TABOR Rebates: Finding Fairness in an Unfair System

Updated March 21, 2022 based on latest economic projections from Legislative Council Services

Economic forecasts from the Governor’s Office and Legislative Council Services are showing a booming macroeconomy in Colorado. This is the case even though many residents in the state are still struggling – by way of lost jobs, missed rent payments, and other consequences of an insufficient safety net – nearly 2 years after the onset of the COVID-19 pandemic. These two facts are seemingly in tension, but many times the gains at the top don’t trickle down to the bottom. Employment in low- and middle-wage jobs – categorized as those under $60,000 per year – has decreased substantially during the pandemic. That is even as Americans for Tax Fairness and the Institute for Policy has found that billionaires in the United States increased their wealth by $2.1 trillion from March 2020 through October 2021. The increase in tax revenues from that wealth has more than compensated for the loss in tax revenue from those at the bottom of the income spectrum.

But because of our state’s constitutional restraints, Colorado has to figure out how to manage a situation in which our state cannot keep all of the tax dollars existing tax rates bring in, even as there is a real need to help Coloradans through investment in education, health care, infrastructure, and child care.

The revenue cap is on general revenue the state takes in, and limits the amount of money that can be spent out of the General Fund. It is calculated based on yearly population growth and inflation. This revenue cap – a major part of the Taxpayer Bill of Rights (TABOR) – generally is triggered in good economic times, as income tax revenues exceed the increase of population and inflation. The amount that comes in over the cap is then doled out to Colorado taxpayers. Going forward, non-partisan economic projections show billions of dollars in public funds will be sent to taxpayers in regressive ways – giving more as a percentage to the wealthiest, compared to the least wealthy in our state.

This piece will explain how tax revenue that comes in over the revenue cap gets sent to taxpayers and why the current system isn’t working for the vast majority of Coloradans.

Current Mechanisms to Refund Dollars

When state tax revenue exceeds the TABOR revenue cap, that money gets returned to Colorado taxpayers in the form of rebates. The mechanisms for doing that, however, can be complicated. This graphic from Legislative Council Services helps to illustrate the way it works:

The first amount of money is approximately $165 million, which is the projected amount that is needed for all counties to offset the losses from the Senior and Disabled Veteran Homestead Property Exemption. This exemption allows seniors and disabled veterans who have owned their home for at least 10 years to reduce their property tax bills that would fund schools, roads, and other county expenditures. To help counties compensate for lost property tax dollars the state backfills that money. When there are public dollars above the TABOR cap, those funds are used to help counties maintain their revenue levels.

The next tranche of money is refunded through a temporary income tax cut. The current income tax rate is 4.55 percent, and in years where there is enough money over the cap, that gets lowered to 4.5 percent for that tax year. (If the income tax rate is lowered below 4.5 percent, then this mechanism will be eliminated or need to be changed in law.) If there is not enough money after the homestead property tax exemption to fulfill an income tax rate cut for all Coloradans, then the process goes straight to the next mechanism: the sales tax rebate.

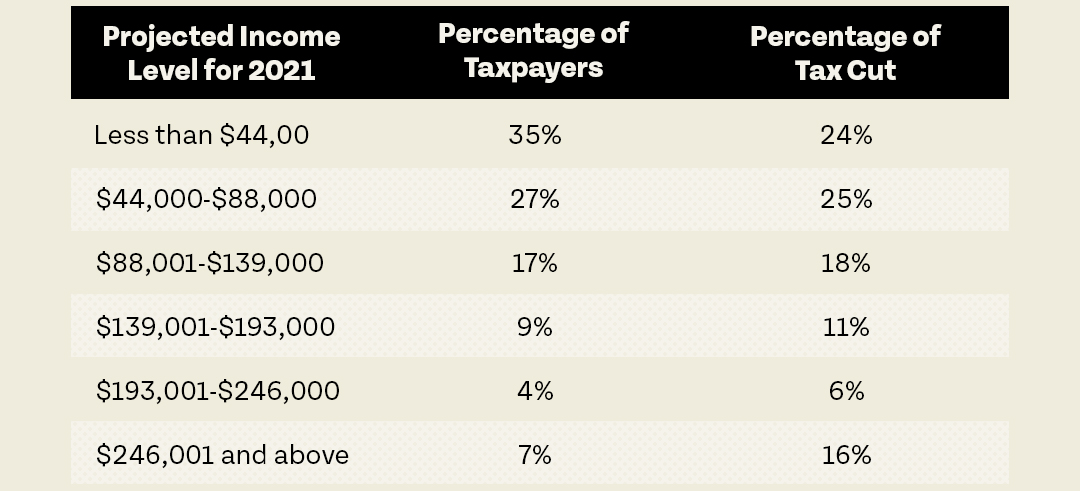

The six-tier sales tax rebate was put in place in 1999 – at a time of large TABOR rebates – as another way to distribute public funds to Coloradans. If there is money left over after the homestead property tax exemption and the temporary rate cut – or there is not enough money for a rate cut for all Coloradans – then the rest is given back through a six-tiered system. The percentages of taxpayers in each tier and the percentage of the dollars in each tier were put in law in 1999 and have not been changed since. It looks like this:

While the income amounts in each tier has changed over time, the percentage of Coloradans in each tier and the percentage of the dollars available that go to each tier has not. This largely leaves the structure from 1999 in place. As a result, the sales tax rebate mechanism is not really a sales tax rebate, but rather an approximation based on decades old assumptions about consumer behavior.

Problems with Current Rebate Mechanisms

The current mechanisms exacerbate the inequities already present in Colorado’s tax code. As The Bell Policy Center has written, Colorado has a regressive tax code that asks our lowest income families to pay a higher percentage of their income in taxes, compared to the highest income Coloradans. Our tax code has a flat income tax and across-the-board cuts to that flat tax end up benefiting the wealthiest Coloradans substantially more than those at the lower end of the income spectrum. In fact, the wealthiest 5 percent – approximately those making $250,000 annually and above – get nearly 40% of all across-the-board tax cuts.

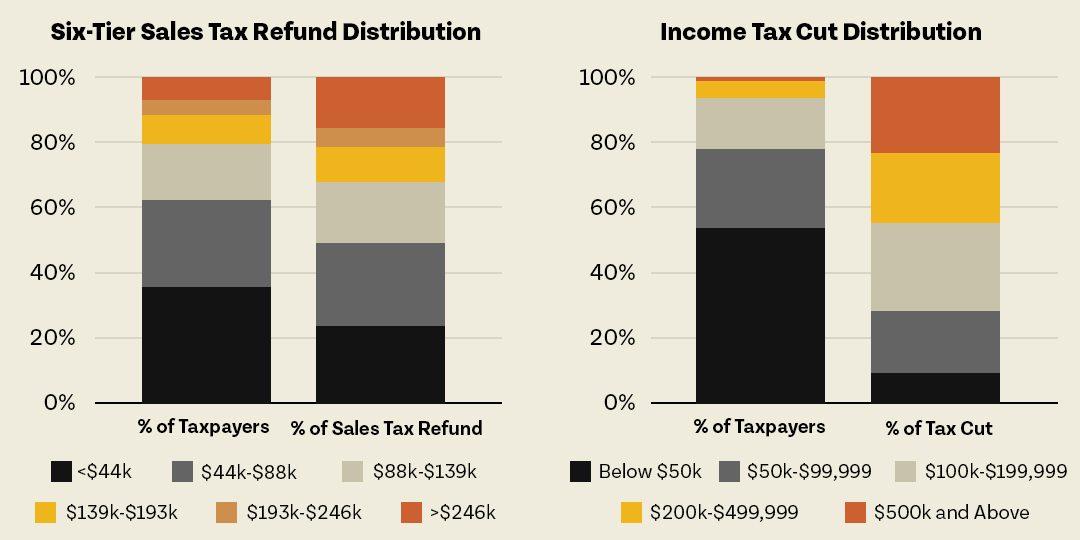

The TABOR rebate mechanisms, besides reimbursing counties for the Senior and Disabled Veteran Property Tax Exemption, only increase the regressivity already inherent in our tax code. The below charts neatly illustrate the point:

The top 1 percent – approximately those making above $500,000 annually – get 24 percent of the income tax rate cut, while those making above $246,000 – the top 7 percent of taxpayers – will get more than 15 percent of the sales tax refunds.

Given that TABOR rebates in the next three fiscal years are projected to total over $4 billion ($2 billion in fiscal year 2021-22, $1.6 billion in fiscal year 2022-23, $622.6 million in fiscal year 2023-24), the gains for those at the top of the income spectrum will dwarf everyone else’s gains. The top 1 percent will get more than $1700 in tax cuts from the income tax rate reduction. On top of that, those making more than $246,000 per year will get over $2,000 in sales tax rebates.

Instead of that money going to investments in our schools, health care, air quality, and wildfire prevention – or even to help those people who desperately need it – it will more than likely go into investment portfolios. Public investments create a foundation in our state that allows all to afford these public goods. Colorado is underfunding K-12 education – the Budget Stabilization Factor – by more than $570 million as of fiscal year 2021-22. These are the sort of investments that would broadly help the people of Colorado, as opposed to giving the wealthy more public money.

Conclusion

Our current mechanisms for refunding dollars over the TABOR cap benefit the wealthiest over those who need it. It is a flawed and regressive way to give away public funds and will lead to bigger wealth and income inequality going forward. Given that the pandemic has only exacerbated wealth inequities in this country, giving a disproportionately higher amount of dollars to those at the top, especially while fundamental state services lack adequate funding, is not the right policy.

Our TABOR rebate formulas need to be reformed and rethought. We are gearing up to give a massive windfall of tax revenue to those who are doing well enough on their own. Instead, we should be helping those who desperately need it, as lower wage jobs have not come back like those jobs that pay more highly. We need to invest in our schools, transportation, health care, and environment. We need to ensure economic mobility for all Coloradans. Giving income tax revenue to the wealthy, instead of reinvesting it in our economy, will only force us to increase regressive taxes and fees to make up for the lost investment that income tax revenue represents. With these historically high TABOR rebate levels, our leaders must weigh the impact they will have on the future and how we can sustainably fund all the programs upon which Coloradans rely.