In The Know: Fees, Fines, and Add-Ons for Installment Loans

Add-on costs and fees are a growing concern for Coloradans. These additional charges quickly add up and exacerbate financial challenges for consumers. Concerningly, they’re beginning to appear in a growing number of places – whether you’re purchasing concert tickets, renting a hotel room, ordering food – and now, when taking out certain loans.

Colorado lenders must follow state lending laws. These laws limit allowable interest and fees (which are collectively referred to as APR.) Despite existing regulations, however, some add-on costs associated with supervised loans are not incorporated into total APR. Problematically, these exclusions drive up costs and make Colorado a less affordable place to live.

Who and what are supervised lenders?

Supervised lenders are non-depositories, or financial institutions that do not allow customers to make deposits. Supervised lenders in Colorado include SpeedyCash, EZPawn, Check City, Ace Cash, Moneytree, and Checkmate.

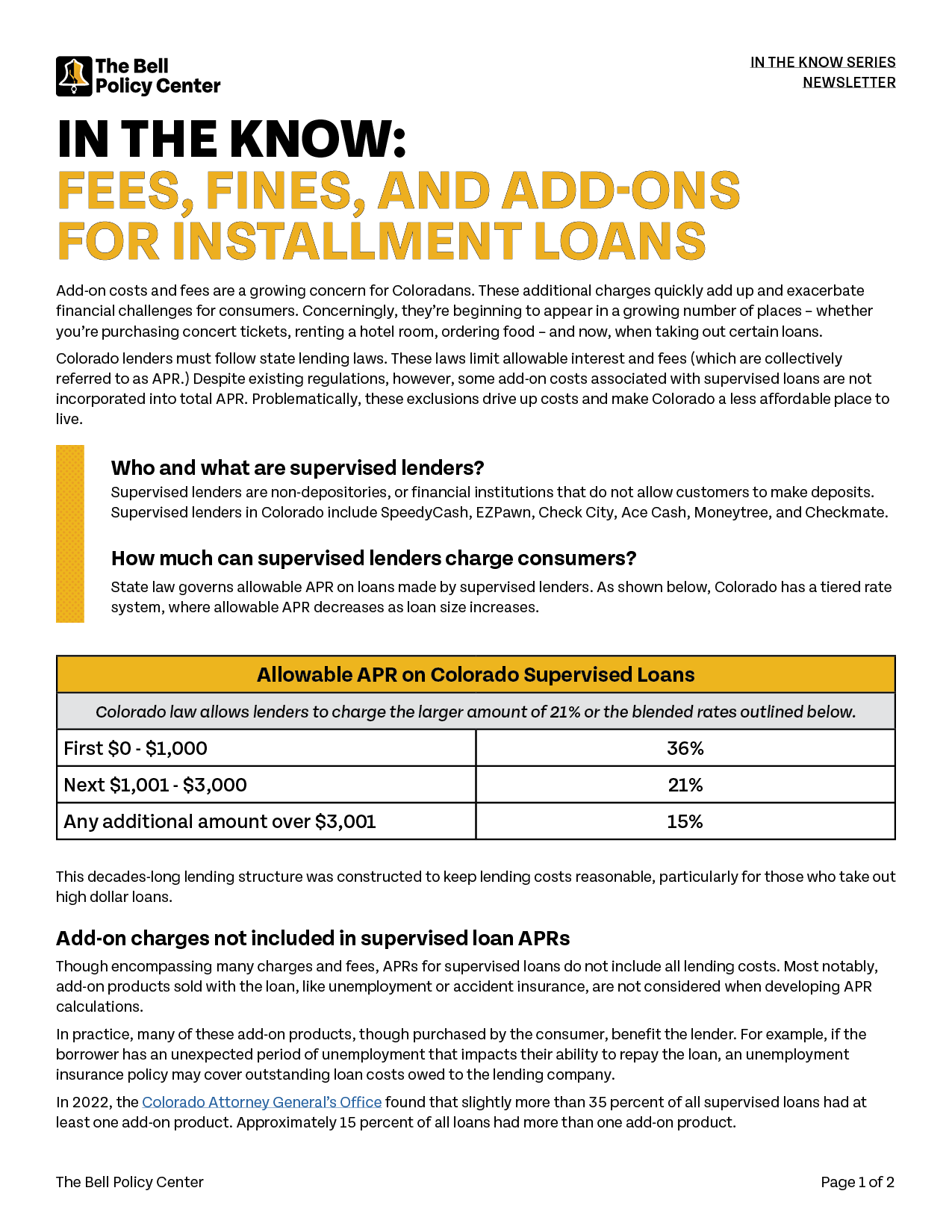

How much can supervised lenders charge consumers?

State law governs allowable APR on loans made by supervised lenders. As shown below, Colorado has a tiered rate system, where allowable APR decreases as loan size increases.

This decades-long lending structure was constructed to keep lending costs reasonable, particularly for those who take out high dollar loans.

Add-on charges not included in supervised loan APRs

Though encompassing many charges and fees, APRs for supervised loans do not include all lending costs. Most notably, add-on products sold with the loan, like unemployment or accident insurance, are not considered when developing APR calculations.

In practice, many of these add-on products, though purchased by the consumer, benefit the lender. For example, if the borrower has an unexpected period of unemployment that impacts their ability to repay the loan, an unemployment insurance policy may cover outstanding loan costs owed to the lending company.

In 2022, the Colorado Attorney General’s Office found that slightly more than 35 percent of all supervised loans had at least one add-on product. Approximately 15 percent of all loans had more than one add-on product.

Problems with excluding add-on products from APR calculations

Excluding add-on products like insurance from total loan APR makes supervised loans more expensive than they might initially seem. Many times add-on products are rolled into the total cost of the loan, in turn increasing the principal upon which interest is charged and driving up costs.

In 2022, the National Consumer Law Center (NCLC) examined supervised loans made in Colorado. Through their work, NCLC found multiple examples where add-on products significantly increased lending costs, as seen in the example below:

Finally, it should be noted that many of these add-on products have received increased scrutiny by the Consumer Financial Protection Bureau (CFPB). In 2023, the CFPB ordered OneMain, a large provider of supervised loans, to pay $20 million as redress for deceptive trade practices related to its selling of add-on products. Among other issues, the CFPB found that One Main misled “consumers into believing they must purchase add-on products to receive loans and that they could cancel the add-on products within a prescribed time period without cost.”

Current laws that exclude add-on products from total APR calculations are allowing lenders to drive up costs in Colorado. Importantly, however, this problem can be addressed. By requiring add-on products to be included in total APR, lending costs can be made more manageable for Coloradans.

Key Facts

- Colorado has a robust history of prioritizing residents’ financial well-being. We’ve capped APR on payday loans at 36 percent, required out-of-state lenders to follow our state’s lending laws, created a first-of-its-kind statewide Office of Financial Empowerment, and developed a new small dollar loan fund.

- Nationally, there was a drop in the number of supervised loans taken out during the COVID pandemic. Since 2021, however, supervised lending has rebounded, surpassing pre- pandemic levels.

- As the number of supervised loans has grown, so have signs of consumer stress. Thanks in part to federal assistance, loan delinquencies fell in 2020. However, since then borrowers are missing payments at rates higher than before the pandemic. Problematically, this can lead to additional charges and fees, which contribute to cycles of poverty and debt.