The 2020 Election & Colorado’s Fiscal Future

While much attention has been paid to the candidates who won or lost on November 3, there were many issues facing Colorado voters that will determine the fiscal future of our state. After taking a long, deep breath, here are some of our thoughts about what happened in this year’s election that will affect Colorado’s budget and tax code, and how we need to do more to make sure our tax code is fair and our public services are appropriately funded for Coloradans across the state.

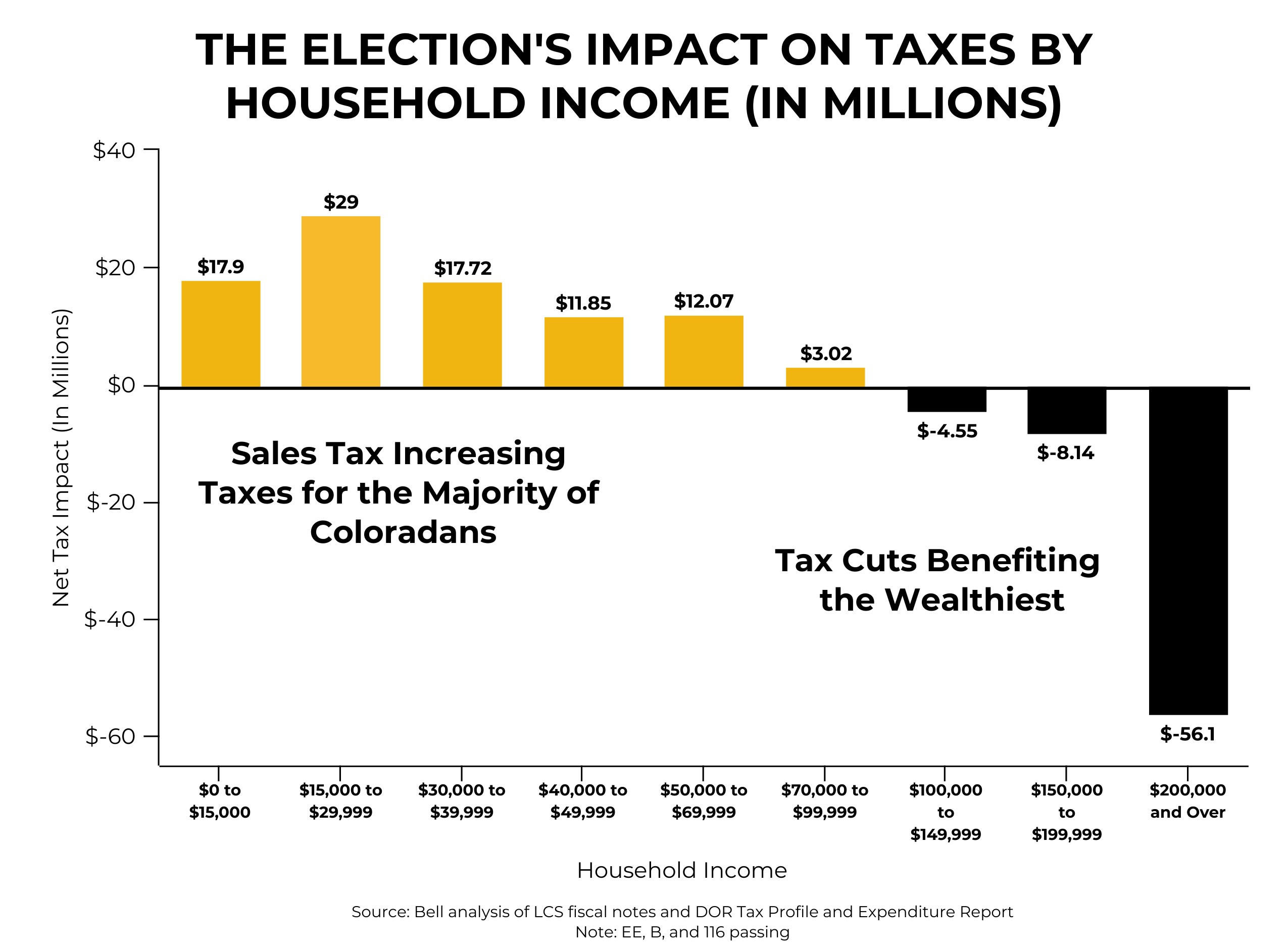

At the same time an across-the-board tax cut passed, so did Amendment B, which will preserve local services and school funding. While Proposition 116 will provide tax relief during a recession, its costs to our state’s public services will be severe. Furthermore, the passage of Prop 116 will make our tax code more regressive, as the tax cut will disproportionately benefit the wealthy and increase the usage of more regressive tax options.

Unfortunately, voters did not have a choice when it came to the structure of the proposed tax cut on the ballot. The pandemic made it difficult to get measures on the ballot, and so voters were not given a choice between a tax cut that primarily benefits the wealthy or a tax cut for 97 percent of Coloradans that would also provide adequate funding for services throughout the state. This is what a fair tax would have accomplished, and a similar measure passed in our neighboring state of Arizona. Without those choices, many Coloradans who are struggling did what they thought would be best. Nevertheless, that will cost our state going forward in budget terms and in making our unfair tax code worse.

Because of the increased regressivity caused by the passage of Prop 116, it is imperative Colorado’s elected officials address the special interest tax credits and deductions that overwhelmingly benefit the wealthiest in Colorado. This will help tilt our tax code back toward those in the middle and at the lower end of the income spectrum, and help address the increased budget crisis caused by the passage of Prop 116. Doing so will ensure our state investments do not suffer more than they need to, while also making our tax code fairer in the long run.

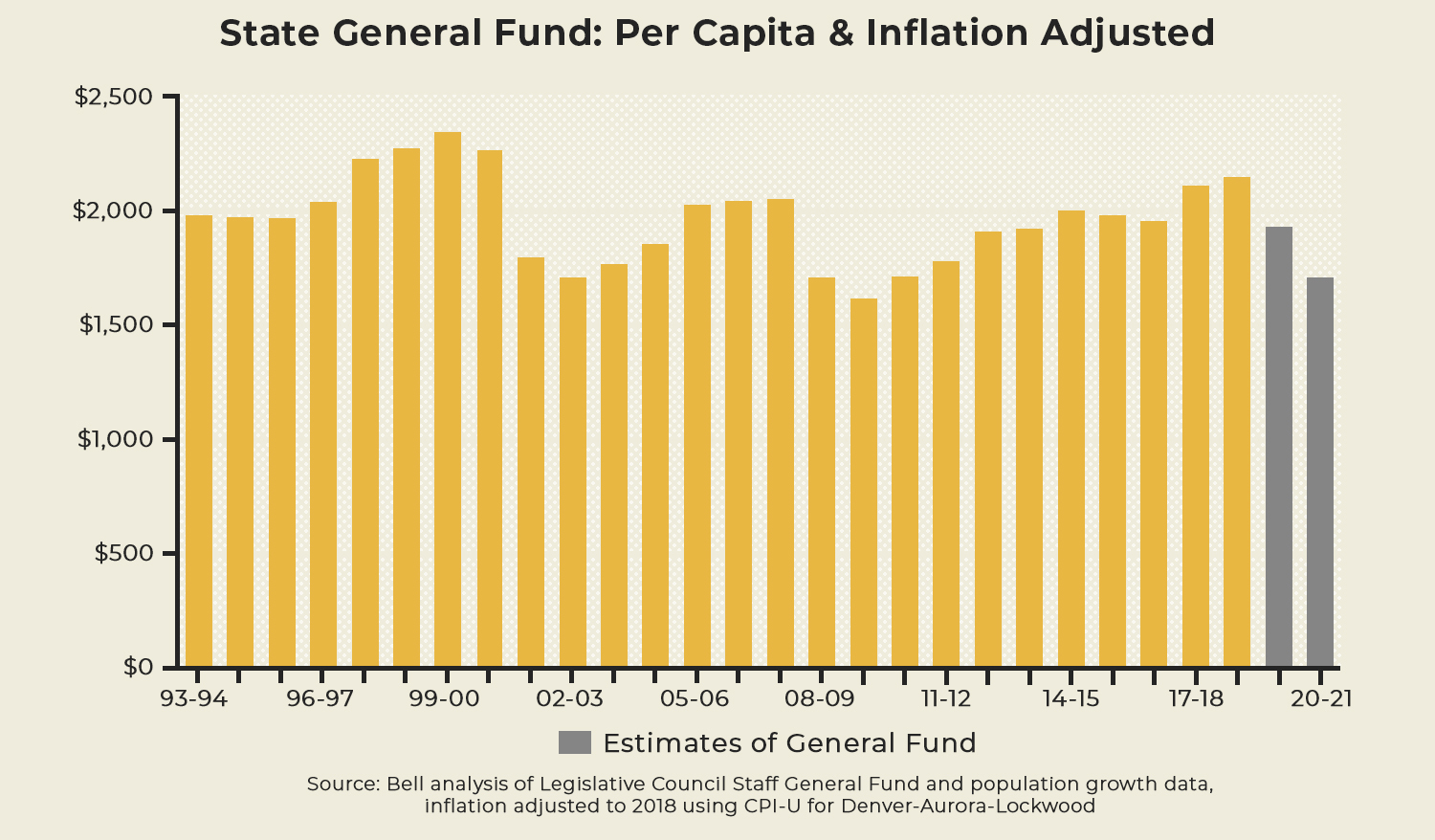

Budget Problems Made Worse

Proposition 116 is a blow to our already decimated state budget. Next year’s budget is projected to be about $1.6 billion below the level needed just to keep pace with demand for public programs, according to Legislative Council Service’s September economic forecast. Add to that the $357 million the legislature will have to cut out of this year and next year’s budget to fund the tax cuts from Proposition 116, and the outlook seems tough to manage. The below chart shows the budget picture, not including the impact from Proposition 116.

Fortunately, the passage of Amendment B, which repeals the Gallagher Amendment, will stave off in significant drops in property tax revenues for counties, school districts, and special districts across Colorado. That would have led to continued severe underfunding of K-12 education, as well as a drop in local services. As a result, the state will not have to find the hundreds of millions of dollars to backfill that lost local revenue, alleviating some of the budgetary pressures in future years. Voters seemed to recognize that property taxes fund important local government services and valued those services over small future drops in property taxes.

There was some short-term relief on the budget from this election, as well, as Proposition EE, the tax on cigarettes and nicotine products, passed. Starting next year for three years, those increased excise taxes will go to K-12 education and housing assistance. That was intended to help plug holes related to the recession from the pandemic, but given the results of Proposition 116, this revenue will be needed even more than anticipated.

Continued Need for Tax Fairness

With a tax cut making our income tax rate more regressive and a tax increase of a regressive excise tax, Colorado’s tax code is even more regressive than it was before the election. Fortunately, the passage of Amendment B will not compound these problems at the local level. As we wrote prior to the election, if Amendment B had failed, local governments would have had to compensate for the drop in property taxes with increases in sales taxes, making local taxes more regressive. That did not happen, but, in totality, this election has set back the cause for tax fairness, as our tax code has become more regressive, and makes that mission even more critical going forward.

We were heartened to see legislators work toward a fairer tax code in the 2020 legislative session, but our elective officials, including Governor Polis, need to double down on that work. A bill, or multiple bills, that end these unfair tax credits and tax deductions will both make the tax code more fair, increase efficiency in the tax code, as well as ensure we do not fall further behind in our investments in communities across the state.

But that cannot be the finish line, as all advocates and policymakers should come together to fight for a fair tax system and fix the rules of our state that have been rigged to allow big business and the wealthy to have a leg up in our tax code. We need a fair tax code that works for all Coloradans. The Bell Policy Center will be there fighting for Coloradans to have access to adequate and available public services and that those at the top pay their fair share.