2025 Special Session Poses Tough Choices

This coming special session, policymakers are tasked with rebalancing a state budget out of whack because of federal H.R.1. This task won’t be easy. Lawmakers will face tough choices — and, ultimately, they’ll be forced to cut an already tight budget. Their decisions will directly impact the critical service Coloradans depend upon. Below, we explore how we got here and some of the challenging choices confronting Colorado lawmakers.

How We Got Here

Unlike most states, Colorado’s tax code, by default, largely mirrors the federal government’s. This is primarily because of two factors: our state’s use of federal taxable income as its base and rolling conformity to the federal tax code. The upshot of these two factors is that when lawmakers in Washington D.C. make changes to the federal tax code, most of the time those changes are automatically incorporated into our state’s tax system. As we see in the passage of H.R.1, the tie between these two tax systems can have massive implications for Coloradans.

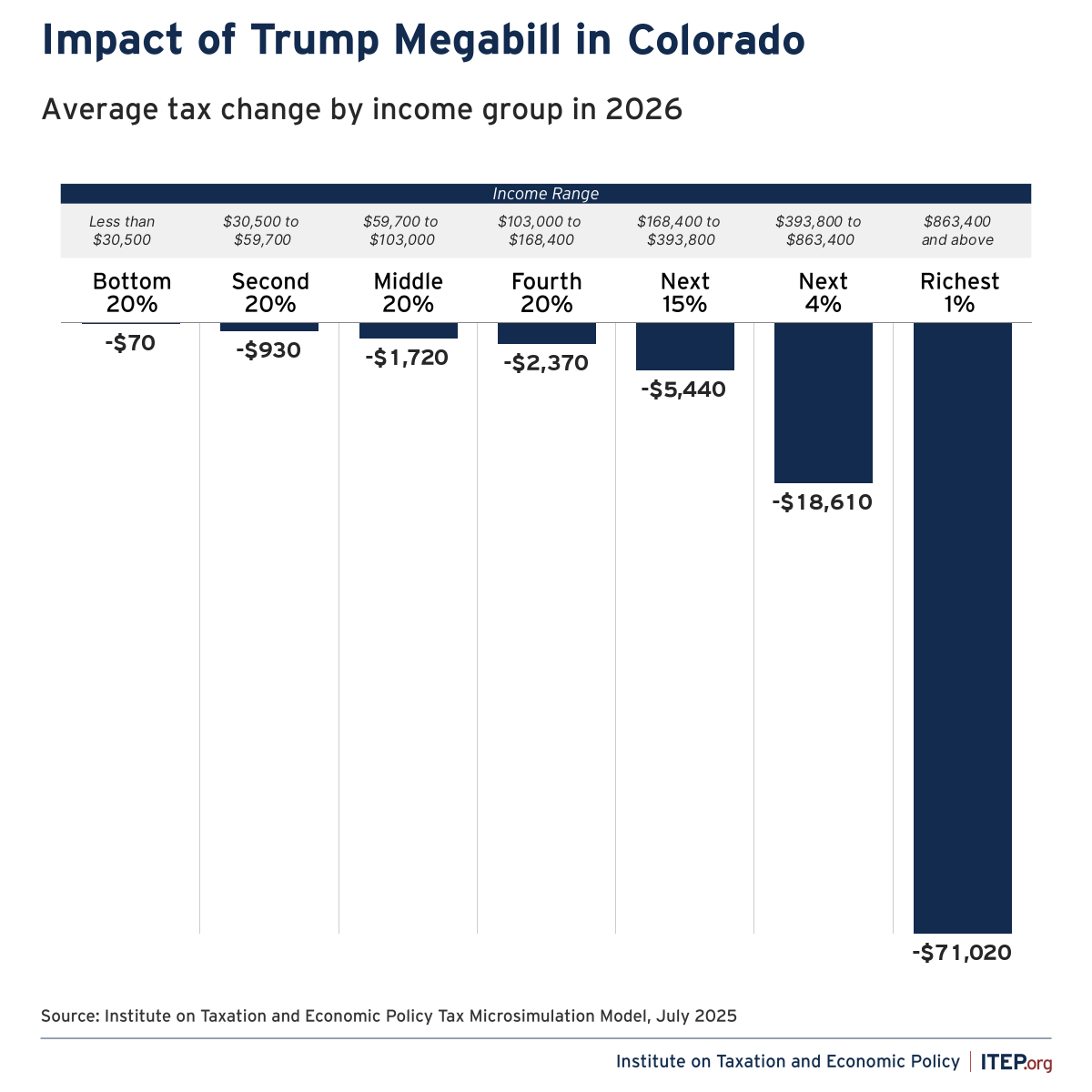

H.R.1, branded by its supporters as the “One Big Beautiful Bill Act,” was signed into law at the beginning of July. At its core, H.R.1 reduces taxes - disproportionately for the wealthy — and pays for them by cutting social safety net and green energy programs. Importantly, because of the connection between our state and federal tax codes, H.R.1’s tax cuts directly led to a $1.2 billion loss in state revenue. H.R.1 threw our previously balanced budget for the current fiscal year out of whack, and state lawmakers must now close a $783 million General Fund deficit for this fiscal year.

It’s this problem — a state budget out of balance by $783 million because of federal actions — that’s drawing lawmakers back to the Capitol at the end of August.

Making sense of the numbers

A lot of numbers are being thrown around ahead of the special session. We break down a few of them below:

$1.2 billion structural deficit from the 2025 legislative session

As many may remember, lawmakers faced a $1.2 billion deficit at the beginning of the last legislative session. This budget hole was the result of TABOR and its outdated expenditure cap. Importantly, lawmakers addressed this deficit by underfunding essential priorities like education, health care, and transportation. When lawmakers adjourned in May, they had successfully passed into law a balanced budget for our current fiscal year.

$1.2 billion revenue loss from H.R.1 for the current fiscal year (2025 – 2026)

This is the total revenue loss to the state from the federal passage of H.R.1 due to lower tax collections, disproportionately benefiting corporations and wealthy individuals. This is in addition to the previous $1.2 billion structural deficit for the same fiscal year described above.

Most of the revenue loss, a little over $1 billion, would have gone into the state’s General Fund — which pays for a broad range of services Coloradans depend upon. However, there are two additional funds, which are outside of the General Fund and are supported through income tax diversions, which will now receive a combined $170 million less because of H.R.1’s passage. These are the State Education Fund, which supports K-12 education, and a fund for the implementation of Proposition 123, which supports affordable housing.

$783 million General Fund deficit for the current fiscal year (2025-2026)

H.R. 1 caused a $1.2 billion loss of state revenue. So why is there only a $783 million General Fund deficit? This is due to several factors. First, as mentioned above, some of the revenue loss is not directly impacting the state’s General Fund. Second, prior to H.R.1’s passage, the Office of State Planning and Budgeting projected a $289 million TABOR surplus. This is revenue the state had already collected but couldn’t use because of TABOR. Because of H.R.1, this surplus is gone. Finally, as often happens, the budget started off approximately $40 million out of balance. It was expected that over the course of the coming year, departments would return enough money to re-balance the budget.

When we factor in each of these pieces — a $1.2 billion total revenue loss — $170 million which would have gone to the State Education Fund and the implementation of Proposition 123 — $289 million of TABOR surplus which will no longer be collected + $40 million to account for the beginning budget balance — we get a $783 million deficit.

Difficult Choices Before the State Legislature

Given the enormity of the deficit, lawmakers have few easy options to re-balance the state’s budget. To put our revenue loss into context, $783 million constitutes 4 percent of the General Fund budget lawmakers passed in April.

Knowing they’ll have few good paths forward, we examine some of the difficult choices lawmakers will be confronted with when they return to Denver.

Closing tax breaks for corporations

According to the Office of State Planning and Budgeting, nearly 70 percent, approximately $825 million, of this year’s revenue loss from H.R.1 is attributable to corporate tax reductions. With this in mind, Colorado lawmakers have an opportunity to rebalance H.R.1’s distributional impacts by closing ineffective corporate tax breaks that are no longer providing a public benefit for Colorado.

Closing corporate tax loopholes won’t solve the entirety of Colorado’s budget crisis. In fact, in his proposal, Governor Polis has recommended that approximately one-third of the deficit be addressed by closing corporate tax breaks (the other two-thirds would come from budget cuts and the state’s reserves). However, taking this action mitigates some of H.R.1’s inequities and reduces cuts to the programs and services Coloradans rely upon.

Taxes on overtime

Due to H.R.1’s passage, some workers won’t pay federal income tax on overtime through 2028 (the benefit begins to phase out for individuals with modified adjusted gross incomes above $150,000/year and $300,000/year for those filing jointly). Notably, this and several other tax provisions billed as supporting low and middle income taxpayers end in 2028. This stands in contrast to many of H.R.1’s corporate and individual income tax provisions that benefit the wealthy, which were made permanent. Structured as a tax deduction, workers will realize the overtime benefit, which is capped at $12,500 a year for individuals and $25,000 for joint filers, when they file their taxes.

As noted above, by default, Colorado tax law largely follows that of the federal government. However, in 2025 the legislature passed HB25-1296. As part of the bill, state lawmakers decided to decouple, or untie, Colorado’s overtime tax policy from that of the federal government. Beginning in 2026, Colorado will collect state taxes on overtime, regardless of federal policy.

Some have suggested that Colorado reverse course, follow the federal government’s lead, and reduce its taxation on overtime. As has rightly been noted, the high cost of living continues to be a concern and we should find ways to make Colorado more affordable for working families.

However, the decision to undo our state’s overtime taxation policies shouldn’t be taken lightly as it comes with a more than $200 million price tag. Perhaps more importantly, however, are the accompanying equity considerations. Many low- and middle-wage workers aren’t eligible for overtime pay, despite repeated attempts by advocates to raise the qualifying income threshold. Moreover, even for those who do earn overtime, because the policy is structured as a tax deduction, the benefits are weighted to middle- and upper-income households.

Ultimately, integrating the new federal overtime policies into Colorado’s tax code will create a bigger budget deficit while only benefiting a small group of workers and leaving many others behind. If we truly want to support working Coloradans, better options exist. We can, for example, expand the number of workers eligible for overtime by increasing the qualifying income threshold, grow the reach of proven tax credits, like the Earned Income Tax Credit, or create a fairer tax code that benefits all middle- and lower-income workers.

Pulling from the state’s reserves

The state’s reserves are meant to mitigate the impacts of a fiscal crisis and help the government meet its obligations until the economy rightsizes. The size of the reserve, which is expressed as a percentage of the General Fund, is set in statute by lawmakers. Historically, Colorado’s reserves have been minimal. However, in the aftermath of COVID, policymakers prioritized strengthening the reserve, which now sits at 15 percent of the General Fund. Though this is a sizable increase from prior years, it’s still lower than the 19 percent recommended by Moody’s.

Certainly the fiscal impacts of H.R.1 constitute a crisis that the reserves were meant to protect against. Importantly, pulling from the reserves will lessen the need to make deeper cuts to government services. However, taking money from the state’s reserves comes with tradeoffs, which include increasing our vulnerability in the event of an economic downturn. Notably, economists from OSPB estimated a 25 percent chance of a moderate recession in their June forecast.

It’s a tricky balance in deciding whether and how much to pull from the state’s reserves in order to cover the revenue loss from H.R.1. Yet, it’s just one of many bad choices necessitated by federal action.

Budget cuts

Given the deficit’s magnitude, it’s unavoidable that lawmakers will have to make cuts to a lean state budget. Though the governor already took steps to reduce government spending by instituting a hiring freeze through 2025, more reductions are needed.

While the bulk of the cuts will be decided during the 2026 regular session, they will nonetheless loom over the special session as lawmakers seek to bring the current year’s budget back into balance. Detailed proposals for reductions will likely emerge in the weeks following the special session, but may include cuts to the following areas that take up significant portions of the state budget:

- Higher education: During times of fiscal stress, the Department of Higher Education has historically faced significant state funding cuts. Concerningly, to make up for lost state support, colleges and universities often raise tuition, which can, in turn, make it more difficult to pursue higher education, and for those who do, grow their student debt and financial insecurity.

- Provider reimbursement rates: We know that many of the reimbursement rates paid to private agencies which offer government-approved, community-based services — including medical care, child care, and behavioral health — are too low. While these rates have increased over the years, their growth has often been below the rate of inflation, a fact that has created limited access to essential services across our state.

- K-12 education: Additionally, because it is such a large component of the state’s General Fund budget, it’s possible that we may see cuts to K-12 education. Notably, the Budget Stabilization factor, which we only recently stopped using to reduce K-12 expenditures, was created during a fiscal crisis.

Reductions in any of these budget areas do not bode well for Coloradans. The impact, however, will be magnified by the suspension of Colorado’s expanded Earned Income Tax Credit and Family Affordability Tax Credit due to the state’s projected revenue loss. Thousands of low- and middle-income families will be doubly hit by the loss of direct financial support from the above-mentioned tax credits and reductions in government services.

Looking Ahead

When lawmakers return to Denver, they’ll be confronting a crisis that’s not of their making. Instead, our state is facing an immediate $1.2 billion loss in revenue because national lawmakers prioritized tax breaks that disproportionately benefit corporations and wealthy individuals.

Bad as our current situation is, it’s also important to recognize that we’re only seeing the beginning of H.R.1’s impacts. In the coming years, OSPB is predicting a nearly billion dollar reduction in federal revenue. This means the difficult choices policymakers are currently confronted with won’t end with the special session.

Because of TABOR, Colorado lawmakers have few options — and almost no good options — for addressing the fiscal crisis caused by H.R.1. Importantly, our state is hamstrung from pursuing revenue raising options, like a graduated income tax, that preserve essential services and reconfigure the burden of federal actions. Until we put more tools on the table, our state will remain vulnerable to the priorities and values of those outside of Colorado.