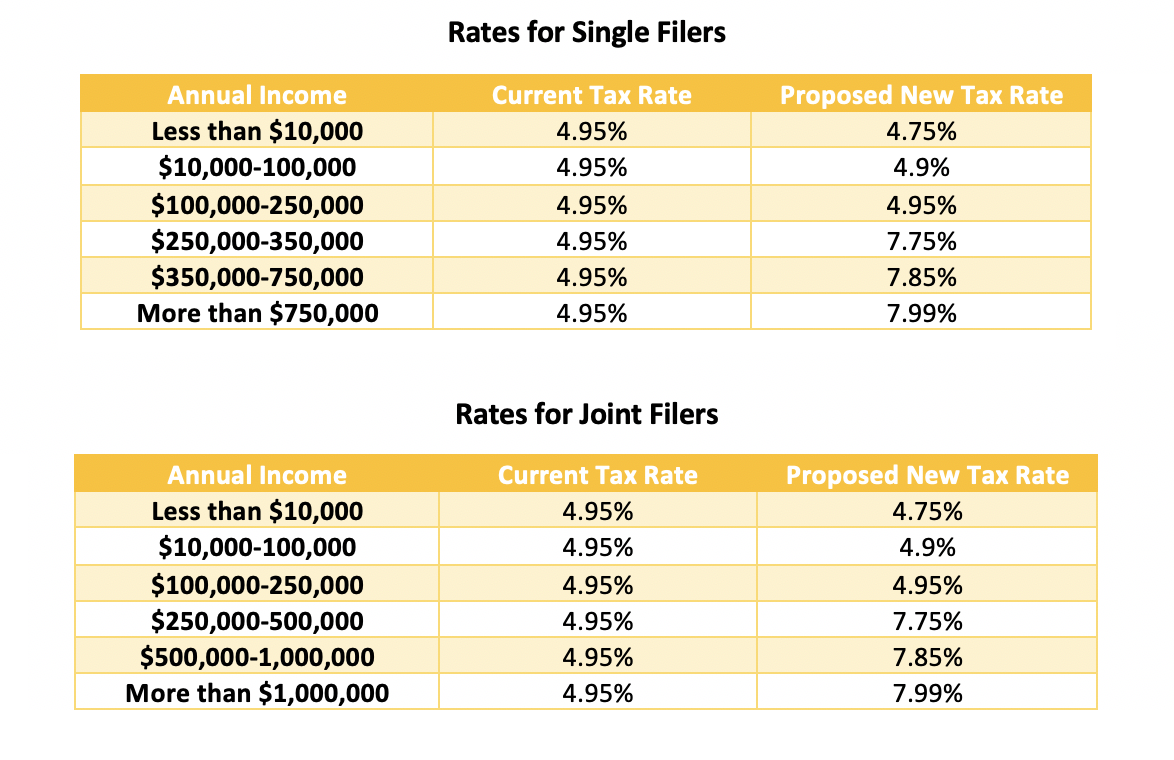

The Illinois House and Senate passed a resolution to put a measure on the 2020 ballot to move from a flat tax to a graduated income tax. The legislature also moved a bill, contingent on the ballot measure passing, to ensure 97 percent of all taxpayers, everyone making $250,000 or less annually, see their tax rates lower or stay the same. If passed, the new tax rates will raise an estimated $3.325 billion dollars for the state.

The tax rate changes are below:

Also, corporate tax rates will rise from 7 percent to 7.99 percent. Illinois is also legalizing marijuana and sports betting, and taxing both industries, to bring in even more revenue and provide robust funding for important initiatives.

The biggest remaining tax hurdle for Illinois is the problem of rising property taxes that aren’t doing enough to fund schools. The state has set up a task force with specific recommendations to try make progress towards a more equitable solution.

Bottom Line

Illinois is a different state with different fiscal issues when compared to Colorado. But the vision put forward by Governor Pritzker presents an interesting look at how changes in tax rates can help people individually while providing the state with needed revenue to make investments and dig out of a fiscal hole. By ensuring that 97 percent of Illinoisans do not see a tax increase, the Illinois legislature and Governor Pritzker are helping to make the system fairer, while also getting revenue that is sorely needed to improve public infrastructure.

While not everything happening in Illinois is applicable to Colorado, there are certainly lessons to be learned. As Coloradans realize our system needs modernization and reform, it’s helpful to look at what other states are doing to help themselves, and give Colorado ideas on how to improve its own fiscal picture.