2020 Policy Proposals: Working Family Tax Credits

The sustained growth following the Great Recession has not had proportional benefit for middle- and low-income families in Colorado. As the Bell outlined in its middle class families study, Colorado has seen a 6.4 percent decline in the middle class since 2000 and it’s clear growth in family income has failed to keep pace with the costs of a traditional middle class lifestyle.

Related: Quick Takes on 2020 Policy Proposals

Efforts to raise Colorado’s minimum wage have helped to generate much needed growth in wages for low income families, but these gains have largely just been making up for ground lost during the Great Recession rather than representing long-term advancements.

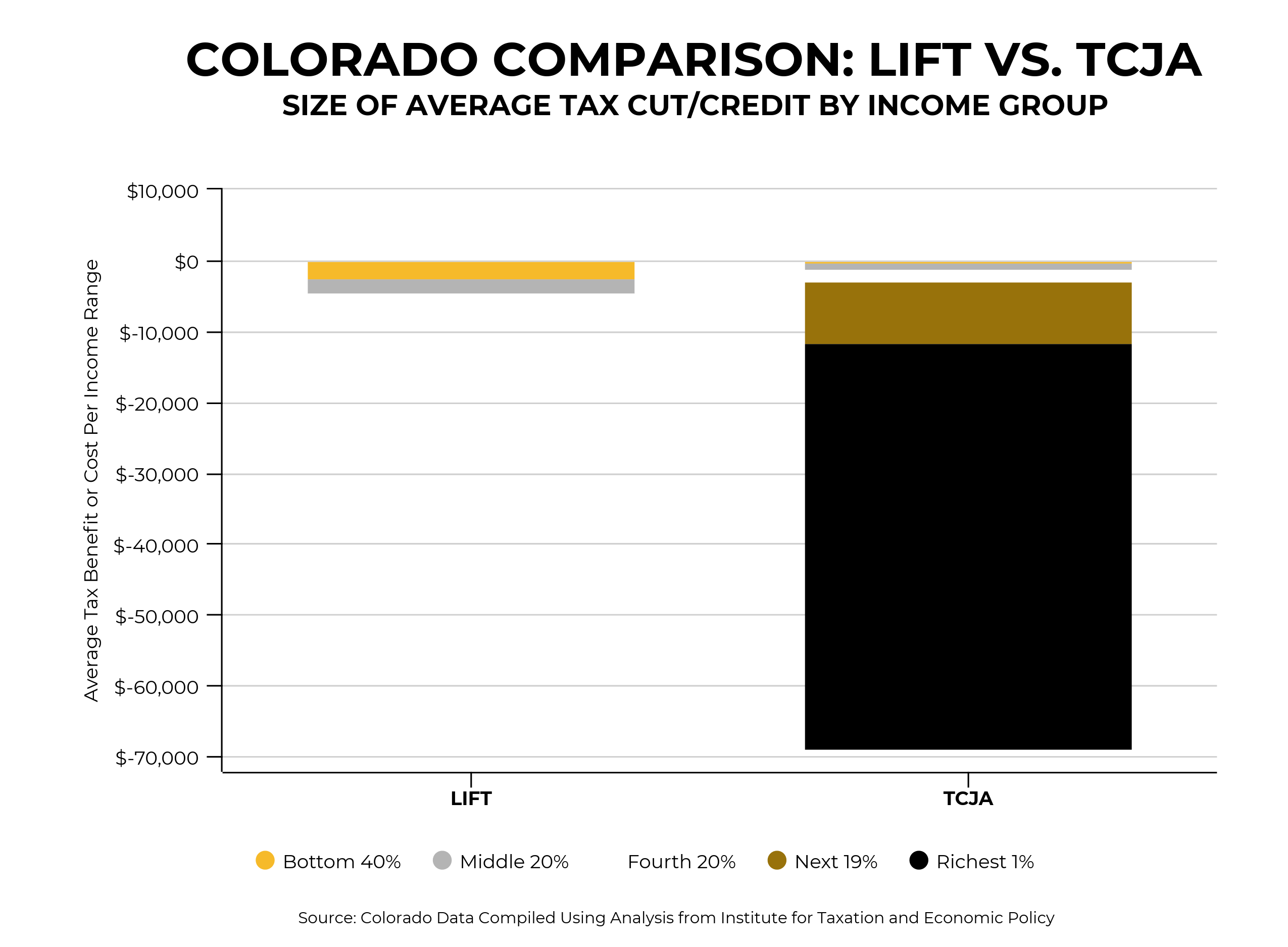

The federal Republican-passed tax cut did little to change these trends, with the overwhelming majority of the benefits of the tax cut going to the richest 20 percent of Americans and foreign investors. In Colorado, 70 percent of the tax cut went to the richest 20 percent.

Based upon the reality of both an economy and a federal tax code not benefiting the average American, it’s no surprise 2020 Democratic presidential contenders have made tax credits for working families a major policy platform in their campaigns.

Background: Tax Credits for Working Families

Using the tax code for policy purposes is not new. The mortgage interest deduction that allows homeowners to deduct certain interest payments from their income was passed in 1913 and provides the equivalent of about $66 billion in yearly subsidies to homeowners.

Tax credits specifically for working families became a larger part of the tax code with the passage of the Earned Income Tax Credit (EITC) by President Ford in early 1970s and a major expansion of the EITC by President Reagan in 1980s. The Child Tax Credit (CTC), the other main tax credit for working families, was passed in 1997 and expanded by the tax cuts of the Bush administration in the early 2000s.

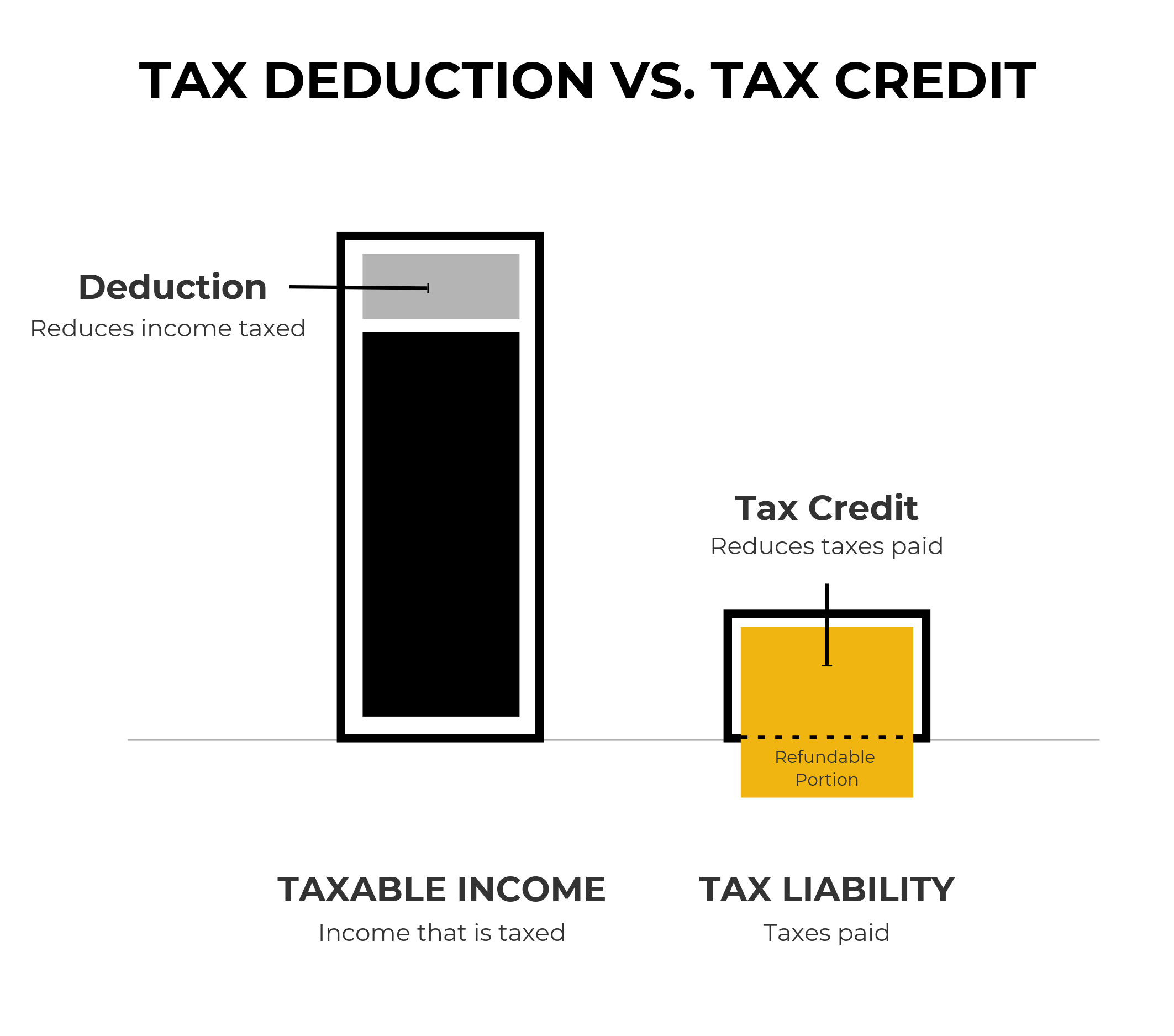

The EITC and CTC both target low- and middle-income taxpayers, with almost all of the benefits going to families with children. They differ from other tax expenditures based upon the fact they reduce overall tax liability rather than reduce taxable income as the mortgage interest deduction does. They are also refundable, meaning a family could receive a refund equal to the remaining credit if the credit had eliminated all a family’s tax liability.

Championed by President Reagan as “the best anti-poverty, the best pro-family, the best job creation measure to come out of Congress,” the EITC, combined with the CTC, has reduced the poverty rate of working-age families more than any other government transfer program in recent decades.

2020 Plans for Expanding Working Family Tax Credits

The programs once championed by Republican presidents and Republican congresses have become the staple of 2020 Democratic presidential proposals. Three of the candidate proposals for greater credits for working families focus on some version of expanding the EITC or CTC. While these proposals still primarily focus on working families, they also address a population that has been left out of previous proposals — single working adults.

- LIFT the Middle Class Act (Sen. Kamala Harris): The proposal would create a new tax credit of up to $3,000 for single people and up to $6,000 for married couples, which would be an addition to existing tax credits. Income limits would prevent well-off households from receiving the credit.

- RISE Credit (Sen. Cory Booker): The proposal would replace the existing EITC and replace it with a more generous credit. In most cases, the Rise Credit would be $4,000 for single people and $8,000 for married couples. People caring for young children and certain students would receive the maximum credit. Income limits would prevent well-off households from receiving the credit.

- American Family Act (Sen. Michael Bennet): The proposal would expand the Child Tax Credit (CTC) for low- and middle-income families. The CTC would increase from $2,000 under current law to $3,000 for each child age six and older and to $3,600 for each child younger than age six. In contrast to the existing CTC, in which benefits come only during a tax return, the benefits of the CTC would be distributed monthly, in advance, so families could pace out their spending and smooth their incomes.

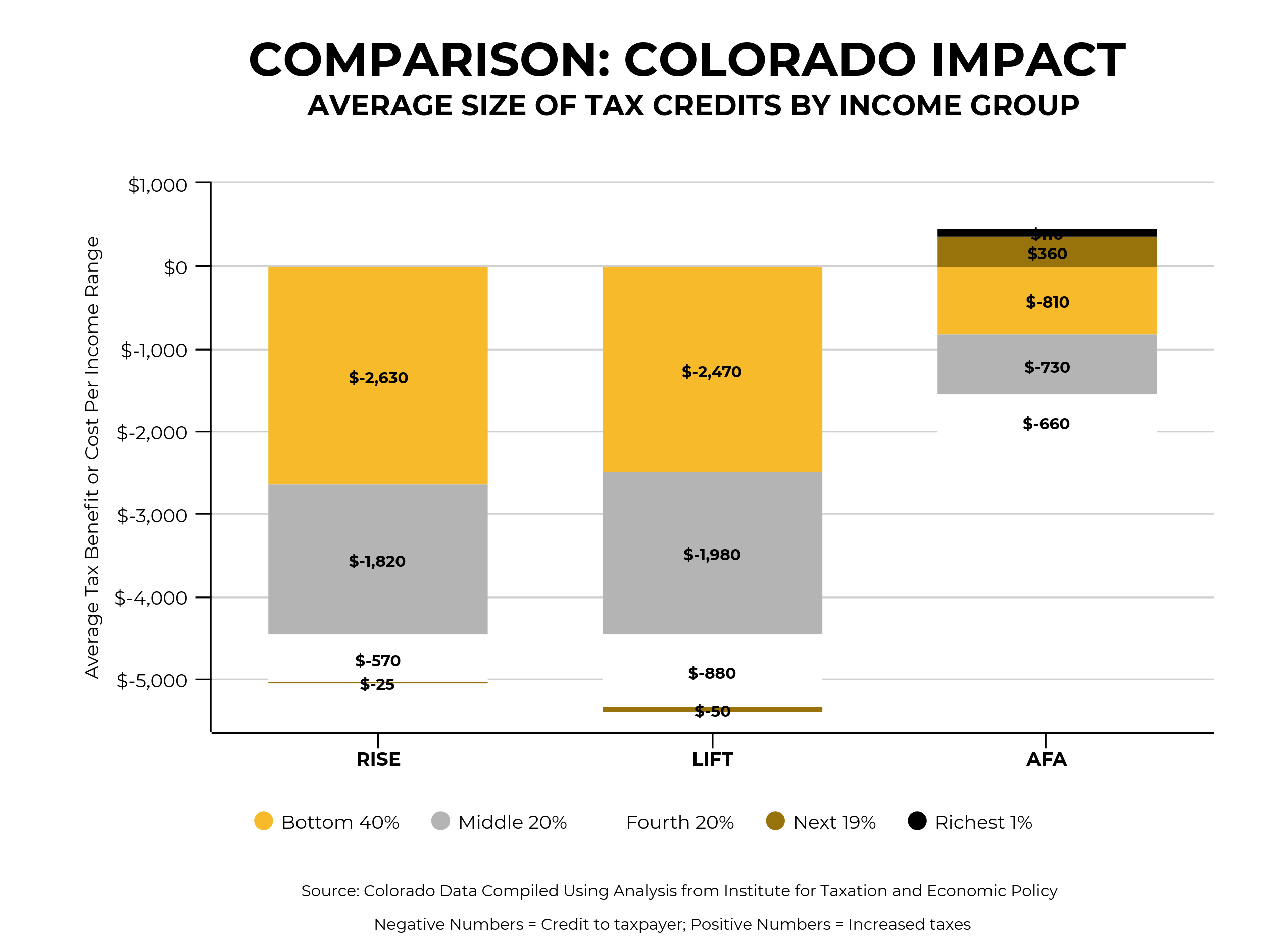

For Colorado working families, the size of benefits would differ under each proposal, but the vast majority of benefits under any of the plans would go to middle class or low-income families in Colorado.

While the Democratic plans may differ in how much they target middle class or low-income families, they all offer a dramatic contrast to the Republican tax cut, the Tax Cut and Jobs Act (TCJA). There are clear winners in Colorado from the TCJA, and it isn’t the majority of working families.

Senators Elizabeth Warren, Kirsten Gillibrand, and Amy Klobuchar have all offered similar proposals to focus on some version of expanding the EITC and CTC for working families. It’s likely many similar proposals will continue to emerge moving forward.

The Bell’s Work on Working Families

Originally passed in 1999, Colorado’s EITC was contingent upon there being a surplus above the TABOR limit (visit our piece on debrucing for a description of TABOR surpluses). In 2013, the EITC was made permanent, providing Colorado families with much needed relief.

Efforts to pass a CTC in Colorado have not yet crossed the finish line. If it had passed in the last session, House Bill 19-1164 would have funded the Colorado child tax credit. The bill passed out of House committees, but the bill did not receive a vote on the floor before session ended. The Bell will continue to work with the lead partner, the Colorado Fiscal Institute, and a larger coalition of partners to move the bill farther in the year to come.

Ensuring the economy benefits all Coloradans, particularly families, remains a priority for the Bell. Whether it’s finding solutions to the cost burdens of child care, the rising costs of tuition, the costs of caring for aging family members, or the struggles of families to stay in the middle class, the Bell will continue to provide the most up-to-date solutions.