COVID-19’s Impact on Colorado’s Budget: Important Takeaways

The economic forecast from the Office of State Planning and Budget and the Legislative Council economists was better than expected. Colorado appears to be recovering better than some of what our worst fears were. Unfortunately, the forecast has made clear COVID-19 will have long-lasting negative implications to critical public services. Preserving existing state income taxes and receiving federal assistance are critical to mitigating the worst of possibilities to come.

Below are five key takeaways from COVID-19’s impact on the state budget.

COVID-19 Will Have a Lasting Negative Impact on Colorado’s Budget & Economy

Before COVID-19, Colorado was already a half billion short of meeting constitutional demands in K-12 spending, ranked 47th nationally in higher education spending, and had a $9 billion backlog in transit. With COVID-19, lawmakers had to balance the budget by cutting $3.3 billion in spending —about 25 percent of the General Fund budget — in key programs and services, leading to even more pain for Coloradans.

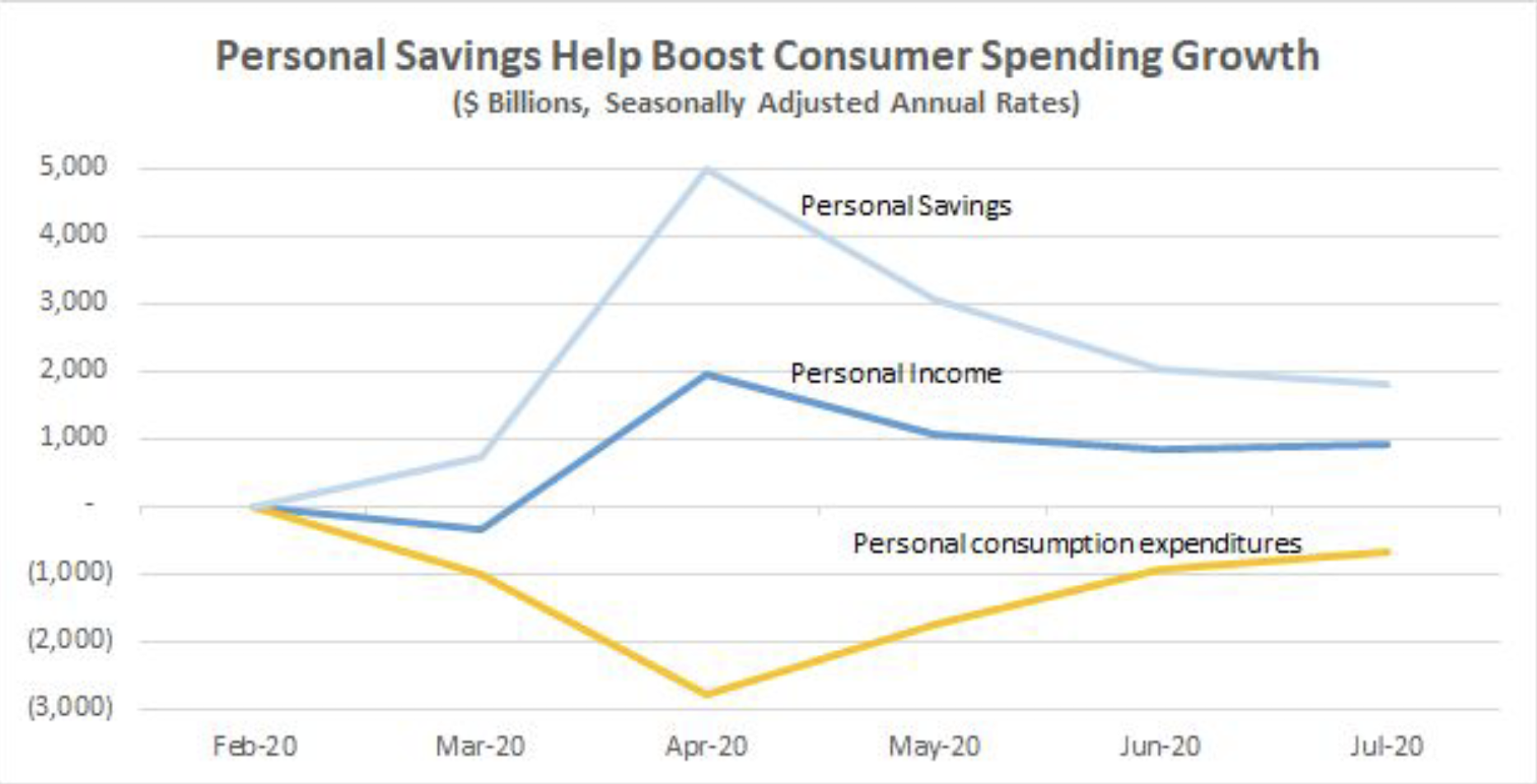

However, Colorado’s recovery has been better than expected, in large part due to a federal stimulus and expanded unemployment insurance benefits, which helped keep personal income and consumer spending from a greater dip. Without more federal assistance, the recovery will likely take longer to get back to pre-pandemic levels.

Despite the “better” budgetary outlook, it will still take years to recover, and Colorado’s economy is far below where we were headed. Overall, the budget for FY 2020-2021 is projected to be 11.6 percent lower than FY 2019-2020.

Continued Inability to Meet the Needs of Coloradans

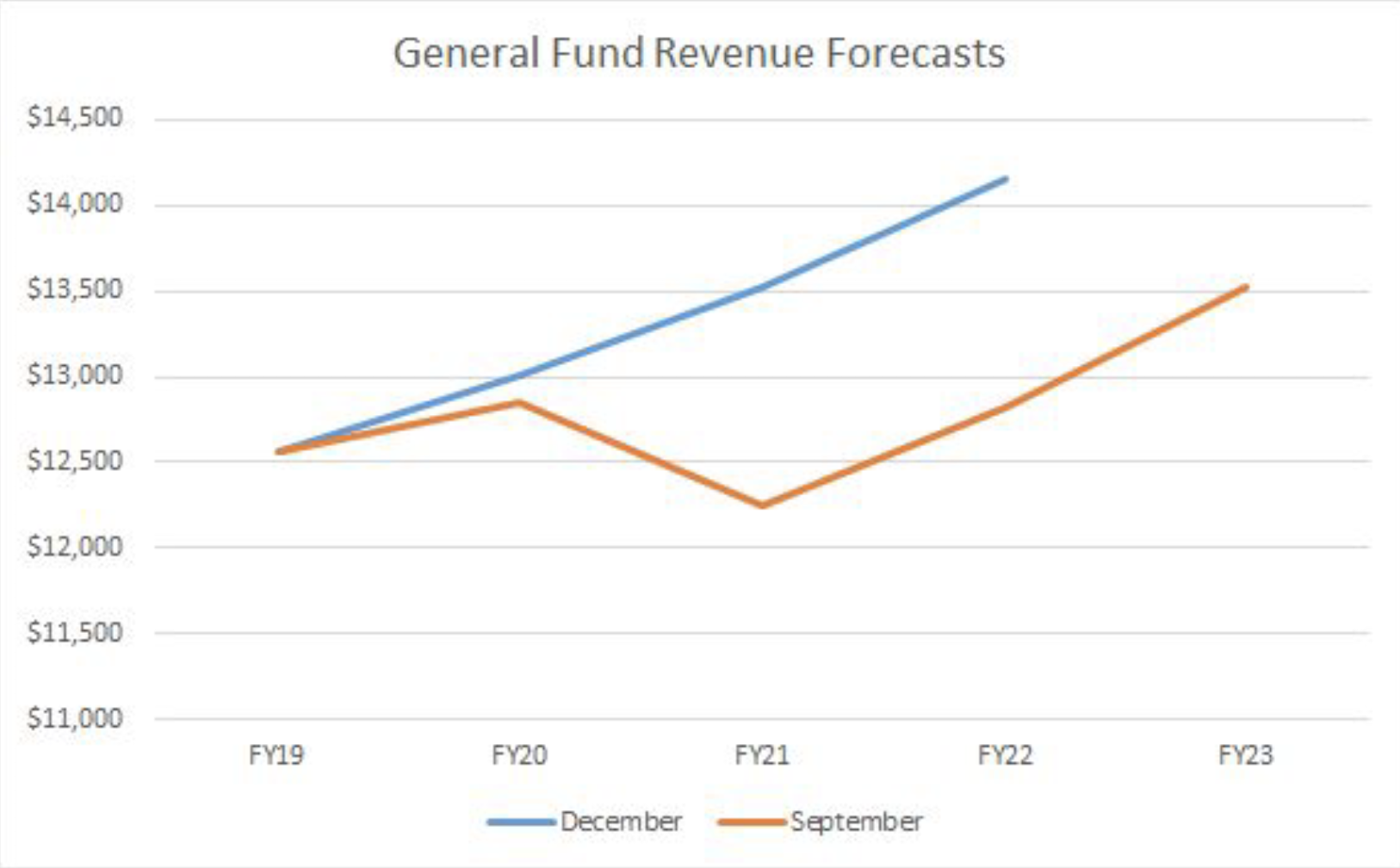

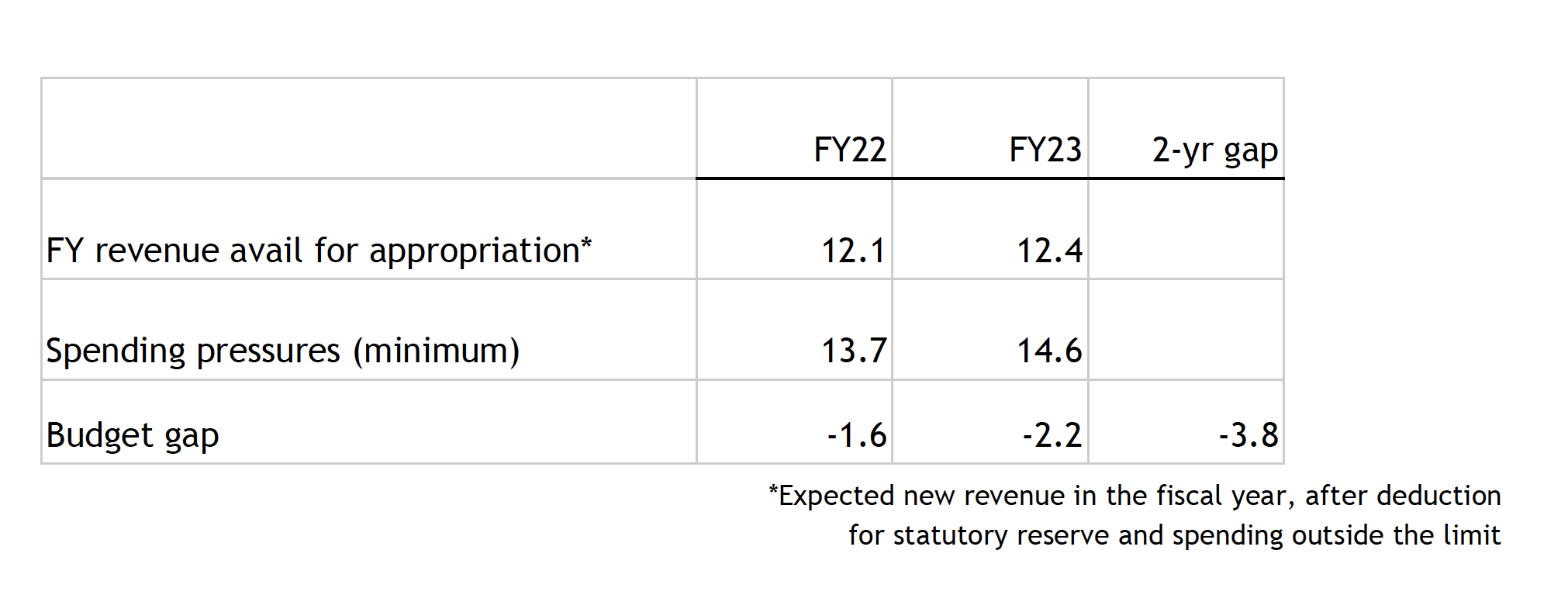

Colorado is projected to have $1.6 billion less in FY 2021-2022 and $2.2 billion less in FY 2022-023 in the General Fund budget than what is needed to meet minimum spending pressures based upon the already slashed budget. This amounts to a $3.8 billion shortfall over two years to meet current demands according to OSPB. This is on top of the 25 percent budget cuts from the previous year.

Revenue isn’t expected to recover to pre-COVID-19 levels until 2023 and that will still be far below where we were headed before COVID-19, and even further below pre-pandemic levels when adjusting for inflation and population.

Current shortfalls don’t account for increased costs and demand for state and federal programs. Demand for programs like Medicaid, Supplemental Nutrition Assistance Program (SNAP), Colorado Child Care Assistance Program (CCCAP), child welfare programs and other social benefits have seen and will continue to see higher demand due to high unemployment (currently 6.7 percent according to LCS) and lower wages. While some of these are federal programs that do not all have a state match, the state is responsible for a share of program operations and management and that share comes out of the General Fund budget.

Also, the legislature was able to make many cuts that were only available in FY 2019-2020 — such as one-year grants and capital costs — that will not be available in future years. This will mean cuts to programs that will cause real pain in communities across Colorado.

Recovery is Very Unequal

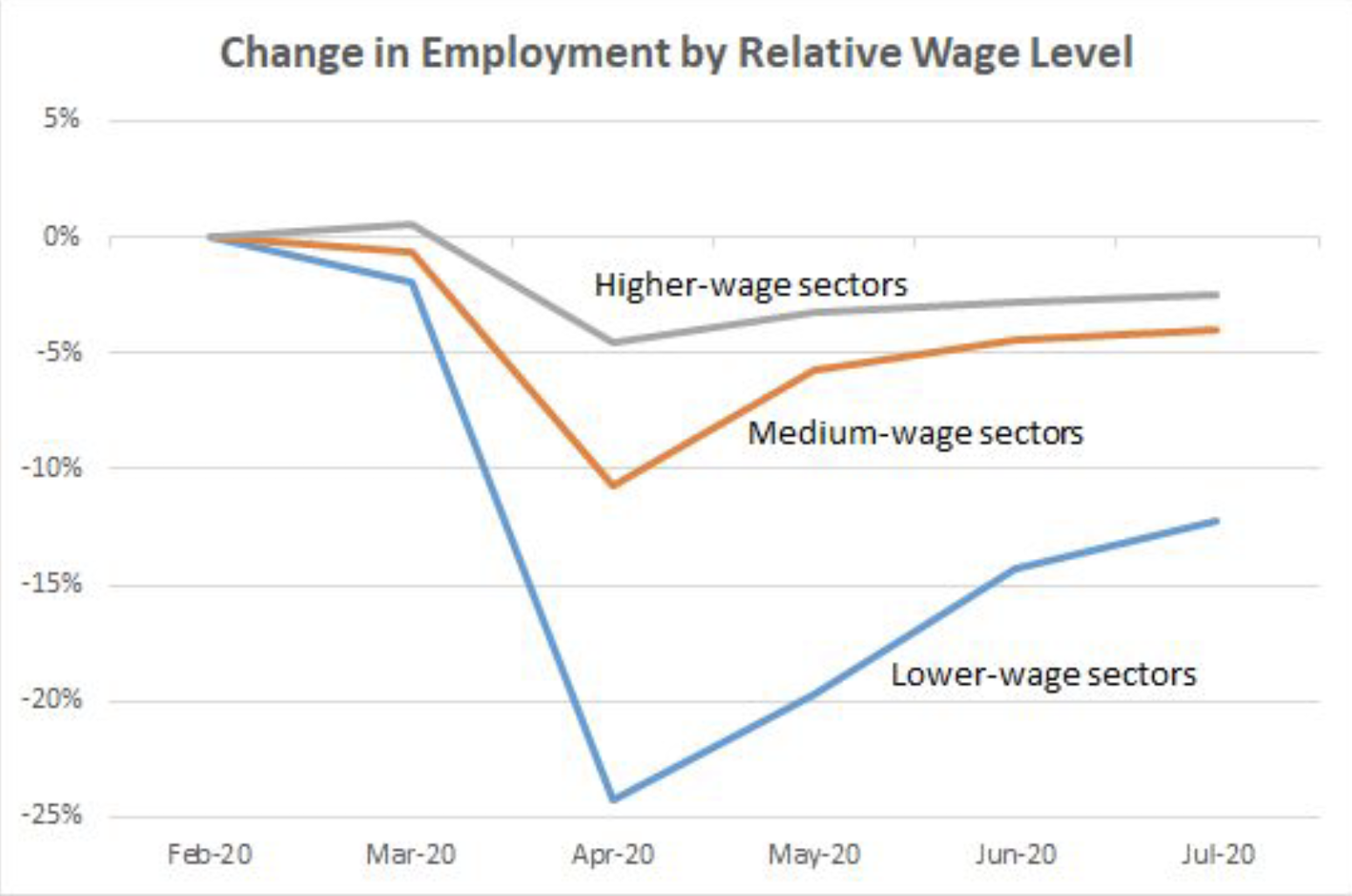

Unemployment rates are improving, but this trend is primarily true for medium and high-wage sectors, both of which experienced lower declines overall. Colorado has only regained 39 percent of lost jobs since the beginning of the pandemic.

The recovery is not just unequal based upon income levels, but also race. We know communities of color are overrepresented in low-wage industries and we have showed Black Coloradans are the only group to continue to see an increase in unemployment insurance claims, meaning more Black Coloradans could be losing jobs and finding it harder to become re-employed.

There continues to be significant differences across industries. Restaurants, and leisure and hospitality industries remain below January levels in terms of consumer spending, while grocery stores and other retail sales have rebounded and exceeded January levels.

Colorado Will Need to Make Up Lost Local Revenue for K-12 Education

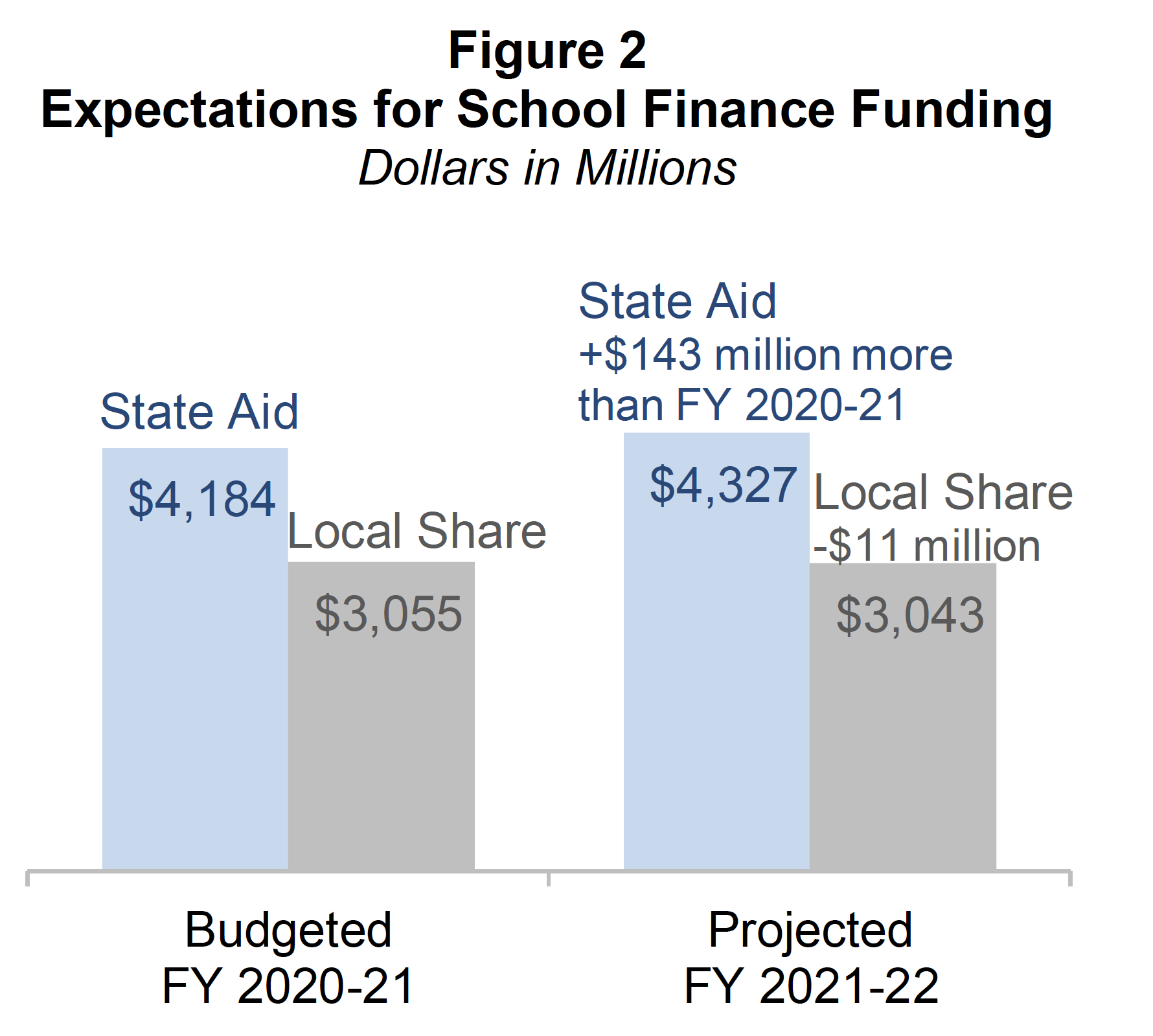

With per-pupil costs rising due to inflation and the decrease of local tax collections, the share of local funding for K-12 education is expected to decrease. That is going to force the state to backfill those revenues — projected to be $143 million — putting even more pressure on the state budget.

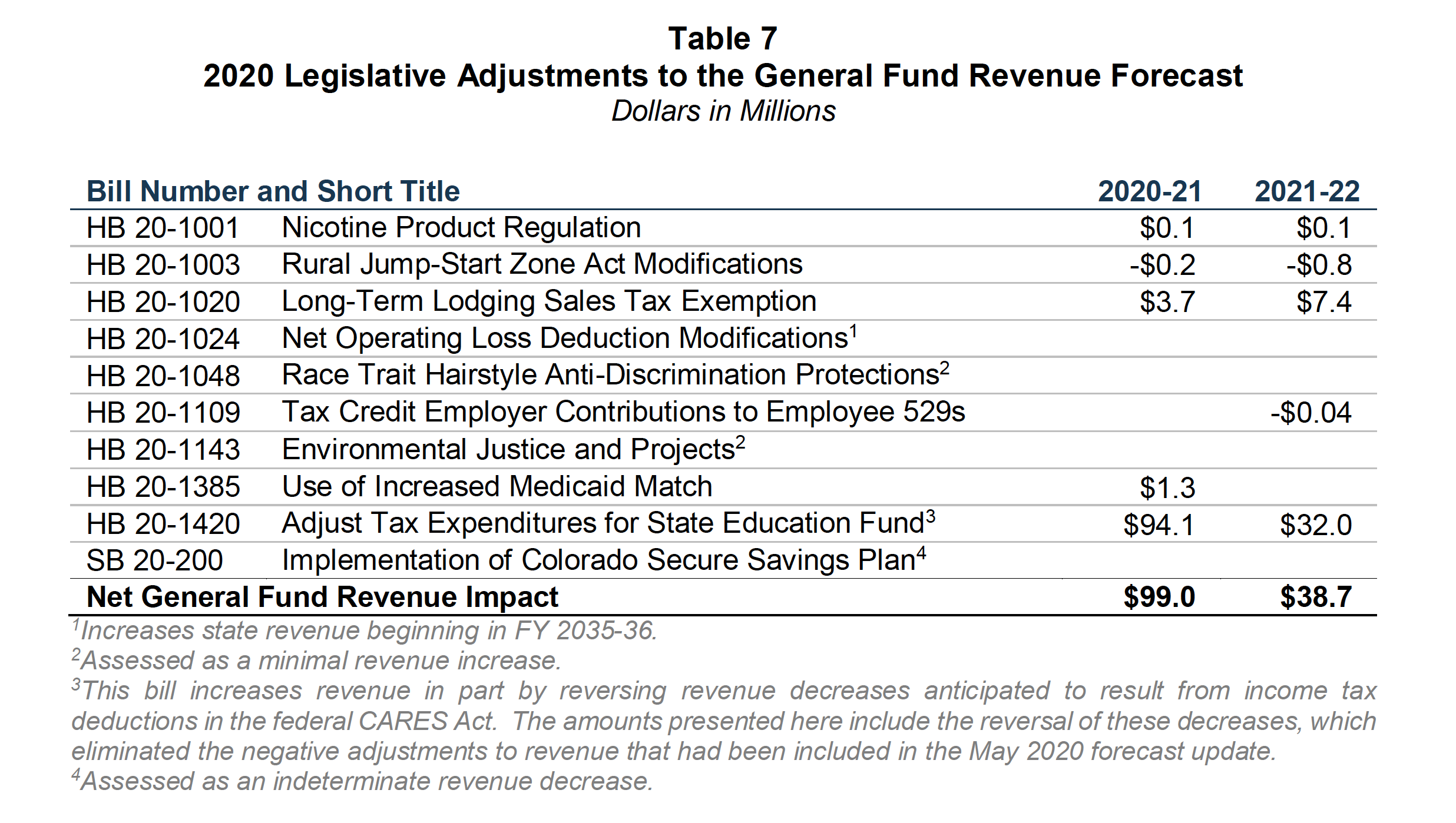

Closing Tax Loopholes Helped Recovery

An infusion of revenue from the federal stimulus (as discussed above) and closing tax loopholes helped stem some of the worst aspects. HB20-1420, Adjust Tax Expenditures for State Education Fund, pumped more than $132 million into the budget through FY 2021-2022. However, like the one-time cuts that were made, these dollars do not go far into the future. A more robust look at closing tax deductions for the wealthiest Coloradans can be a continued strategy to mitigate future cuts to public investment.

For full information on the economic forecast and to see the graphs and charts contained within this piece, please visit the four links below.