In The Know: Douglas County Value Reduction

All of us – homeowners or renters – pay property taxes in Colorado. These bills reach us after a year and a half of assessments, calculations, and revisions. Each county has a team headed by their elected county assessor who determines the actual value of each home in the county. Property value is an important part of the formula for determining property taxes. Property taxes are calculated using the following formula:

(Value X Assessment Rate) X (Mill/1000)

Douglas County Commissioners, acting as the county equalization board, last September overrode the assessor’s value determination in an effort to lower property taxes when they announced a 4 percent reduction in property values for all homes in the county. Given the recent spike in property tax values, local governments have been encouraged to reduce their mill levies to provide tax relief to homeowners and businesses. In December, the State Board of Equalization – tasked with ensuring fair and accurate assessment values statewide – struck down Douglas County’s value reduction by a unanimous 5-0 vote. In response, Douglas County announced it would sue to overturn the state board decision. The commissioners then reduced the mill rate, thereby accomplishing the tax reduction they had in mind without adversely affecting other taxing districts. And finally, to make matters even more confusing, Governor Polis criticized the board’s decision and removed one of his designees.

Here’s why this seemingly simple move by Douglas County doesn’t make sense and why the State Board of Equalization was correct in striking down the decision.

Equity Issues

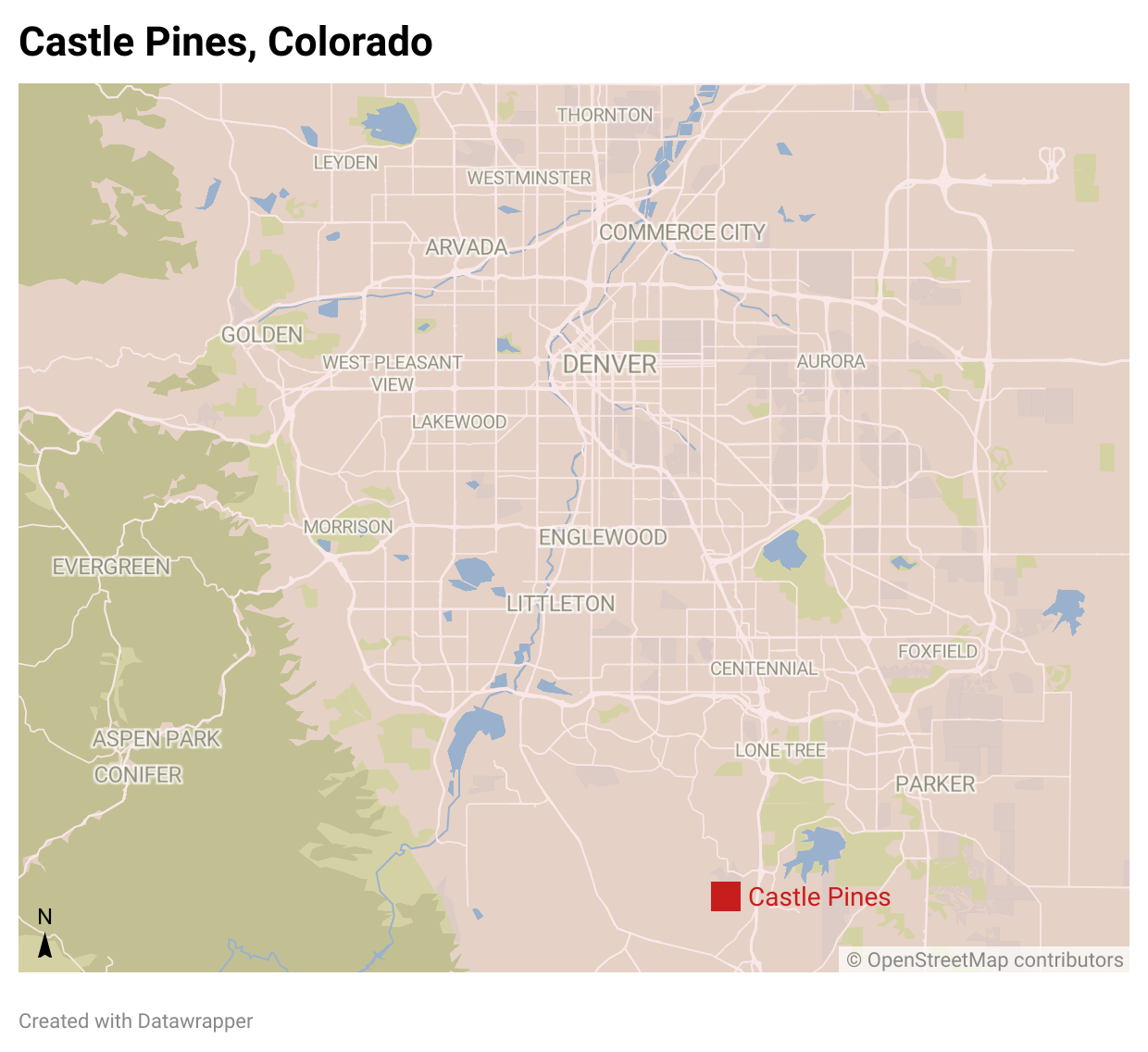

Let’s look at a home in Castle Pines with the median sale value of $665,000 for Douglas County. A typical home sits in 13 taxing districts. The boundaries for most of these districts are within Douglas County, like the Douglas County School District or the Douglas Public Library District. In these districts, a 4 percent reduction in assessment values applies equally to all taxpayers.

The complications occur in districts that are partially in Douglas County but extend into other counties. South Metro Fire Rescue Fire Protection District is one example. In addition to Douglas County, it also sits in parts of Arapahoe, Denver, and Jefferson counties. This fire district sets its mill rate of 9.25 (or an effective tax rate of 0.925 percent) for all homes that sit within its district, regardless of whether they’re located in Arapahoe, Douglas, Denver, or Jefferson County. The fire district also sets its budget based on the expected tax revenue of all homes within its boundaries paying this 0.93 percent rate.

There is another lever for local governments to provide tax relief to homeowners in the South Metro Fire District. The first is controlled by this district and every other local government. If the district determined that its expected tax revenue exceeded its budget requirements, it could lower the mill rate (or effective tax rate). In fact, a bipartisan bill from the last legislative session passed, allowing local governments to temporarily lower their mill rate without requiring a vote from its constituents. With this approach, a local government may decide its own revenue needs and tax constituents accordingly.

Instead, this 4 percent reduction lowers the tax burden for Douglas County residents in the South Metro Fire District while maintaining a higher rate for its taxpayers in Arapahoe, Denver, and Jefferson counties. Douglas County residents receive the same level of services but do not pay their equitable share. The fire district has to determine how to budget accordingly with less revenue for services they have already budgeted or equipment previously purchased. A reduction of $17 for this typical home may seem small, but it quickly adds up when applied to all Douglas County homes in this fire district, and further, it is not fair to taxpayers in neighboring counties receiving the same services at a higher personal cost.

If Douglas County’s value reduction had stood – or if other counties were to follow suit – taxpayers in neighboring counties would have had to pay extra to put out fires in homes in Douglas County.

School Finance

As a state, we’ve struggled to adequately fund our public schools, only recently turning the tide from 47th in per pupil funding to 35th. That improvement is due in large part to an increase in the local share, which comes from property taxes. The other chunk of school funding is made up by the state. Even in the case of wealthy Douglas County, the state funds 41 percent of Douglas County Re-1 School District. Last May, the state decided how much funding to allocate to each district to buffer each district’s local share. It does not seem that Douglas County’s recent decision would have affected the state’s approved share, at least not in the short term. The state only requires local governments to freeze their mills to avoid their local share falling. A potential problem would be created, however, if Douglas County’s decision were extended in future years, permanently lowering the taxable base and thus the local share. In this scenario, the state would have to step in and backfill losses to schools in Douglas County. In effect, this would lower the State Education Fund and siphon these funds away from lower-income districts and communities in our state.