Poverty Data Shows Who Would Benefit From a Child Tax Credit

Addressing child poverty is a high, but elusive, public priority. We know that reductions in child poverty have significant short and long-term benefits for academic success, health, financial well-being, and economic mobility across our state. In 2020, approximately 11 percent of all Colorado children under the age of 18 lived in poverty and, as census data show, no part of the state is immune. In fact, while it affects every community, child poverty is particularly concentrated in rural areas.

A bill currently making its way through the legislature, HB24-1311 Family Affordability Tax Credit, offers a valuable way to reduce child poverty, promote economic well-being, and boost local economies. HB24-1311 would create a new, refundable tax credit for middle- and lower-income families with children. This policy would benefit families throughout the state – but especially those in rural communities.

Lower Median Household Income and Higher Child Poverty in Rural Colorado

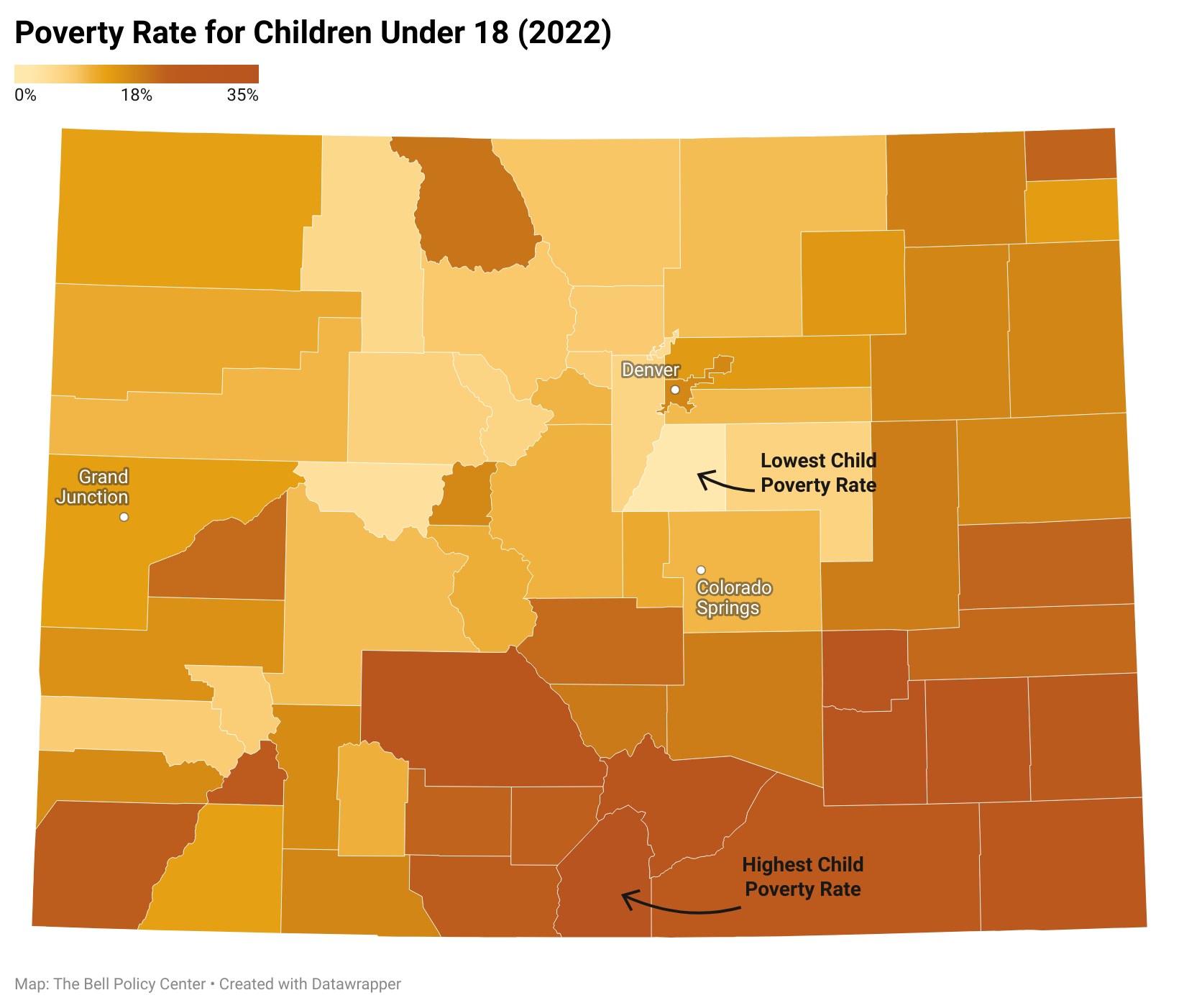

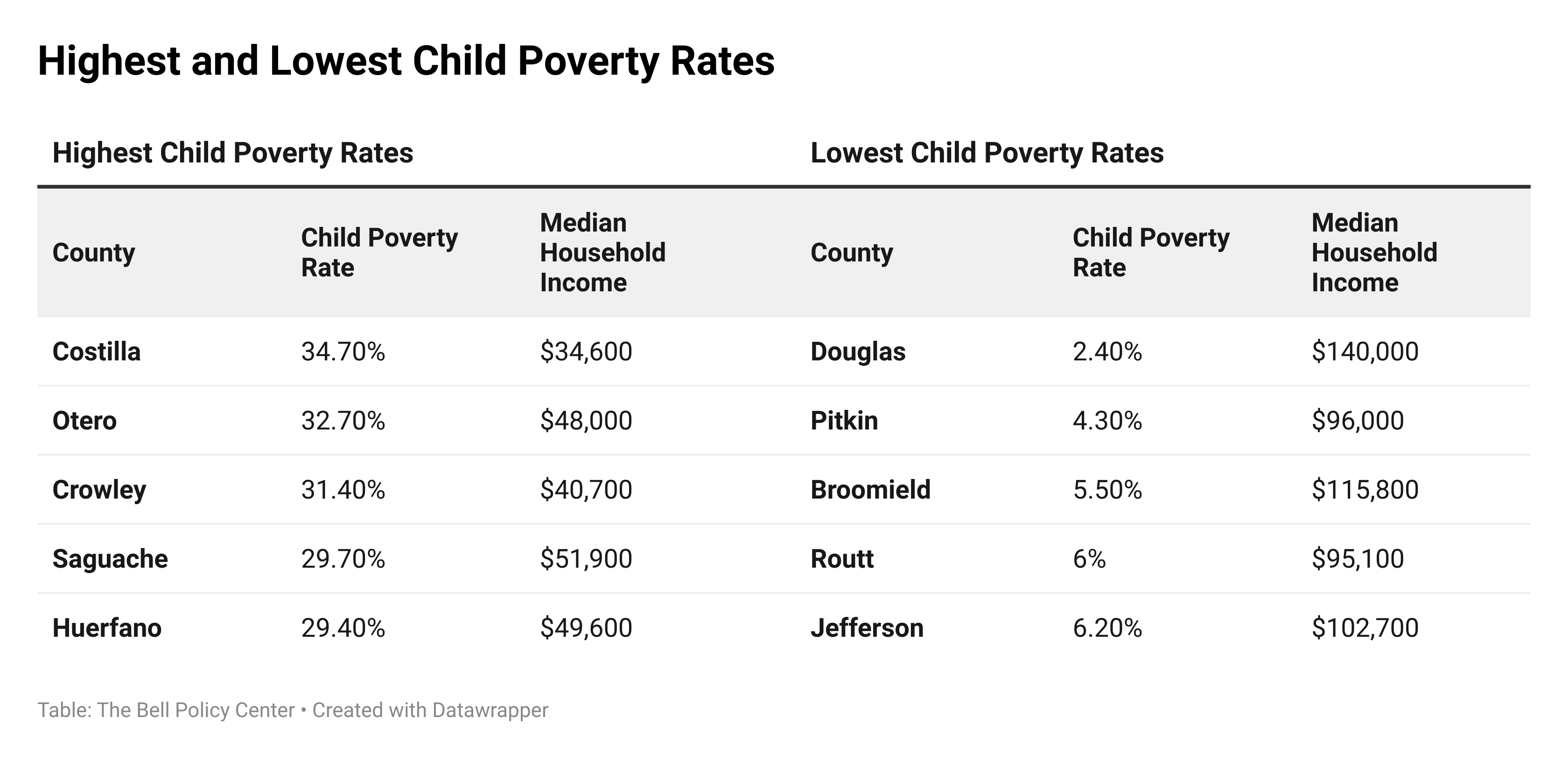

The two maps below show both median household income and child poverty rates in Colorado. As is evidenced in these maps, there is a significant correlation between child poverty and median household income. Generally, counties with higher household incomes have lower child poverty rates, and vice versa.

Importantly, these maps also show geographic clustering – with the highest child poverty rates (and lowest median household incomes) occurring predominantly in Colorado’s southeast and south central counties. The chart below shows the Colorado counties with the five highest and lowest child poverty rates.

Community Impacts of Putting Money Back into the Pockets of Colorado Families

The tremendous benefits of providing refundable tax credits to low and middle-income families with children are well-documented. Importantly, many of these studies note the outsized impact of these credits in rural areas.

The benefits of refundable tax credits targeted toward families are self-evident. Additional money helps parents – many of whom are already overstretched by the high cost of child care – pay for food, utilities, and housing. Lesser known however, are the ripple effects for community well-being. When parents have, and then spend, additional money in the local economy businesses and employers benefit. This infusion of support can be especially impactful in rural communities, where as shown above, incomes are often lower to begin with.

Addressing child poverty benefits our entire state – but especially those outside of the front range where child poverty rates are highest. By taking steps to reduce child poverty via a refundable credit, we’ll be supporting Colorado’s children and families, while also creating a stronger, more equitable state.