The Economic Scale of Student Debt

Student debt in America has reached crisis levels. The economic consequences on the housing and labor markets are just as concerning as those on families of borrowers and the financial well-being of future generations. Student debt is leading to further social stratification, delayed rates of homeownership, and changes in family composition. It’s also affecting the current retirement plans of many Americans, as they now often take with them their children’s student debt into retirement.

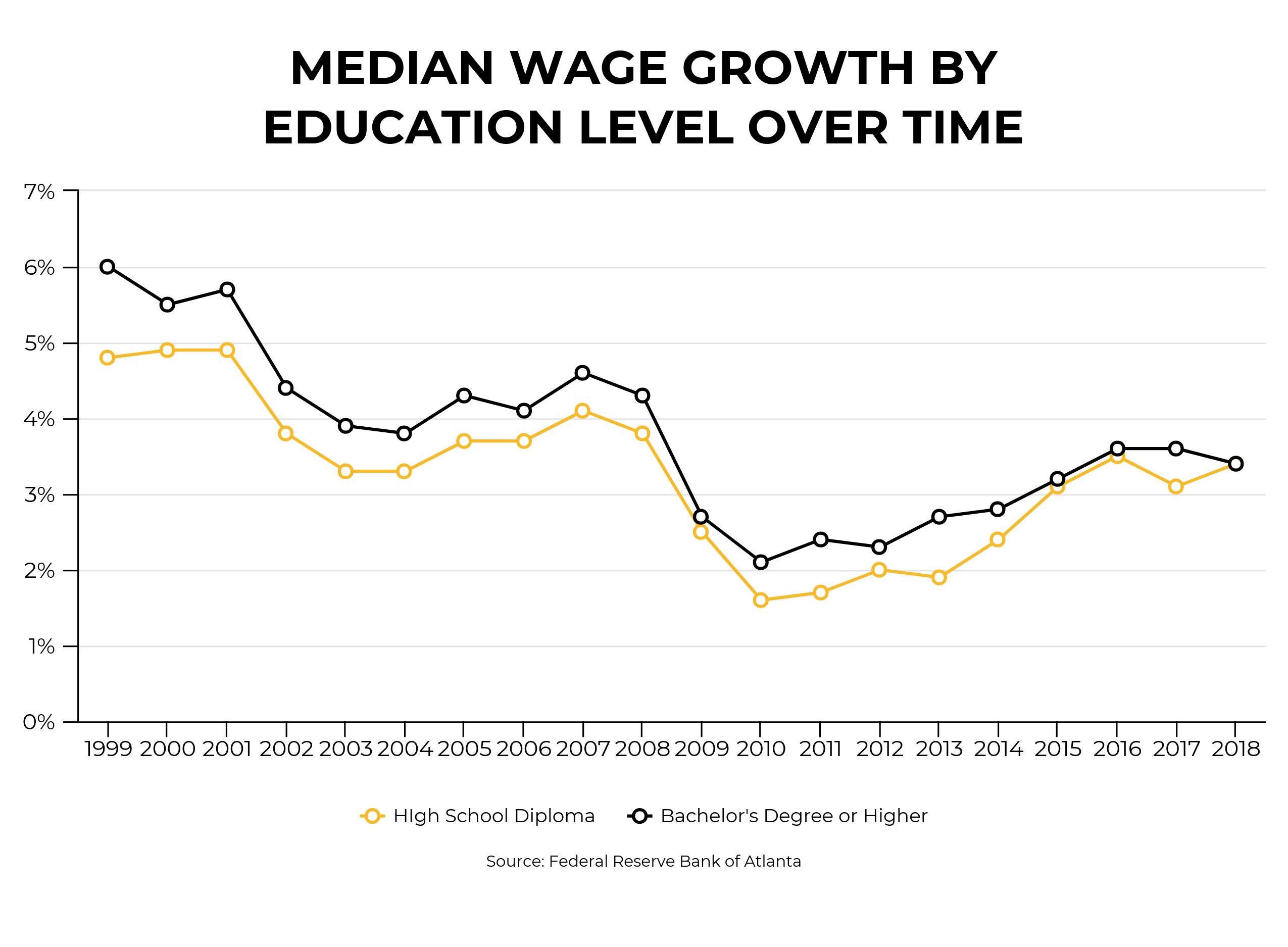

At the same time, student debt is buying a less valuable good. Degrees are now needed for jobs that formerly didn’t require them, and degrees aren’t providing as strong a salary increase as they once did. As degrees become more important for job entry rather than career advancement, student debt represents many of the costs that were formerly borne by employers through on-the-job training.

Current higher education financing policy depends on the college earnings premium, or the narrative that more education equates to higher wages. Theoretically then, higher amounts of student debt would mean more students going to school and attaining degrees that lead to larger paychecks. In reality, the value of a degree is decreasing because of credentialization — a phenomenon in which employers demand higher levels of educational attainment for a given job.

Jobs that didn’t previously require a degree now do — file clerks, receptionists, paralegals, and administrative assistants are just a few examples. This is because the rise of “upskilling through higher education” reduces the obligation of employers to train employees themselves. Even when the requirements for a job remain the same over time, employers often favor employees who have paid the cost of higher credentials over those who haven’t. Consequently, workers with more advanced degrees are steadily pushing less educated workers out of the labor market.

Furthermore, although educational attainment has risen across almost every group in the last 20 years (black, white, Asian, Hispanic), average earnings have decreased. We could reasonably expect educational attainment would lead to more desirable skills for employers, in turn leading to higher earnings for workers with higher credentials, yet earnings have stagnated. Part of the explanation is schools aren’t equipping students with the skills that correspond to the expectations employers have from such credentials, and so employers demand even higher credentials. Those who only have a high school education then find even middle-skill career pathways shut off to them.  In this environment, universities have added graduate degrees and other advanced programs to help students stand out in a packed labor market. As the perceived value of degrees rises, even as their true market value decreases, employers use the accessibility of loans to selectively demand more credentials from potential employees without incurring the cost of on-the-job training. Lower skilled potential employees respond by taking out loans for higher education because they understand their options are limited without additional credentials. At the same time, schools increase tuition as demand for credentials remains robust. Thus, student debt and over-credentialization are connected, as schools respond to competition in the higher education and the labor markets.

In this environment, universities have added graduate degrees and other advanced programs to help students stand out in a packed labor market. As the perceived value of degrees rises, even as their true market value decreases, employers use the accessibility of loans to selectively demand more credentials from potential employees without incurring the cost of on-the-job training. Lower skilled potential employees respond by taking out loans for higher education because they understand their options are limited without additional credentials. At the same time, schools increase tuition as demand for credentials remains robust. Thus, student debt and over-credentialization are connected, as schools respond to competition in the higher education and the labor markets.

As a result, advanced degrees become the method to differentiate, adding pressure on students to pursue degrees and careers with a high ROI, and subsequent pressure to find workers to fill critical, but low-wage jobs, like qualified teachers.

In a 2018 Student Loan Hero survey of student loan borrowers, respondents say student debt delayed saving for a house downpayment, saving for retirement, and even hindered their ability to pay for health insurance. They put off taking vacations, buying a home, and starting a family. One family has described their collective experience with student debt — which included unexpected medical costs, delayed retirement, and foreclosure — as “a chain of rotten luck and a system that is an abject failure by design.”

- Fewer Children: Americans aren’t having as many kids, even as the economy has returned to normal levels. Many of the reasons return to its affordability, stunted by lower wages and higher amounts of debt. According to a survey by Morning Consult on why young adults aren’t having children, 31 percent say they can’t afford child care, 24 percent can’t afford a house, and 13 percent say they have too much student debt.

- Decline in Homeownership: A NeighborWorks’ survey shows in 2018, 36 percent of responders knew someone who had delayed buying a home because of student debt. The number of people aged 24 to 32 buying homes has declined 9 percent from 2005 to 2014. According to the Federal Reserve, 20 percent of that drop is a direct effect of student loan debt.

- Reduced Retirement Savings: The long-lasting scale of the student debt crisis is especially reflected in the number of older Americans strapped with their children’s debt. Since 2004, student loan debt has grown the fastest among those aged 60 and older. These borrowers have the debt from their own education, Parent PLUS loans for their children, or as cosigners on their children’s loans. In fact, student debt grew 6.5 percent for households led by someone aged 50 or older between 1990 and 2014. Parent PLUS borrowing also increased, with the typical amount up to $16,100 in 2014 — nearly triple the $5,200 taken on in 1990 (adjusted for inflation). Paying off this debt keeps borrowers from accumulating retirement savings and building wealth in other forms.

Racial & Wealth Equity

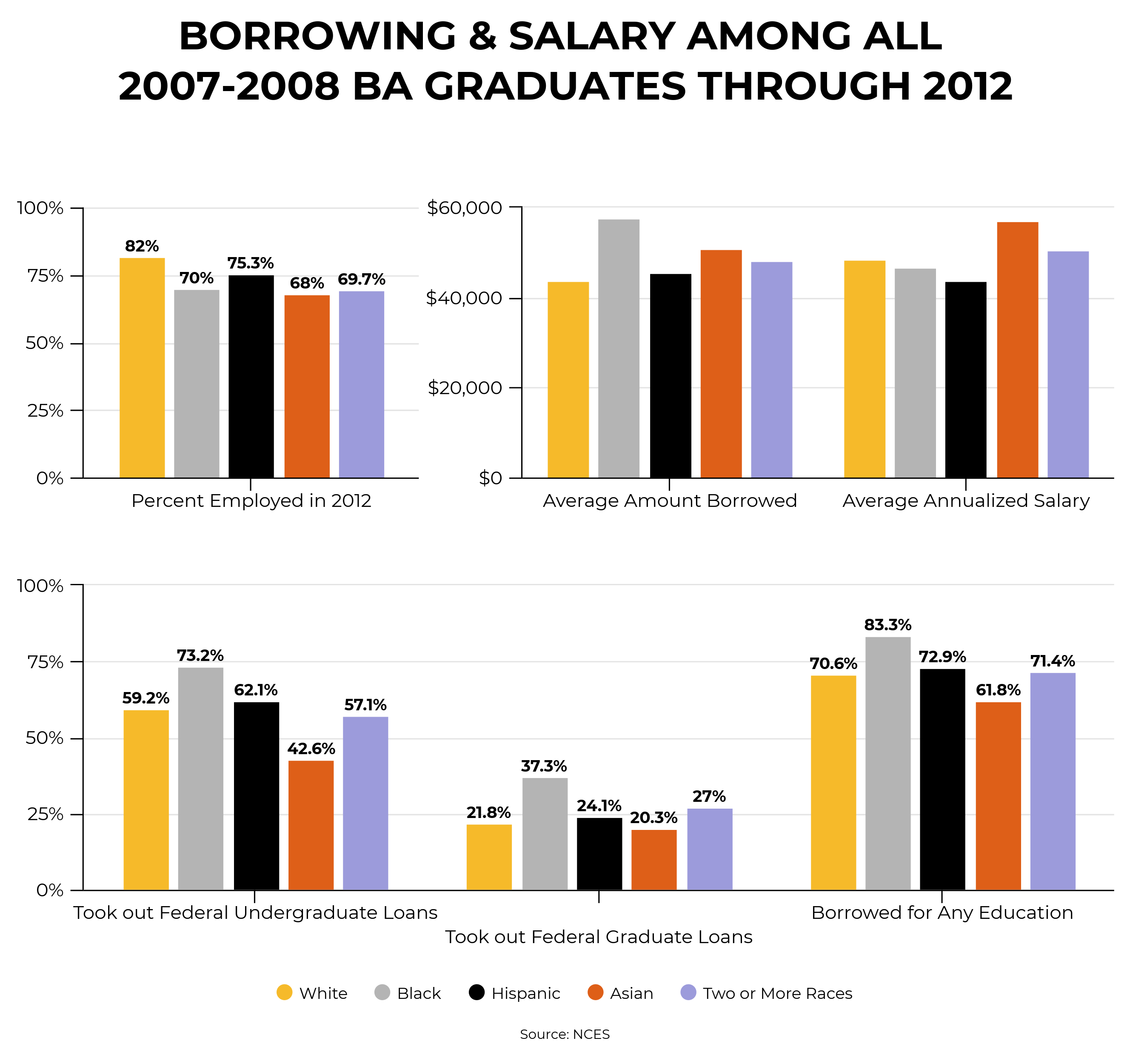

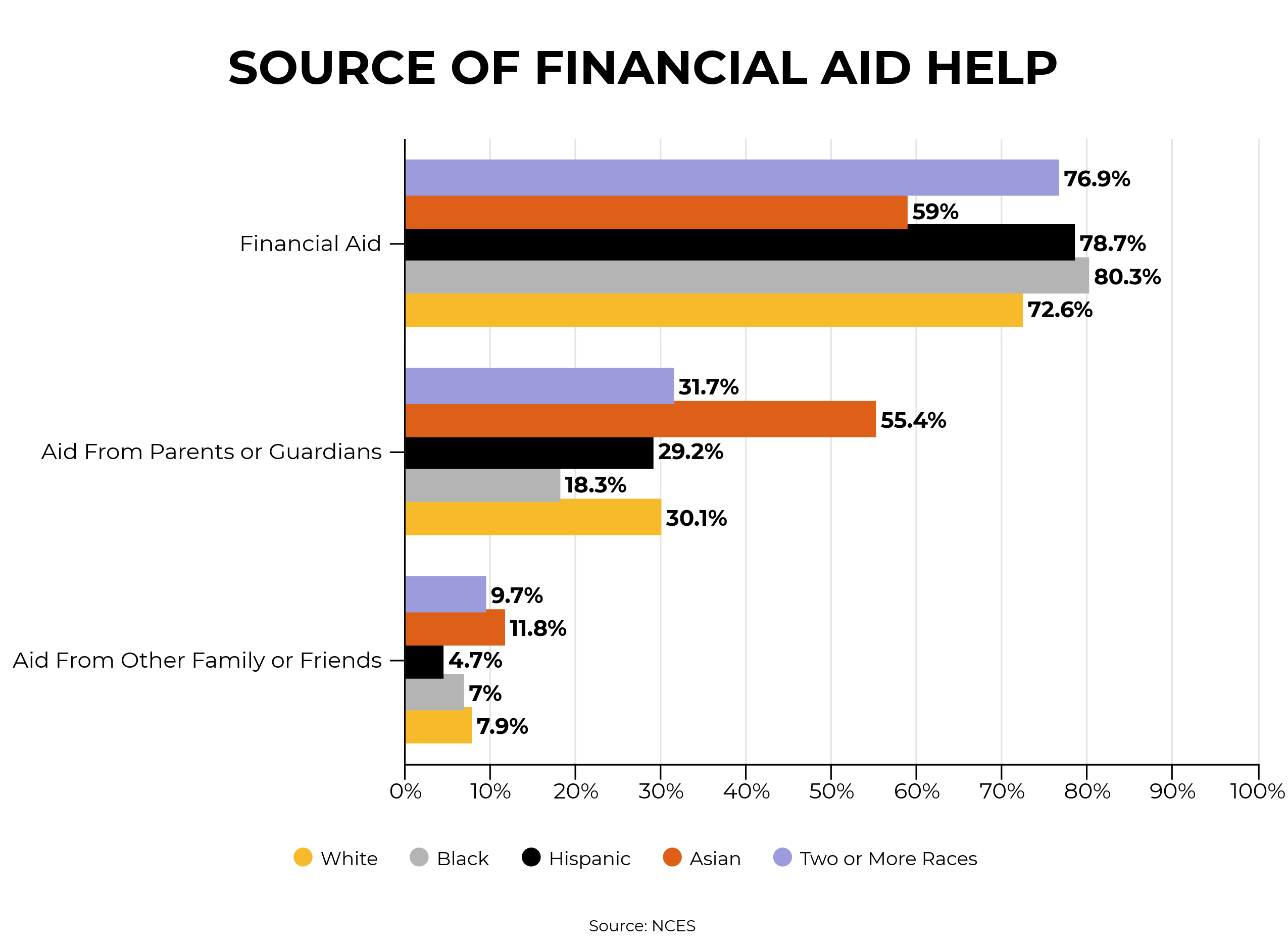

Student debt exacerbates existing wealth inequalities. Students of color are more likely to take out student loans due to the lower levels of income and wealth among their parents. The value of college is also declining among students of color, particularly black students. This is a disastrous combination.

Because of these factors, students of color take out larger loans than white students. Black students borrow more than white students, have 85 percent more student debt than their white counterparts, and are five times more likely to default. The gap in student debt between white and black borrowers also grows by almost 7 percent each year. This difference has consequences for wealth accumulation: Black students accumulate 10.4 percent less wealth than white students over the course of their lives. U.S. Census data show black wealth amounts to about 7 percent of total white wealth. The gap is worsening because, on top of the greater debt, black workers also earn less than their white counterparts upon entering the workforce.

This difference has consequences for wealth accumulation: Black students accumulate 10.4 percent less wealth than white students over the course of their lives. U.S. Census data show black wealth amounts to about 7 percent of total white wealth. The gap is worsening because, on top of the greater debt, black workers also earn less than their white counterparts upon entering the workforce.

Again, while a college education is expected to lead to higher wealth accumulation, studies show, in fact, this is only true of white college-educated households; the wealth of black college-educated households is actually declining. Black college graduates are less likely to receive assistance from their families than white college graduates.

Between 1989 and 2013, the median net wealth of white college-educated households increased by $13,343 on average, while the average for black college-educated households decreased $19,816. The racial wealth gap between white and black households grew from around $142,000 to $193,000, and the ratio of white to black wealth tripled. Student debt has an immediate impact on students and borrowers, as well as a delayed, but significant, consequence for future generations. It’s also a concerning driver of increasing racial inequality by perpetuating disparities in wealth accumulation. The burden of repayment gets in the way of starting families, affording homes and other important milestones, and has introduced a new method of social stratification, by keeping young people from participating in the economy, in the workplace, and in larger society.

Student debt has an immediate impact on students and borrowers, as well as a delayed, but significant, consequence for future generations. It’s also a concerning driver of increasing racial inequality by perpetuating disparities in wealth accumulation. The burden of repayment gets in the way of starting families, affording homes and other important milestones, and has introduced a new method of social stratification, by keeping young people from participating in the economy, in the workplace, and in larger society.