Has the Colorado State Budget Grown?

Conservative commentators have been on a mission to describe Colorado’s state budget as growing out of control. By their accounts, the budget has grown by epic proportions over the last three decades, but for those who have lived in Colorado, it’s hard to square these claims with what we see every day: significant declines in per-pupil education spending, a backlog of over $9 billion in transportation projects, and a drastic reduction of state spending for higher education.

How do we make sense of it all? It all comes down to how you define “growth.” Growth is a relative term, meaning it compares one thing to another in terms size, time, or another set of factors. Take a simple example — a child’s allowance. In 1930, a child’s allowance may have been 50 cents. In 2018, a child’s allowance may have been $2.00. One might argue children’s allowances have grown by 300 percent. While not wrong, that’s not a very good analysis of growth in children allowances. In 1930, 50 cents may have bought that child a soda, a hamburger, a comic, and more. In 2018, a child would be lucky to afford one of those items with their allowance. When considering the relational factor of purchasing power, we would more accurately conclude children’s allowances have decreased over time.

As Colorado continues to have conversations about growth in the state budget (or lack thereof), the Bell is breaking down some of the key principles and approaches to measuring growth. Overall, it’s also important to note growth in public spending often results in very positive outcomes — more citizens with strong educations, affordable health care for all, roads that generate strong economic activity, or beautiful parks and recreation opportunities. Nonetheless, it’s important to fully evaluate whether or not the state budget has indeed grown over time.

Comparing the Right Budget Over Time

When talking about Colorado’s state budget, it’s important to talk about the portion of the budget that’s related to actual Colorado taxes. That portion is almost solely encompassed within the General Fund (about $12 billion). Too often, those who want to exaggerate state budget growth will include federal pass-through funds or fees paid for specific services. (Below is a breakdown of the entire budget, but for more detailed information on the state budget, please visit the Bell’s overview of the Colorado state budget.)

- General Fund (~$12 billion): The portion of the budget comprised of state taxes. This is the portion of the budget legislators have discretion in deciding what does and does not get funded.

- Fees for state-operated businesses and cash funds (~$9.4 billion): Funds set up to provide a direct service financed by fees for a particular service. Often collected through “enterprises,” these are state-operated businesses created under TABOR. The largest cash fund is the Higher Education Enterprises, which are primarily funded by direct tuition payments from students.

- Federal funds (~$8.7 billion): Federal funds are like cash funds in that they’re obligated for specific programs through the Congressional appropriations process. The state government has little say in much of where this revenue goes throughout the state.

When reviewing commentary on the state budget, it’s important to note whether the author is talking about the General Fund or lumping together other funding sources that aren’t directly related to Colorado state taxes.

Different Ways to Calculate Growth

1. State Budget as a Percentage of the Economy

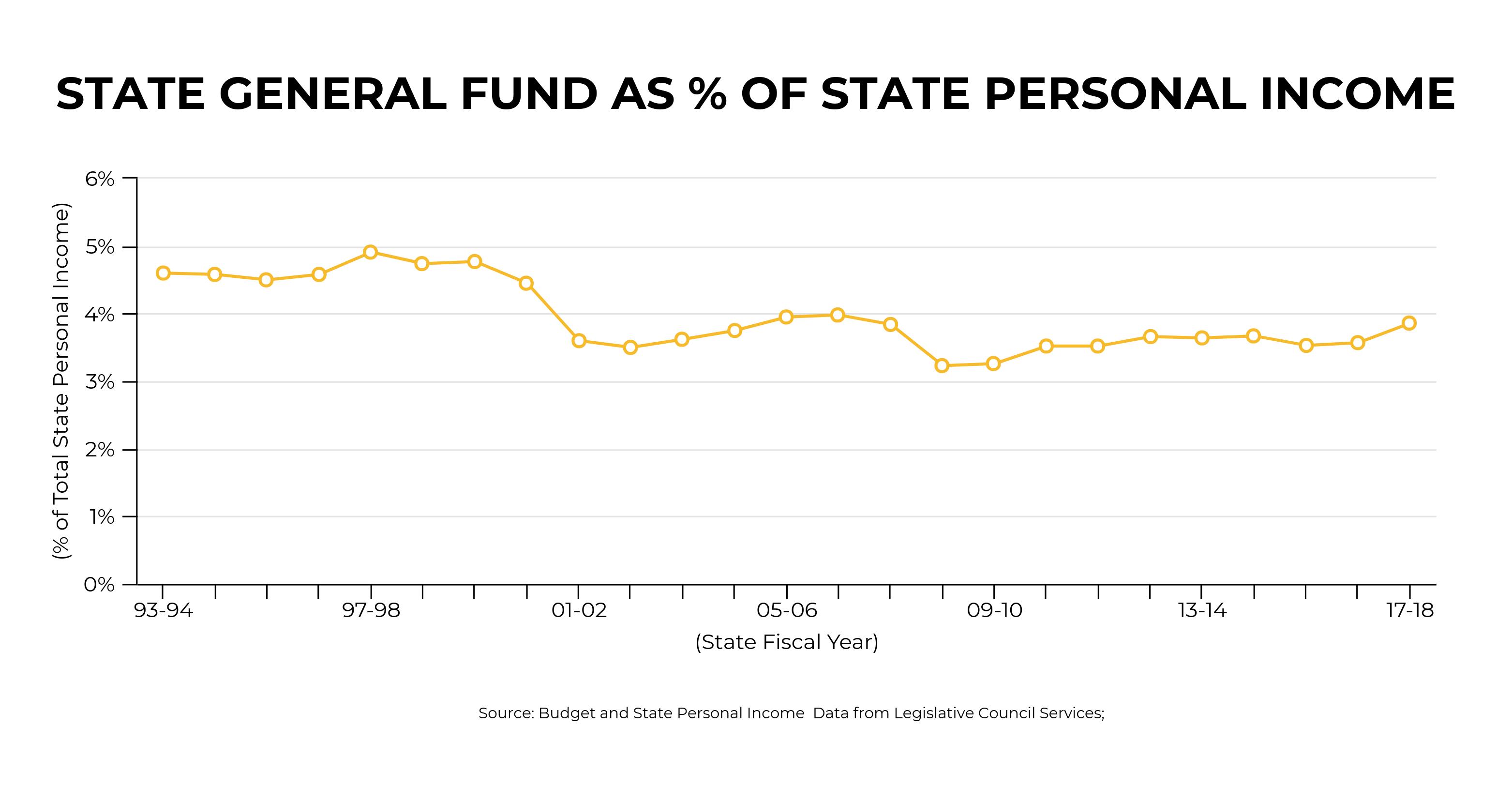

In comparing the relative size of governments or of government over time, most economists do so by comparing government spending to a measure of that government’s economy. By doing so, these analyses can account for changes in prices, possible needs within the economy, and overall growth that is occurring within that region. It also allows for a more direct comparison of public spending to private market activity.

For Colorado, the possible measures that allow for this comparison over time are total state personal income, which measures the total income of state taxpayers, or the gross domestic product (GDP), which measures the monetary value of all finished goods and services made within a particular area.

Because state personal income connects directly to state taxes, the Bell has used this economic indicator in analyzing public spending over time. As shown in the chart below, as a percentage of total state personal income, General Fund spending has declined over the last 20+ years. The decline is even greater when looking at years before 1990.

Limitations of Measure: While the Bell believes this method is one of the more accurate methods for evaluating state budget growth over time, it still has limits:

- It is not an account of actual public need for services. Over time, need for public goods could increase and those goods may be more costly than pervious public services purchased by government.

- It does not directly account for population growth, but indirectly does so because it is a common measure over time that adjusts to growth in population income.

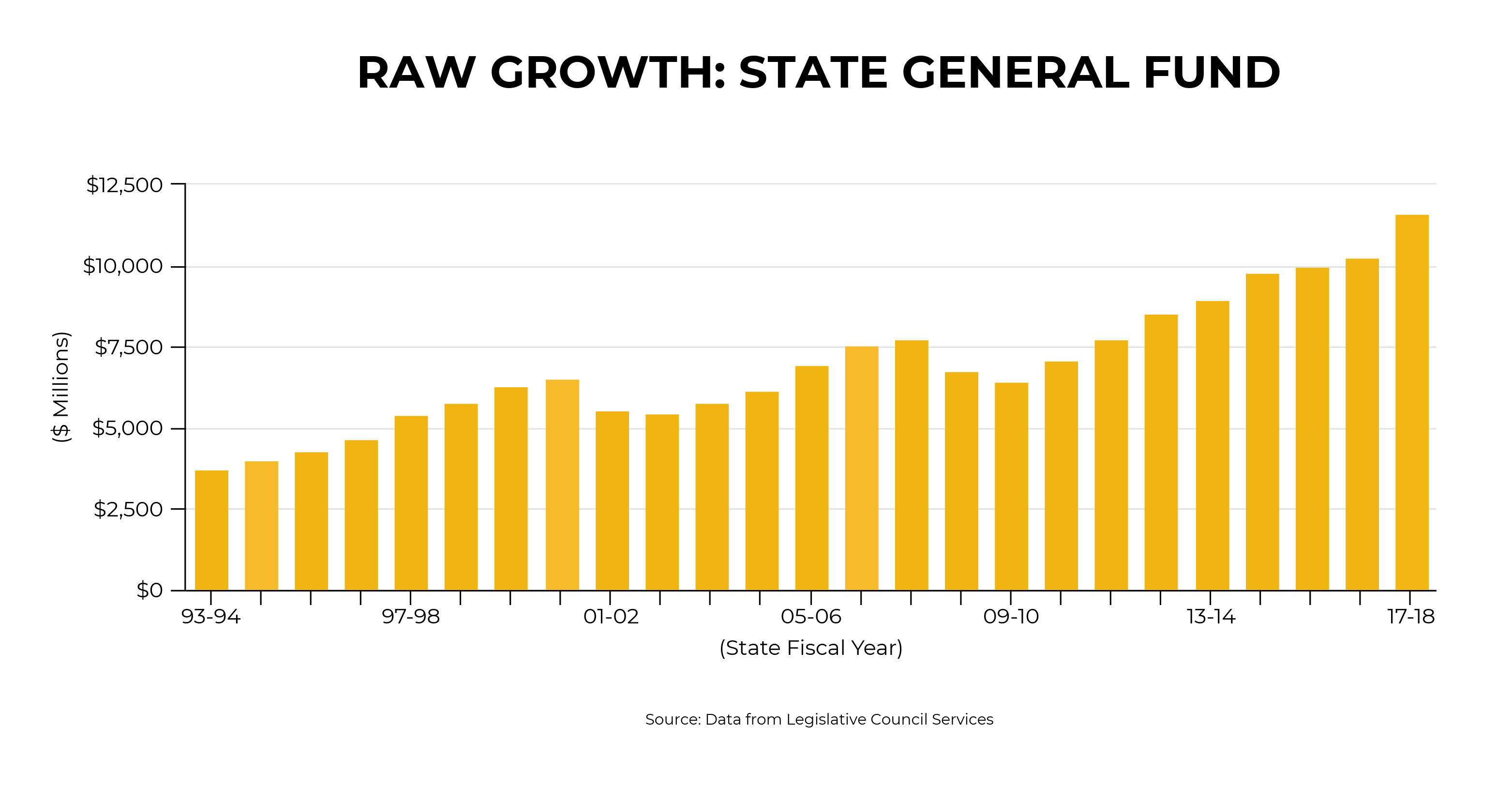

2. Raw Growth in the State Budget

There are some analyses that start and end with just a raw calculation of the difference in state General Fund budgets over time. Just as was done in our child allowance example, these analyses are able to conclude the state budget has grown by over 300 percent over the last 20+ years.

Limitations of Measure: While this measure is not necessarily inaccurate, it is the least useful measure of growth.

- Does not adjust at all for the value of money over time (i.e. what a dollar is worth in purchasing power).

- Does not consider changes in population over time, thus not analyzing weather budget growth has kept up with increased population needs.

- Does not compare the budget growth in relative terms to some version of economic growth.

- Does not account for changes within the Colorado populations and overall needs for public services. More children and/or seniors may lead to increased demand for public services.

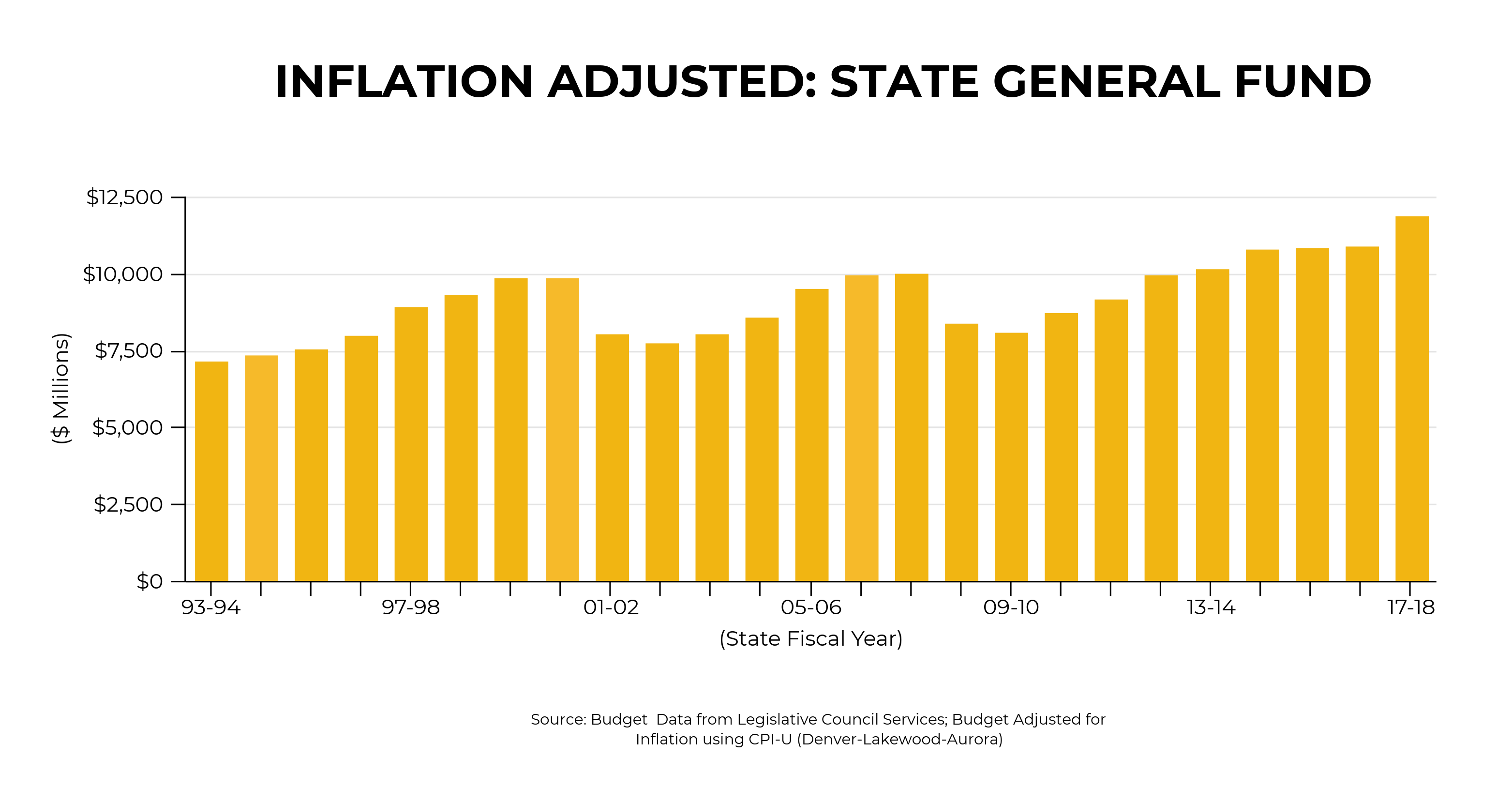

3. Inflation Adjusted Growth

Adjusting for inflation allows for a better comparison of the value of money over time. The most common method for adjusting for inflation is to use a version of the consumer price index (CPI). The CPI is a measure of the change in prices for a certain basket of consumer goods and services over the years. By adjusting to the difference prices for that basket of goods, one can create a common measure of the value of consumer money between time periods. In our simplistic child allowance example, this would have allowed us to compare the prices of items such as soda or comics over time and compare the value of 50 cents in 1930 to $1.50 in 2018.

Based upon this method of analysis, the state General Fund has grown over the last 20+ years.

Limitations with Measure: Obviously better than a raw analysis of growth, merely adjusting using CPI doesn’t provide a robust understanding of state budget growth.

- While CPI adjusts for a basket of consumer goods and services, it does not measure the basket of goods and services purchased by governments. When governments purchase goods such as healthcare, those prices might increase much more than consumer goods calculated by CPI.

- Does not consider changes in population over time, thus not analyzing weather budget growth has kept up with increased population needs.

- Does not compare the budget growth in relative terms to some version of economic growth.

- Does not account for changes within the Colorado populations and overall needs for public services. More children and/or seniors may lead to increased demand for public services.

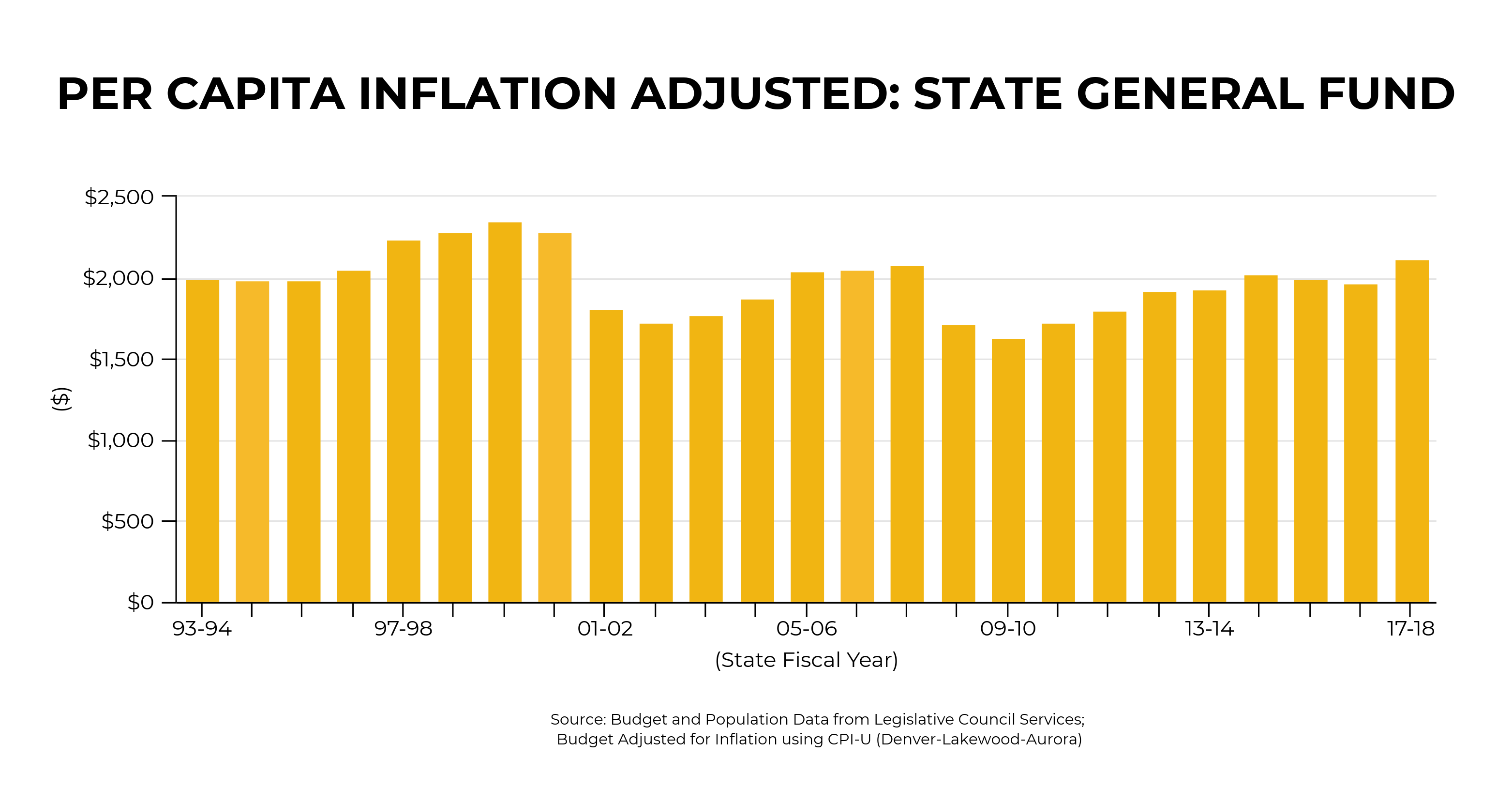

4. Inflation & Population Adjusted Growth

Adjusting for inflation and population growth allows for a better comparison of both the value of money over time and the amount of state funding per individual. As the population grows, one would expect state funding to adjust in a similar manner. Millions of new Coloradans leads to a need for additional services, including new roads, schools, or other public services.

Based upon this method of analysis, the state General Fund has grown compared to the early 1990s, but is lower than levels seen during a period of similar economic expansion in the late 1990s.

Limitations with Measure: Better than most analyses of growth, this measure still has severe limitations.

- While CPI adjusts for a basket of consumer goods and services, it does not measure the basket of goods and services purchased by governments. When governments purchase goods such as healthcare, those prices might increase much more than consumer goods calculated by CPI.

- Does not compare the budget growth in relative terms to some version of economic growth.

- Does not account for changes within the Colorado populations and overall needs for public services. More children and/or seniors may lead to increased demand for public services.

Stay Engaged & Informed

As Colorado continues to debate tax and spending measures, it’s important for all Coloradans to understand where our budget stands and the growing needs of our state. The Bell will continue to provide you with an in-depth analysis of the state budget and areas of public investment that can increase economic mobility for all Coloradans. For additional information on the state’s budget and key economic and budget forecasts, please also visit the nonpartisan Legislative Council.