Understanding Tuition Assistance in Colorado

The amount of student debt owed in the U.S. has reached $1.5 trillion and is steadily growing. The rising cost of tuition combined with the trends within tuition assistance — characterized by loans, Pell grants, private scholarships, and institutional, state, and federal grants — exemplify much of the problem underlying to student debt crisis. As tuition has grown over the decades, the rising costs to individuals and families have not been significantly lessened by grants or scholarships, leaving students with increasing student debt burdens. For Coloradans and students of color, this trend is even more severe.

To address larger problems within tuition assistance, Colorado can:

- Address the rising costs of tuition

- Continue to develop grant and scholarship programs for students

- Ensure students needing to take out loans are protected from predatory practices

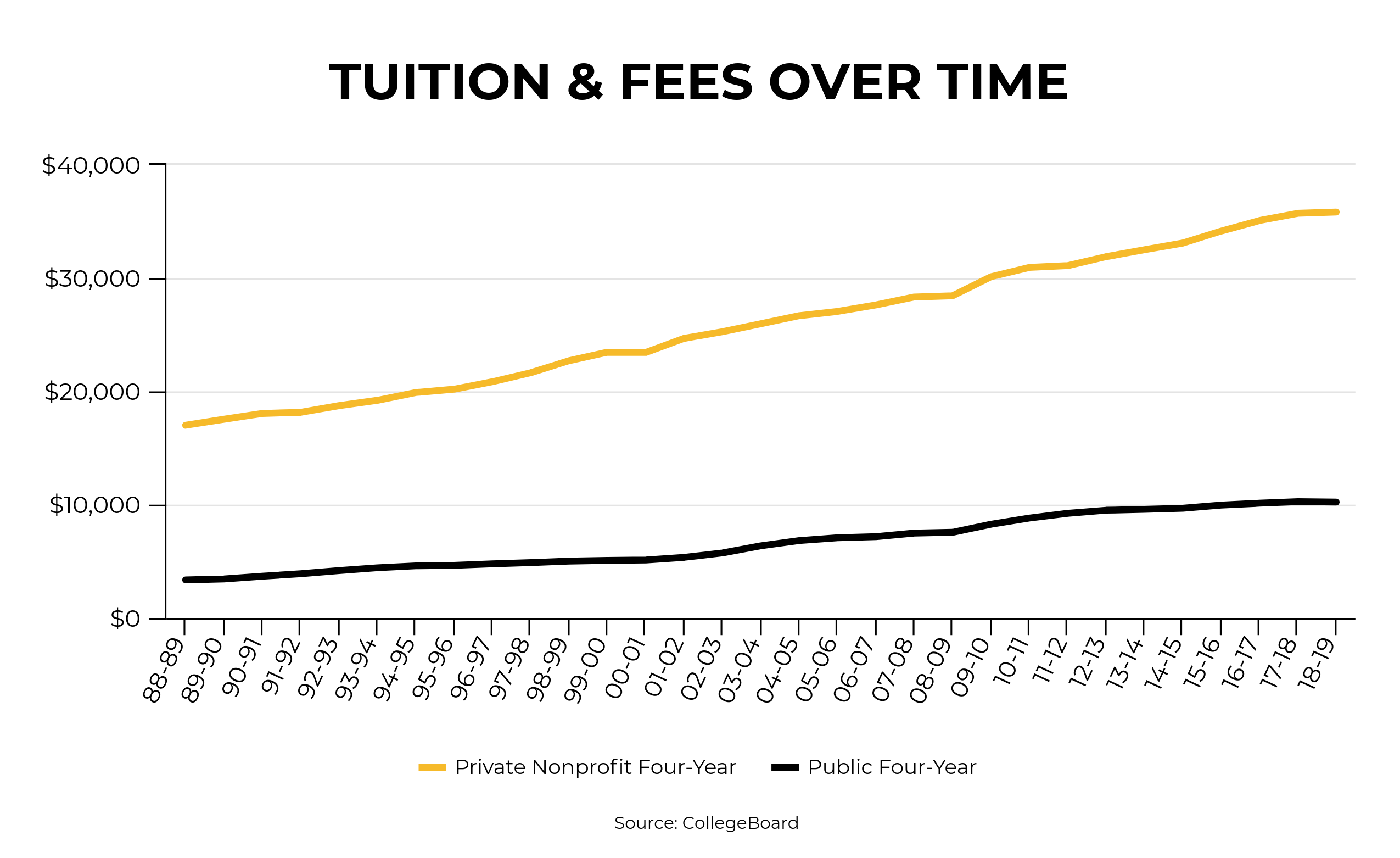

The cost of tuition at every type of institution has consistently increased since 1985, and is only expected to continue over time. As documented in our Student Debt 101 brief, tuition at both public and private institutions has significantly increased over the last three decades. These increases have put tremendous strain on all aspects of tuition assistance.

Rising tuition costs have been particularly caused by depleted public investment in higher education. For the first time, in fiscal year 2016-2017, more than half (28) of states funded higher education primarily through tuition revenue, placing a higher burden on students and their families. Schools offer tuition assistance packages to help offset these costs, but assistance in the form of grants and scholarships has not negated or significantly reduced the rising student loan debt burden. Loans remain a major source of tuition assistance.

The main components of tuition assistance are:

Loans:

- Private loans: Banks, private student loan lenders like College Ave

- Federal loans: Distributed by Department of Education, applied for via the Federal Application for Student Aid (FAFSA)

Grants:

- State grants: Specific to each state and their qualifications (need or merit-based)

- Federal Pell grants: Determined by financial need based upon FAFSA

- Institutional grants: Distributed by the school, can also include scholarships (need or merit based)

- Private and employer grants: Distributed by foundations, civic groups, companies, charities, religious groups, community organizations

Other:

- Federal work-study program: Provides part-time jobs for students with financial need

- Federal education tax benefits: Distributed by Department of Education, applied for via FAFSA

- Federal veteran benefits: Assistance for veterans, service members, and their family members

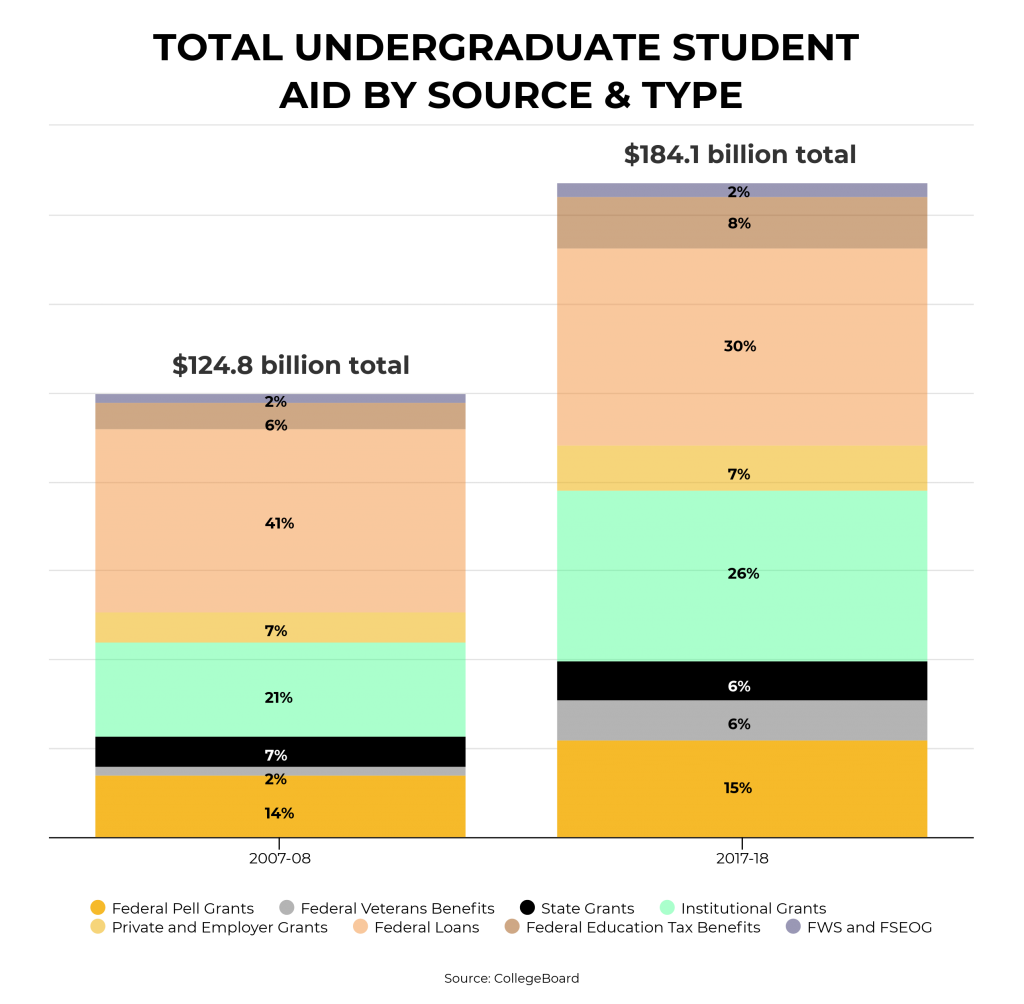

As a result of increasing in tuition costs, the primary components of tuition assistance packages and programs have also increased over time in response. Over the course of the last 10 years, the amount of aid distributed to undergraduates grew from $124 billion to $184.1 billion.

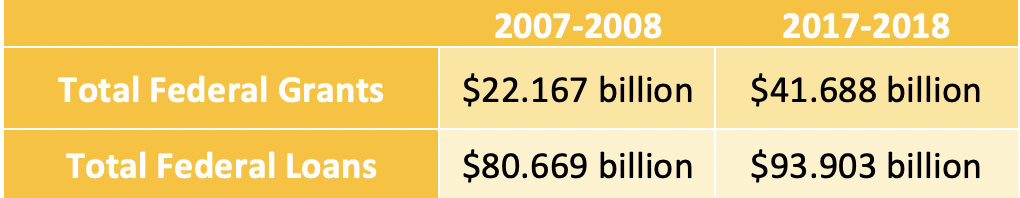

Between 2007-2008 to 2017-2018 the percentage of tuition assistance in the form of loans has decreased and the percentage in the form of grants has increased, but loans still make up a significant part of tuition assistance. Additionally, the size of student loans within tuition assistance has increased from $51 billion to $55 billion in this 10-year period, while the share of tuition assistance made up of loans has decreased.

At the federal level, student loans continue to be the primary means of supporting education:

The landscape is Colorado is bleaker, with public investment for higher education lower than most states, higher education institutions are more reliant on tuition for funding and tuition is more expensive for students. More than 70 percent of higher education funding comes from tuition in Colorado, compared to the national average of 46.4 percent. The average cost of tuition in Colorado is more than $30,000, which again places Colorado on the higher end of the spectrum (the highest is Vermont at $39,400). Exacerbating this problem, Colorado tuition assistance packages are also more dependent on student loans.

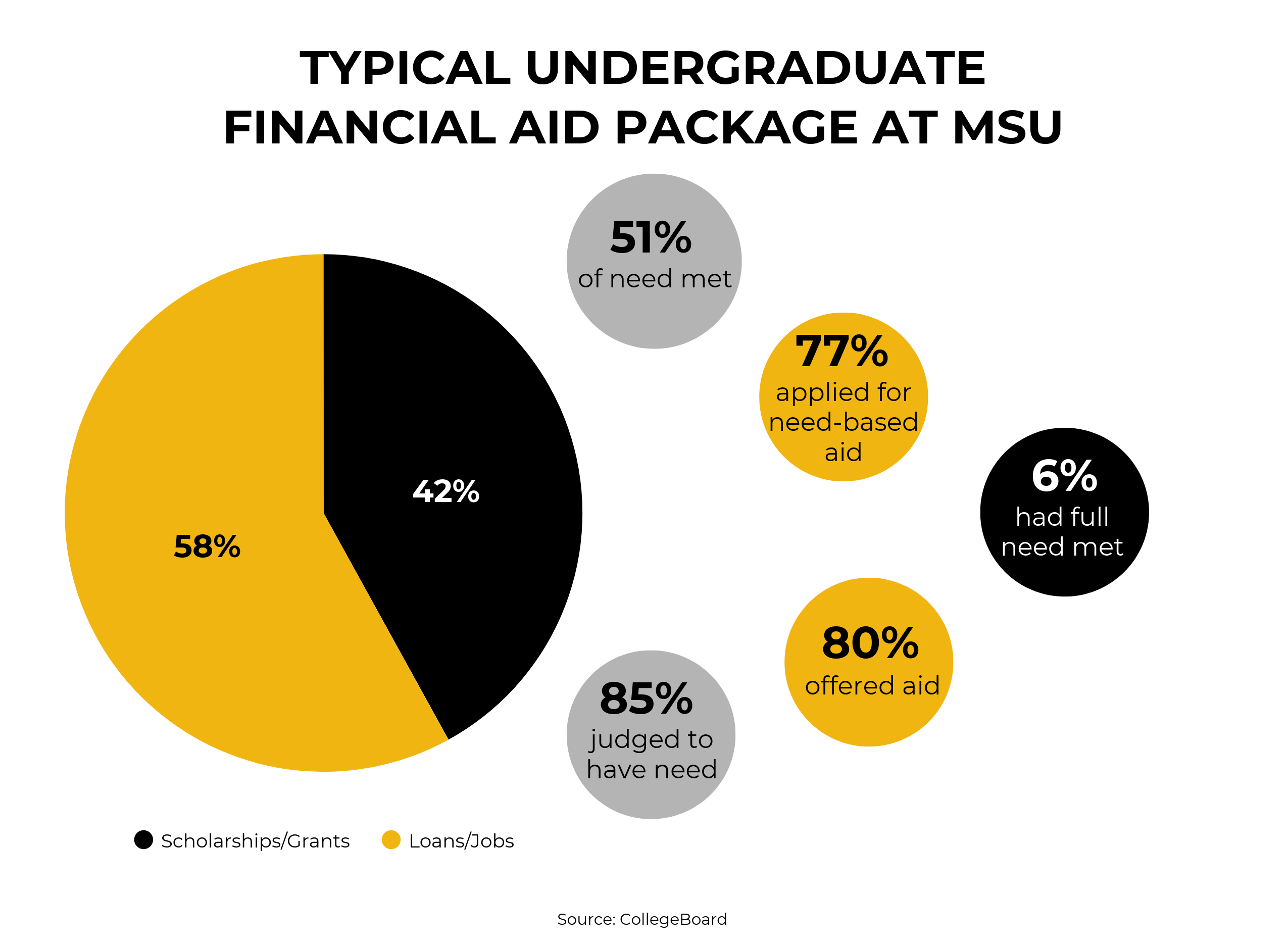

For example, students attending Metro State University in Denver average $25,805 in debt. A majority of an MSU student’s tuition assistance comes in the form of loans.

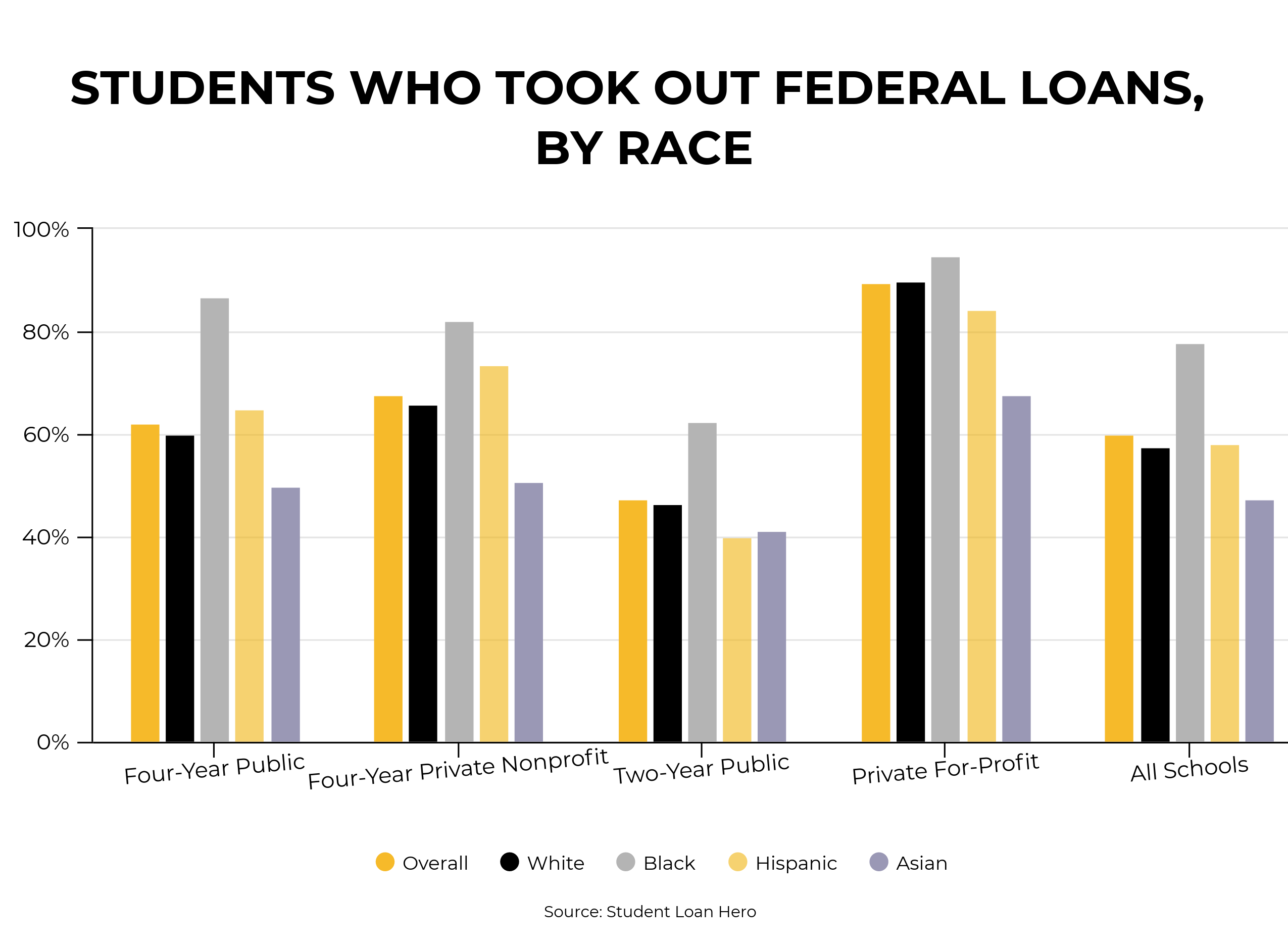

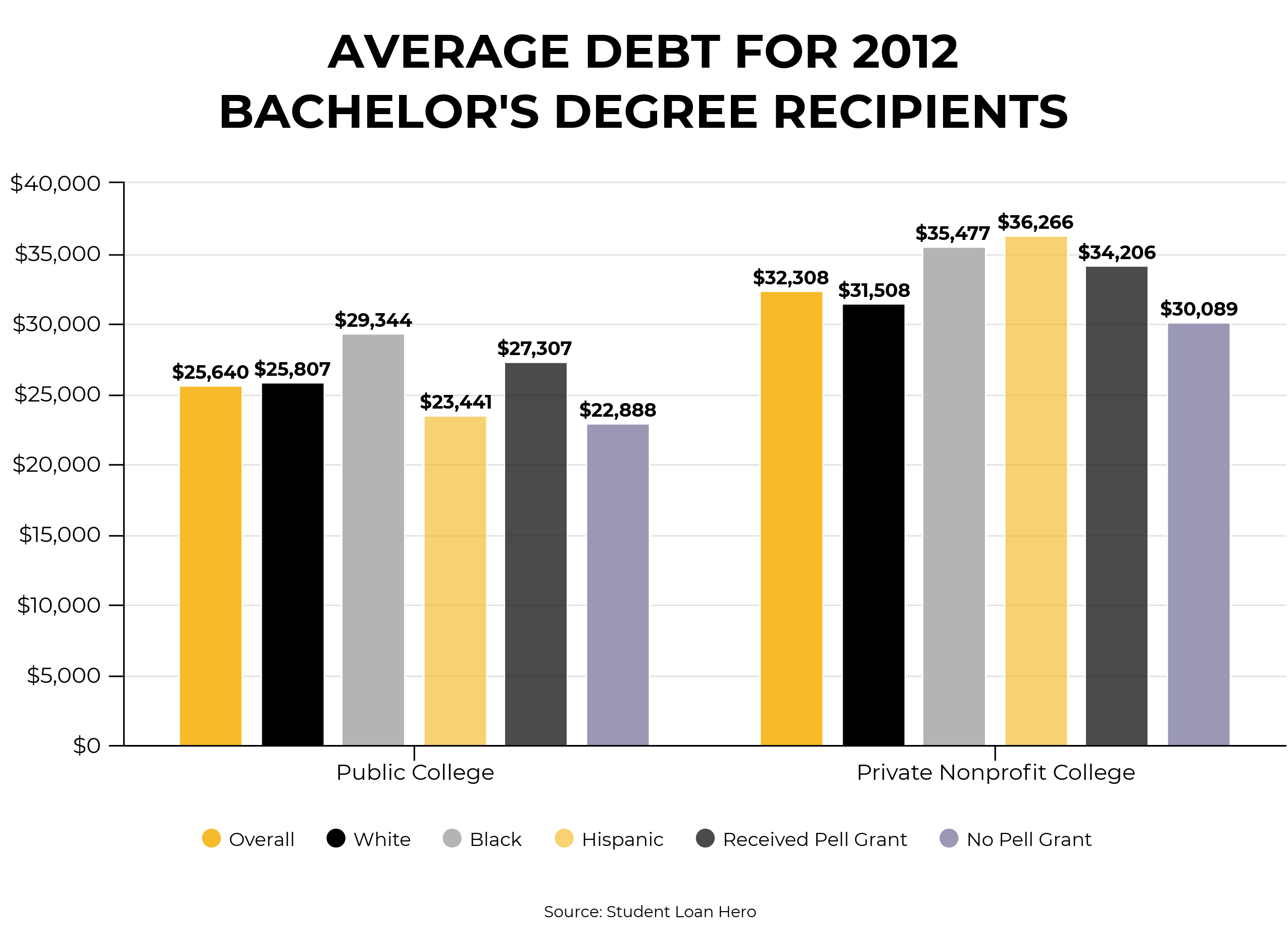

Students of color are more likely to take out loans and leave college with higher levels of debt. This trend is especially true for black students.

It’s important to note, however, even though grants are readily available for students of color, the process makes accessibility difficult, especially through the Free Application for Federal Student Aid (FAFSA). For example, a report on the class of 2013 shows 34 percent of Hispanic students and 27 percent of black students didn’t complete FAFSA because they didn’t have enough information to do so, compared to only 18 percent of white students. In 2018, $2.6 billion of free money in the form of Pell grants was left behind because 661,000 students who were eligible didn’t complete the FAFSA.

It’s important to note, however, even though grants are readily available for students of color, the process makes accessibility difficult, especially through the Free Application for Federal Student Aid (FAFSA). For example, a report on the class of 2013 shows 34 percent of Hispanic students and 27 percent of black students didn’t complete FAFSA because they didn’t have enough information to do so, compared to only 18 percent of white students. In 2018, $2.6 billion of free money in the form of Pell grants was left behind because 661,000 students who were eligible didn’t complete the FAFSA.

Redefining Tuition Assistance: Possible Solutions in Colorado

At its core, the real problem relating to tuition assistance is the rising cost of tuition. Until the problem of rising tuition costs can be addressed, Colorado might make advances through greater accessibility and availability of grant-based tuition assistance.

In Colorado, expansion of existing grant programs can provide needed support. For example, the Completion Incentive Grant program and Colorado Graduate Grant Program are specifically designed to provide financial support to resident students with demonstrated need. Additionally, the Perkins Student Loan Program and Certain Health Professions Loans are federal programs that match the funds of the state provides. These programs offer families with demonstrated financial need a strong boost to their prospects.

For families who might not qualify for grants like the Completion Incentive Grant Program, an expansion of scholarships is a promising options. The Colorado’s Opportunity Scholarship Initiative seeks to increase accessibility and affordability for students to achieve postsecondary credentials and degrees that will set them up not only with tuition assistance by matching funds from community scholarships, but also by providing advising and supports through completion. This project incorporates state agencies, nonprofits, institutions, and community partners to invest in and produce grants and scholarships for students in Colorado. Through this program, entities across the state are incentivized to invest in students who will, in turn, enter the workforce through development programs, effectively beneficial for all parties. In addition, scholarships are available to students whose household income is 250 percent or less of Pell eligibility, addressing at least part of the gap in equitable tuition assistance distribution.

Finally, tuition assistance should be redefined to erase the need for student loans, or to at least offset the increasing amount of student debt. However, student loans remain a major portion of tuition assistance. As such, Colorado should continue to ensure these loans are fair and students are not subjected to predatory loan servicers. SB19-002, a bill to regulate student loan services, is a strong start. The bill brings loan servicers into the state’s regulation purview and provides students with a single point of contact for complaints and assistance.