Setting the Record Straight on Colorado’s SB24-233

The timing was suspect. As the Colorado legislature was finalizing bipartisan, long-term property tax relief, a right-leaning think tank dropped a highly critical report about the legislation with questionable facts and conclusions. The Common Sense Institute claimed Colorado SB24-233 constituted a “tax increase.” Nevertheless, the legislature voted overwhelmingly to approve SB24-233, with only eight out of 100 legislators voting against the bill. While this piece will dive into some of the more misleading and false claims in the report, there is a very conspicuous piece of information completely absent.

No Mention of What Property Taxes Pay For

When talking about taxes, it is always important to discuss both sides of the ledger: how much the taxes are, and what the taxes are used for. Ignoring either part of the equation makes any analysis incomplete. Common Sense Institute completely leaves out of this report why local property taxes in Colorado are so important. These are local taxes paid to local governments, special districts, and school districts to provide services like education, mental and behavioral health, child care programs, public and fire safety, affordable housing, and water infrastructure. While Common Sense Institute regularly puts out reports on the importance of funding affordable housing, education, health care, and child care, they choose to ignore impacts that property tax cuts will have on all of these vital programs. Cuts to property taxes mean cuts to these services.

SB24-233 was a fiscally responsible property tax reform package that ensured no cuts to public education funding, an end to severe spikes in property taxes, and real relief for commercial and residential property owners. Lawmakers did the hard work. They balanced the need for community revenues supporting basic services with the problem of seeing property taxes rise too far, too fast. However, in their desire to set the stage for more tax cuts, the Common Sense Institute missed the mark on a few extremely important details.

Claim: We can just continue the special session property tax cuts from 2023.

Using the emergency relief provided during the 2023 Special Session – SB23B-001 – as a baseline for property tax cuts is disingenuous. The relief in that legislation lowered the residential assessment rate from 6.765 percent (which had been lowered from 7.15 percent) to 6.7 percent. It also increased the exemption from $15,000 off of a home’s value to $55,000.

- While those cuts to assessment rates and home values will continue for one more year to give certainty to property owners and local governments, they come at a real cost to the state and local governments. Continuing them indefinitely would be a significant financial strain on state and local budgets.

- The most minimal backfill for property tax cuts at this level would cost nearly $700 million. School districts would lose $380 million in one year, and backfilling local districts at previous levels would cost nearly $300 million. That means that continuing these property tax cuts would mean harmful reductions to basic services in local communities – think road maintenance, education funding, mental and behavioral health services, and maintenance of local parks. Or, it would mean severe cuts to the state budget, due to the need to backfill the cuts to local governments. That would impact health care, transportation, higher education, and many other vital state services.

Claim: There are other options for property tax relief that weren’t considered.

When looking at SB24-233, it is important to think about other possible roads not taken. The other options were:

- Continue Special Session relief: This option would have forced an ongoing state expense of hundreds of millions of dollars because the state has had to backfill local government losses. If the state did that, it would lead to cuts to existing state programs or a raiding of state reserves that are an important buffer against economic downturns. If the state did not backfill local governments, then that would force significant revenue reductions for schools and local governments.

- Do Nothing: After the repeal of the Gallagher Amendment, legislators pledged to find a fix for rising property taxes. That solution had been elusive. Yet, in the 2024 legislative session, lawmakers engaged in robust stakeholdering efforts and intense bipartisan negotiations to come up with a legislative package that both Republicans and Democrats overwhelmingly supported. If they had done nothing, or failed to pass that package, not only would they have broken that promise, but homeowners and businesses would have seen their property taxes go up considerably, especially hurting homeowners on low and fixed incomes and small businesses.

- Ballot Initiatives 50 and 108: These reckless ballot initiatives would cost the state significantly. Initiative 108 would cost the state upward of $2-3 billion dollars in the beginning, with Initiative 50 costing that within a few years of being enacted. The state would have to cut nearly a third of its already limited General Fund budget, forcing broad and deep reductions. On the chopping block: health care, transportation, higher education, corrections and public safety, and general government functions. These draconian cuts, would risk bond downgrades and would severely limit the state’s ability to meet Colorado’s needs.

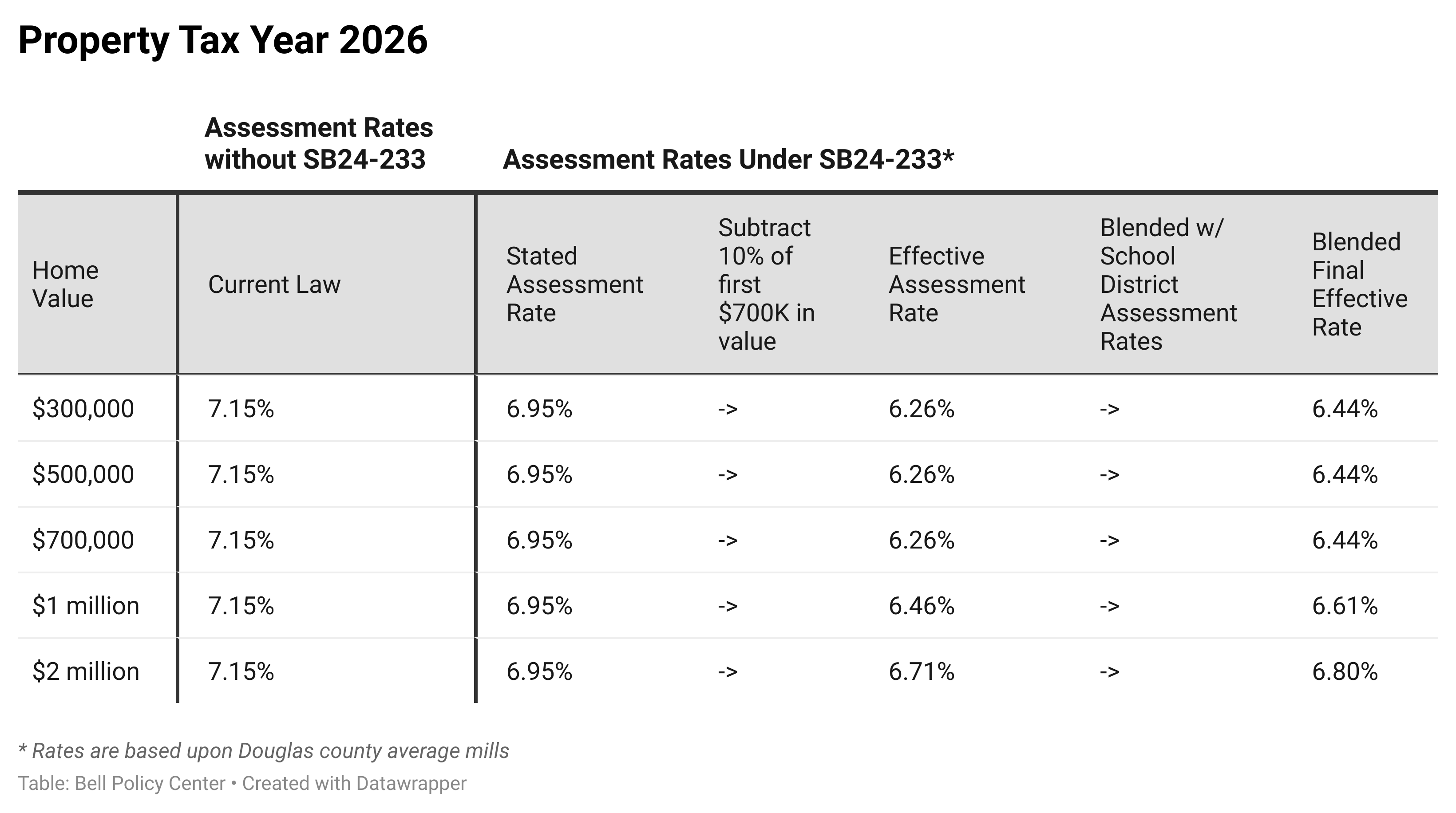

In fact, the Colorado legislature has already addressed the Colorado’s property tax issues with the responsible reductions included in SB24-233. It uses familiar tools – exemptions and property tax rate reductions – to create a sustainable, long-term property tax solution. The following chart lays out the relief Coloradans will see from this legislation.

Claim: A 5.5 percent cap is not a long-term fix and doesn’t provide “predictability”.

A 5.5 percent cap is durable and important. While Common Sense Institute may brush off a 5.5 percent cap as “not predictable,” the fact is that a cap of that size would have kept property taxes low over time while not significantly hamstringing governments. It’s important to note that the historical average property tax revenue increase in Colorado is about 6.5 percent. There are some carve-outs to ensure that school districts maintain funding, but those constitute significantly less than half of the taxes to schools. And there would have to be assurances that bond commitments are met, but homeowners and local governments would be better off with a cap of this size, as opposed to a smaller one that would force cuts to local governments, or no cap, which would lead to spikes over time that hurt property owners across the board.

Claim: This was a backroom deal foisted on the people of Colorado.

The Commission on Property Tax included legislators from both parties, local elected officials, representatives from business and public education, property tax experts, and special districts. The Commission spent several months very publicly poring over possible avenues for reform, and came up with a set of recommendations – many of which were included in the 2024 property tax bill.

- It was a difficult task given the competing interests at the table, but the only other option was to make policy that would leave out a crucial voice in Colorado.

- Ignoring the recommendations of a commission that is representative of interests in this issue and has studied all corners of it would have been a waste of time, capital, and knowledge.