Tired of Local Regressive Tax Choices? Amendment B Would Help

Amendment B, on the 2020 statewide ballot in Colorado, would repeal property tax requirements that are embedded in the Colorado Constitution. These property tax requirements, known colloquially as the Gallagher Amendment, were passed by voters in 1982 to keep residential property taxes low.

While the Gallagher Amendment has achieved that specific goal, it has also had very real negative consequences. It has forced local governments to lean on regressive taxes and has strained resources at the state level. With the state having to foot larger bills for K-12 education, because local governments have had to cut back due to low property tax revenue in many places, our state budget has had to take on additional burdens that it is unequipped for. We need to be rethinking the broader tax code in Colorado — and that includes property taxes.

The Gallagher Amendment froze the ratio between property taxes collected statewide from residential and non-residential property — 45 percent to 55 percent, respectively. It put the non-residential assessment rate in the constitution at 29 percent. As residential property values have risen substantially since 1982, the residential assessment rate has decreased from 21 percent in 1982 to 7.15 percent currently, in order to maintain the 45-55 ratio. That has meant in many localities — especially those that don’t have a commercial property base or large mineral interests, which have the non-residential assessment rate of 29 percent — there are fewer property taxes available to sustain services.

As mentioned in our 2020 Ballot Guide, the residential assessment rate is projected to decline from 7.15 percent to 5.88 percent if Amendment B fails at the ballot. That will lead to a nearly $500 million loss in revenue for school district and more than $200 million lost in county revenue across the state.

A Shift Toward More Regressive Taxes

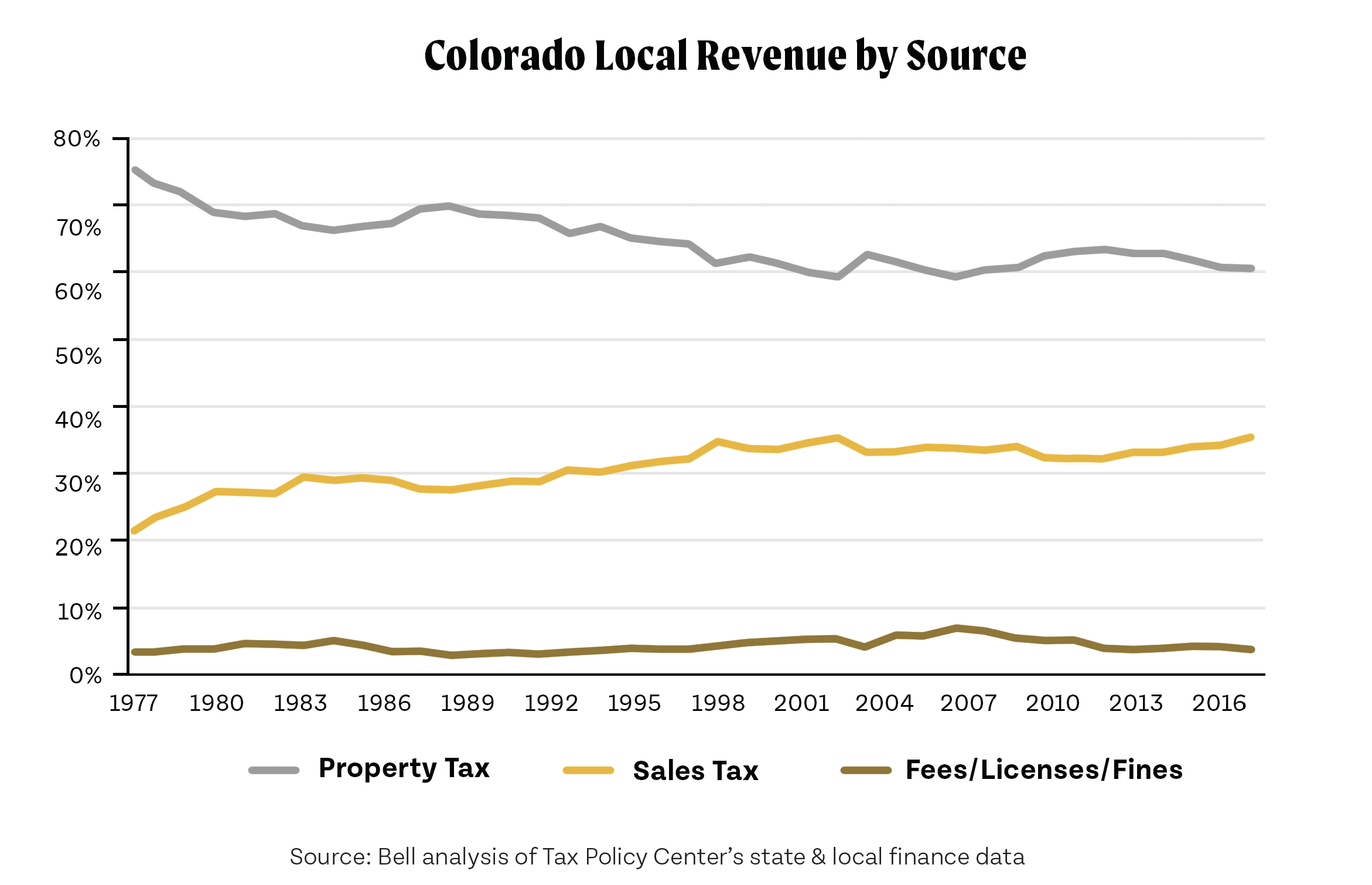

Property taxes are an essential part of county revenue, local K-12 education funding, and funding for special districts. They help pay for first responders, city and county roads, as well as education, among many other crucial local services. But, with total property taxes declining over the last 35 years, that has left counties, municipalities, and special districts to compensate in other ways. Because local income taxes are prohibited by the Taxpayer’s Bill of Rights (TABOR), the only tax besides property taxes that can be raised on the local level, and generate substantial revenue for general expenditures, is the sales tax – a tax that is regressive and impacts lower-income people, and communities of color, disproportionately. That has led to many counties, cities, and special districts to ask voters to raise sales taxes, which just increases the regressivity in the overall Colorado tax code.

Local elections demonstrate this problem. In Denver there are two measures on the ballot, 2A and 2B, that ask to raise sales taxes to fund climate change and homelessness programs, respectively. In Loveland, CO, there is a measure to increase the city’s sales tax from 3 percent to 4 percent to fund street and sidewalk improvements, as well as city operations. Buffalo Mountain Metropolitan District also has a sales tax increase on the ballot in 2020. This increase would fund snow removal and street improvements. These are vital services for these cities and because of declining property tax revenues and TABOR restrictions, there are few options other than regressive sales taxes. These local governments do not have any other choices when it comes to funding basic operations, and given what will happen if Amendment B does not pass, the problem will get substantially worse.

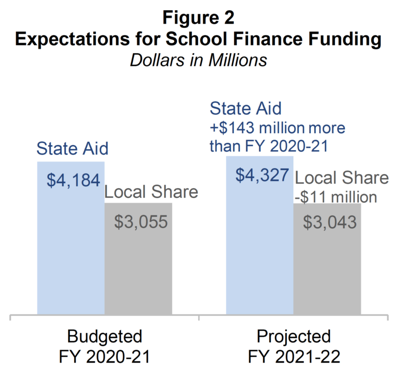

State Subsidizing of Lost Local Property Taxes

Colorado is obligated to finance K-12 education, and the state has been putting in a larger share of the money over time, due to the decline of local property tax revenue. As mentioned, in 2022 (the next time there is a property assessment) school districts will see a nearly $500 million drop in revenue, if the status quo prevails. That is on top of the projected $143 million state backfill to local K-12 education that is to be expected next year because of the recession. Given Colorado’s state budget is expected to decline by 20 percent from projections prior to the pandemic, it will be even more difficult for the state to fill the gaps that will open wide, if Amendment B does not pass. For context, after this last budget year the state has a current $1.2 billion negative factor, an IOU to local K-12 education.

Even with the state pitching more money in to alleviate some of the local tax revenue drops, Colorado is still horribly behind the national average in per-pupil funding and teacher pay. According to the Colorado Association of School Boards, Colorado ranks 42nd out of 50 in per-pupil funding and 50th in teacher pay competitiveness, according to Great Education Colorado. The problem is not just that K-12 education suffers when the state has to backfill all this local revenue. Because Colorado, like nearly every other state, has to balance its budget, the money that local governments should be covering, but cannot, does not go to other important priorities. Colorado cannot invest in higher education and transportation because our state budget is on the hook for all that K-12 money. But if residential property taxes didn’t fall across the state consistently, then money could go to other public programs and not just be funneled to K-12 education.

What is important to remember is single aspects of the tax code do not operate in a vacuum. Each tax plays off of each other to create the broader “tax code” that ultimately determines fairness. We need to give our governments more options for funding their services and not just continue to raise regressive taxes to invest in our communities. That is what a fair tax code is all about. While repealing the Gallagher Amendment is not a silver bullet and will not lead to a fair tax system in Colorado by itself, it is a piece of the puzzle and would allow local governments across the state to address their needs in a fairer, less regressive way. And after Amendment B passes, Colorado can develop comprehensive solutions to create a fair tax code.