Student Debt Solutions: Sizing Up Colorado’s Approach

Student debt

In 2018, Americans held about $1.5 trillion in outstanding student loan debt. In Colorado alone, 761,000 borrowers owe $26 billion in student debt. Several factors have led to this huge debt burden, including shrinking public investment in higher education, the increasing requirement of higher education in the labor market, and institutional competition for student enrollment. The explosion of student debt has contributed to the lack of economic mobility for many Coloradans.

A way to combat student debt increases is to help borrowers navigate the private loan sector. Some private loan servicers are at fault for rising student debt, and a few have even made headlines for their predatory practices. In addition to forcing borrowers into high-cost repayment plans, private loan servicers have consistently presented misleading or inaccurate information on crucial aspects of their loans. And it seems the problem has become more acute: A 2017 report by the Consumer Financial Protection Bureau shows borrower complaints against student loan servicers were up 429 percent from the previous year.

As outstanding student debt has increased, government regulation of lending has been severely diminished by lax federal oversight and an overall decline in consumer protections. It took a recent federal ruling to compel the United States Department of Education to implement a suite of regulations protecting borrowers affected by school closure or fraud, but a larger crackdown seems to be far away.

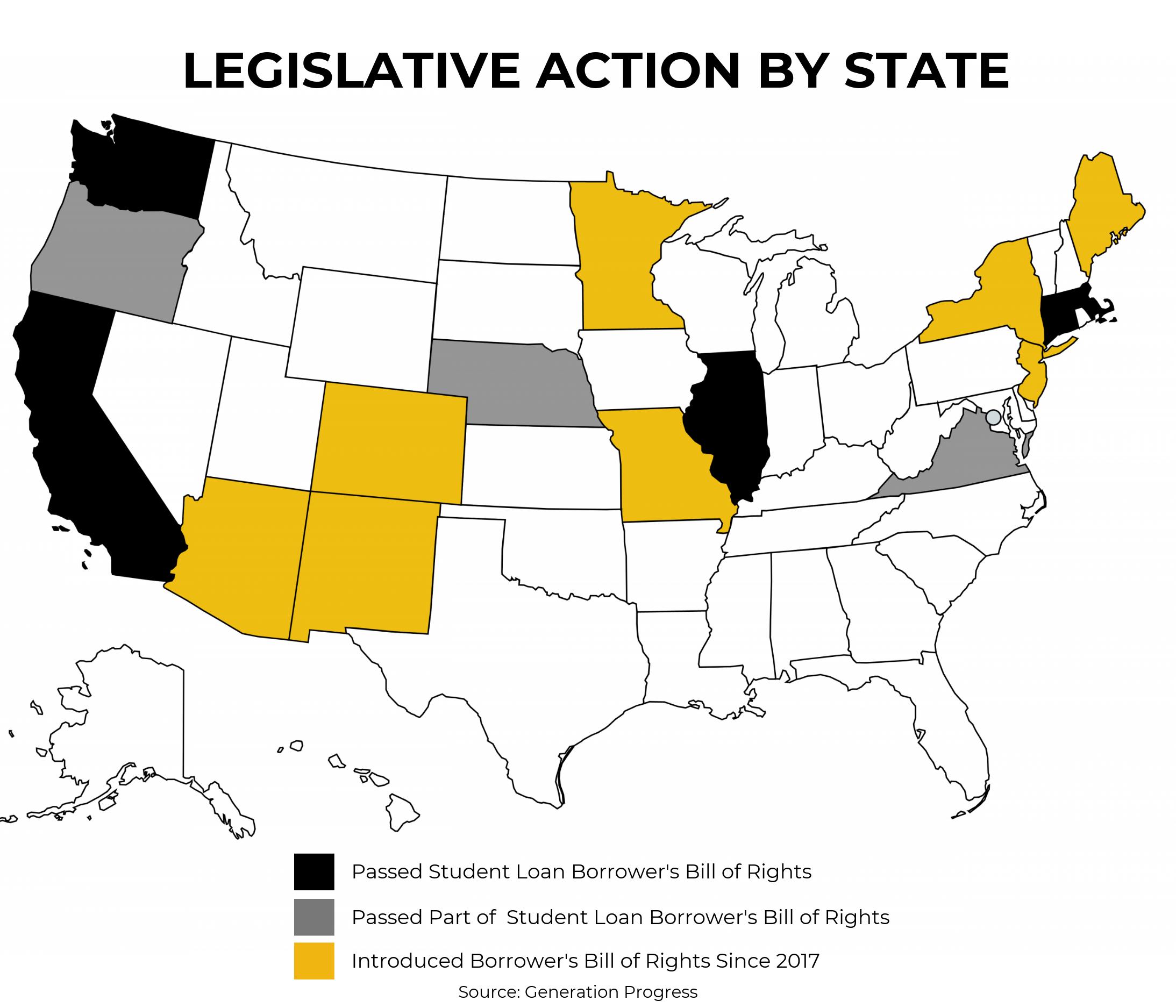

Fortunately, eight states used 2017 and 2018 to mend fractures in the system that expose borrowers to fraudulent and unfair practices at the hands of loan servicers. While some of the states took very narrow steps to help borrowers, others have looked at the issue in a more comprehensive way. These holistic laws, commonly known as a “Student Loan Bill of Rights” are essential at a time when more people need a postsecondary education to get a good job.

While Colorado has been somewhat behind the curve on this nationwide trend with some caveats (Colorado did pass HB18-1217, which created temporary income tax credits for employers who contribute to employee 529 accounts), legislation introduced on the first day of session, SB19-1002, could help ensure Colorado’s students and their families don’t need to borrow for higher education at their own financial peril.

Two states that have moved to protect borrowers with comprehensive relief bills are Washington and Massachusetts. While many other states have taken a piecemeal approach to student debt, Colorado should move forward with a plan that’s similar in scope to the problem it’s confronting to truly deal with the significant problem at hand. Fortunately, Colorado can learn from efforts in Washington and Massachusetts and would do well to implement its own versions of these laws.

There are three important categories that a comprehensive “Borrower’s Bill of Rights” should include. A look at how Washington and Massachusetts tackled these issues provides a roadmap on what Colorado can do.

Various states license student loan servicers that operate within their borders. This ensures the servicers undergo oversight and follow the same process other businesses do to get established. While the process is relatively painless — submitting financial records and paying application and other fees — it ensures there’s a record of loan servicers operating in the state, as well as the amount and type of loans they hold. Connecticut, which passed the first Borrower’s Bill of Rights in 2015, released a report in 2017 on the licensing aspect of the bill. In total, there were seven examinations of student loan servicer licensing, which helped many borrowers who had loans with those servicers. A continual check on licensing requirements for student loan servicers will only help to make the process more transparent and better for borrowers.

Several states have created a student loan ombudsman to advocate for borrowers’ rights, but making it part of a comprehensive package is a necessity. An ombudsperson would be a state employee who is the advocate for borrowers in any dispute with student loan servicers, as well as someone who can help borrowers “analyze and understand their rights and responsibilities” when it comes to their student debt. The role would also be important in communicating with state agencies and legislators on these issues. The Consumer Financial Protection Bureau (CFPB) had an ombudsperson until recently, when he resigned over frustration at the lack of federal attention being paid to bad actors in the student loan servicing sector. However, a 2017 report from the CFPB shows the importance of an ombudsperson to oversee student debt:

“From July 21, 2011 through August 31, 2017, CFPB handled over 50,700 private and federal student loan complaints, and about 9,800 debt collection complaints related to private or federal student loan debt. These complaints have served as the critical link in a process through which government agencies and market participants have repeatedly taken action to improve the student loan system for millions of Americans. In effect, these complaints have led to actions that have collectively returned more than $750 million to student loan borrowers.”

With the federal government abdicating its responsibility to student loan borrowers, it has become even more important for Colorado to step forward and lead, and an ombudsperson is one important way to do that.

Any holistic “Borrower’s Bill of Rights” needs to explicitly put a stop to predatory practices that harm consumers and force them to pay more money than they owe. In concert with licensing servicers, this includes putting an end to practices such as falsifying or purposely omitting important loan information, bad reporting mechanisms that risk borrowers’ misunderstanding their repayment plans, and steering borrowers toward repayment plans that cost more.

While most of the comprehensive legislation has been enacted recently — leaving little data to study — the individual pieces have proven to be effective at various levels of government and worthy of tackling the scope of the student debt problem.

WASHINGTON vs MASSACHUSETTS

A COMPARISON ON STUDENT DEBT SOLUTIONS

Washington: 2018 Senate Bill 6029 — Establishing a Student Loan Bill of Rights

Massachusetts: 2018 Senate Bill 2421 — An Act Establishing Student Loan Bill of Rights

Colorado: 2019 Senate Bill 2 — Concerning the Regulation of Student Education Loan Servicers

Washington: Legally requires student loan servicers to obtain a license in order to operate within the state.

Massachusetts: Legally requires student loan servicers to obtain a license in order to operate within the state.

Colorado: Includes provisions to require loan servicer licensing in order to operate legally in Colorado. The license application must be accompanied by proof of financial status, a history of criminal convictions, a license fee of $1,000, and an investigation fee of $800.

In Washington, it creates a new position responsible for:

- Resolving borrower complaints

- Evaluating policies and laws

- Conducting a census of residents with federal student loans in the process of loan forgiveness

- Assisting borrowers who wish to apply for forgiveness/discharge

In Massachusetts, it creates a new position within the state attorney general’s office to help borrowers:

- Navigate repayment options

- Apply for federal repayment plans

- Avoid or void a default

- Stop wage garnishment

- Resolve disputes with servicers

- Gather loan details

- Stop collection calls

- Apply for discharge

In Colorado, it includes provisions for a state ombudsperson who, in consultation with an administrator in the attorney general’s office, will:

- Review and resolve borrower complaints

- Compile and analyze data on complaints

- Assist borrowers in understanding their rights and responsibilities

- Analyze and monitor laws pertaining to local, state, and federal student lending

- Review borrower loan histories

- Establish a borrower education course

- Submit a yearly report

Washington’s approach considers a student loan servicer in violation of state law if that servicer:

- Conducts licensable activity from an unlicensed location

- Falsifies or omits student loan information

- Reports fraudulent student loan information to a credit bureau or fails to report to a credit bureau

- Doesn’t communicate with borrowers or their representatives

- Applies inconsistent payments

In Massachusetts, its plan prohibits student loan servicers from engaging in unfair methods of competition or deceptive acts or practices.

Colorado’s method prohibits student loan services from:

- Defrauding or misleading student loan borrowers

- Engaging in unfair or deceptive practices or misrepresenting or omitting any material in connection loan servicing

- Obtaining property by fraud or misrepresentation

- Misapplying payments to an outstanding balance

- Providing inaccurate information to a credit bureau

- Failing to report borrower payment history to a nationally recognized consumer credit bureau

- Refusing to communicate with a borrower’s authorized representative

- Making false statements or omitting material fact in government reporting

- Failing to evaluate a qualifying borrower for an income-based repayment program prior to placing the borrower in forbearance or default