Pandemic Policy Making and the Return to Status Quo

Pandemic Policy Making and the Return to Status Quo

One of the most overlooked features of the COVID years centers on a surface level incongruity: during a time of deep financial uncertainty, poverty dropped. Yet, now that our economy is beginning to right itself, economic vulnerability is seemingly on the rise. Understanding why this is happening necessitates a close look at our collective policy choices.

During COVID, we largely rose to the occasion, and made historic investments in an often-beleaguered social safety net. As we’ve highlighted, this included bolstering funding for programs that support older adults, behavioral health, child care, education, and more. But we also made direct investments in our people, through an expanded child tax credit, supplemental nutrition assistance program, and other efforts.

These investments worked. Poverty dropped and financial security, for many, rose. But now, many of these same proven programs that have made a difference in the lives of thousands of Coloradans are ending. And with their end comes a return to a pre-COVID status quo.

Poverty and financial insecurity are directly tied to the public policy decisions we make. We know what works. We have the evidence. What we choose to do with it is up to us.

Poverty, Social Safety Nets, and COVID

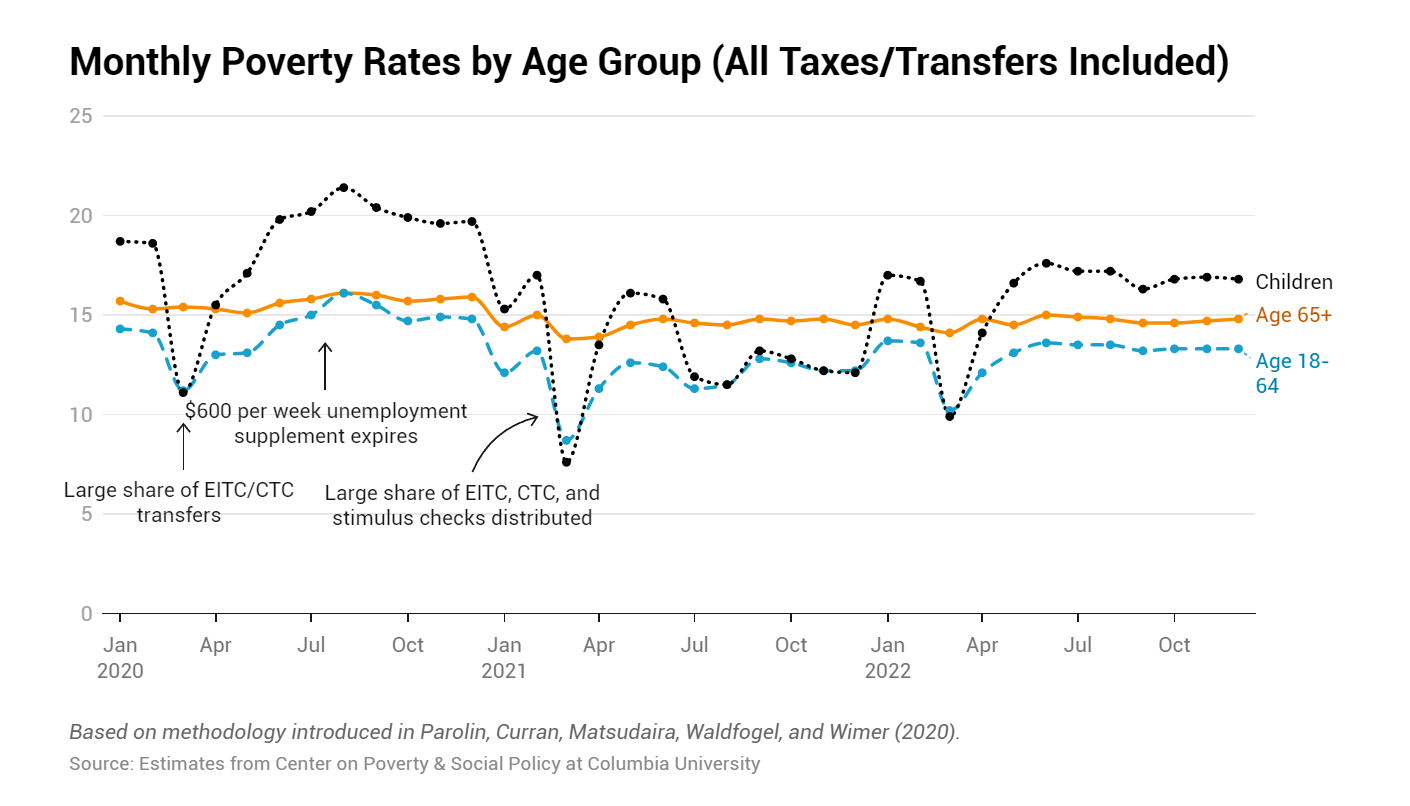

On the surface, it may seem counterintuitive that poverty didn’t skyrocket and remain elevated during COVID. Yet, despite record unemployment rates, that’s what happened. In fact, between 2020 and 2022, poverty declined, sometimes significantly. This is evidenced in the graph below from Columbia University’s Center on Poverty and Social Policy.

These happenings raise an important question: why didn’t poverty rates grow significantly during one of the most turbulent periods in recent American history?

The answer to this question is simple: We made unprecedented, widespread, and comprehensive, investments into the proven programs which comprise our social safety net. As we note below, these included direct and immediate investment into the health and well-being of individuals across our state and country.

There is no shortage of data on the individual and collective impacts of these programs, a small sample of which can be found below:

- According to the US Census Bureau, in 2021, the supplemental child poverty rate fell to the lowest level in over 10 years. The Census Bureau attributes this to the “expansion of anti-poverty programs during the COVID pandemic.”

- The Urban Institute noted a similar drop in poverty, and attributes this reduction to government assistance. As the Institute notes, this drop in poverty was unprecedented in how quickly it occurred.

- Individual programs have also been singled out for their impact. For example, additional SNAP benefits have been credited with keeping 4.2 million families out of poverty, and the expanded child tax credit reduced child poverty by almost three percent.

- A variety of other indicators also suggest increased overall well-being:

- Savings rates increased during the pandemic — including for those in the lowest income quartile.

- Between 2019 and 2020, eviction filings in Colorado fell by 57 percent.

- Before COVID, nearly 10 percent of all student debt in Colorado was 30 or more days delinquent, and thus in default. This has dropped to less than 1 percent.

End to Federal Assistance

By a multitude of measures, COVID pandemic relief was a success. Yet, despite their accomplishments, many of these programs, if they have not already, are coming to an end.

As these programs conclude, there has been a troubling rise in indicators of financial stress:

- Eviction rates across the country have increased by almost 80 percent between 2022 and 2023.

- Credit card debt has risen to record highs. Notably, Colorado has the 11th highest credit card debt in the country, with the average borrower holding a balance of approximately $8,000.

- In addition to increased credit card debt, Colorado also has one of the highest rates of new users of alternative lending products – many of which are known for their high interest rates and fees.

Many of the most significant program expansions – like SNAP and Medicaid – have only recently ended. As a result, it’s still too early to understand the cascading impacts. Yet many are concerned about growing food insecurity and rising numbers of those without health insurance.

Local Efforts to Fill Growing Gaps in the Social Safety Net

The end of COVID support has not gone unnoticed by state and local leaders, and there are efforts underway to plug holes. These include:

- Legislative efforts to increase funding for healthy and affordable food. Recently, these included HB23-1008, which will improve access to low cost healthy food options, and HB23-1158, which is specifically designed to grow food access for older adults.

- State departments like the Department of Health Care Policy & Financing are making intentional efforts to alert those who may lose Medicaid coverage about their recent change in status, while also connecting them to other insurance options.

- Similarly, nonprofit organizations, such as Hunger Free Colorado, are connecting individuals to community-based resources.

- During the 2023 legislative session, lawmakers expanded the state’s Child Tax Credit (CTC). Qualifying families can now receive up to $1,200 per child under six. With this expansion, Colorado now has the second largest CTC in the country. Importantly, this benefit has been shown to reduce poverty for families across the United States.

These local efforts are important, and reflect the ongoing, vital work of the existing organizations and networks committed to supporting economic well-being throughout our state. However, these organizations also have limited resources, and without an infusion of funds, can’t match the tremendous investments made by the federal and state governments during COVID.

Takeaways

During COVID, we intentionally chose to address poverty and bolster programs we knew worked. We chose to prioritize the health and well-being of families across our state and country. And we succeeded – poverty dropped during a time of deep financial and social upheaval.

However, the risk of economic vulnerability didn’t start or end with COVID. Even as government assistance programs come to an end, many families continue to face economically challenging times. Concerningly, some indicators suggest these challenges will only grow in the coming months.

We know what social safety systems and networks work. COVID spotlighted their value and efficacy. We have the tools to foster the outcomes we all say we support. It however, remains up to us to learn from these past several years and grow the effective policies that support our communities.

Related

FISCAL POLICY

What is Debrucing?

FISCAL POLICY