Dismantling Effective Consumer Protections: The Wrong Path for Colorado

The predatory lending industry is renewing dangerous efforts to loosen consumer protections on supervised installment loans. If successful, this will have disastrous consequences for vulnerable families across our state. In order to build back stronger, we must prioritize Coloradans’ financial security by guarding the very consumer protections that foster economic well-being.

Current Lending Protections for Supervised Installment Loans: Meaningful & Important

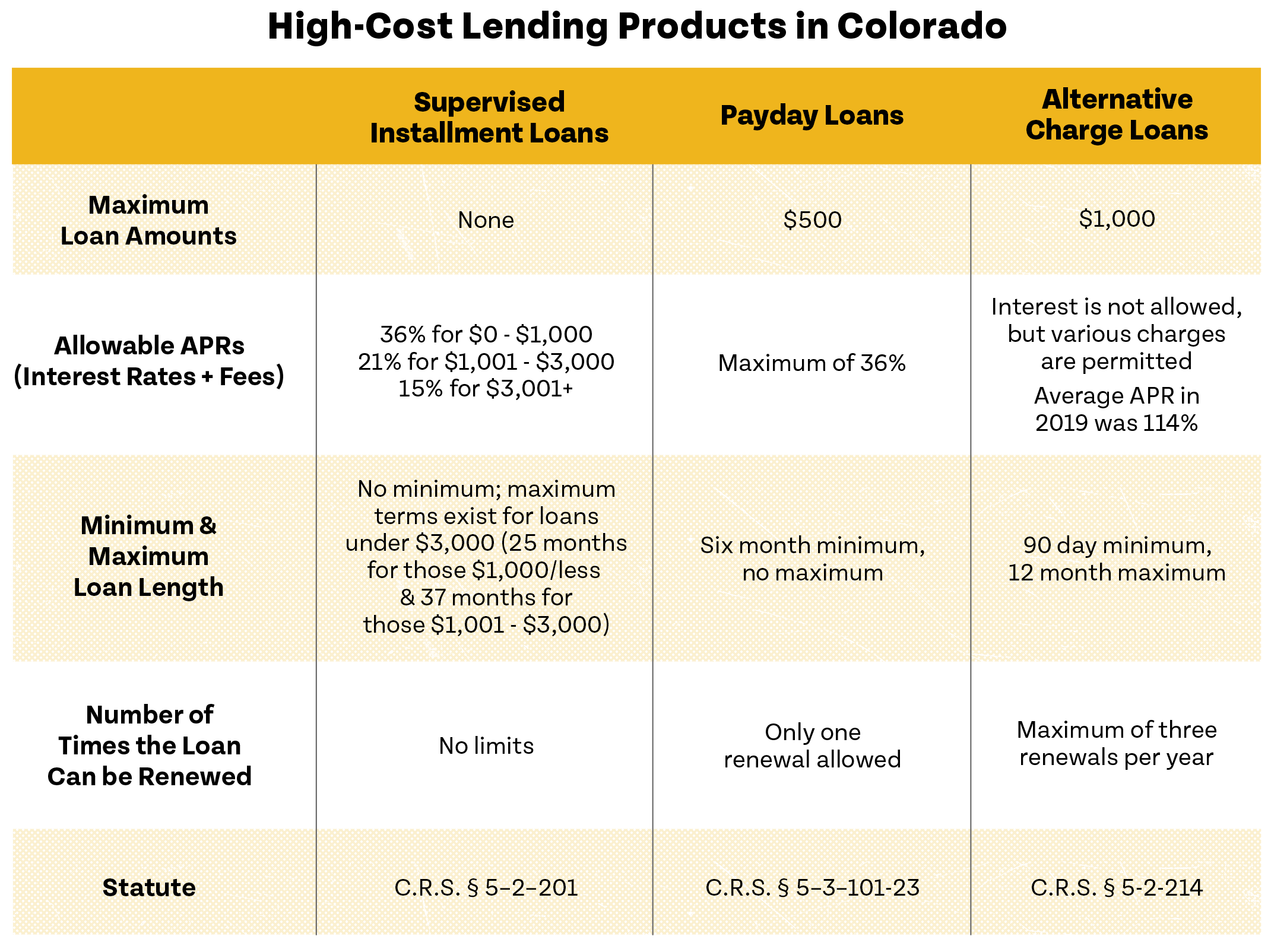

In 2000, a bipartisan coalition and Republican Governor Bill Owens passed legislation capping allowable interest rates and fees for supervised installment loans. Similar to other high-cost products detailed in the chart below, these loans are often used by Coloradans who have limited access to lower cost credit options, such as loans offered through traditional banks.

Existing regulations that protect consumers against predatory lending have made Colorado a national leader in this field. Our protections follow historical, well-recognized best practices and are critical to helping vulnerable Coloradans avoid cycles of debt. Notably, these protections are also widely popular. For example, Proposition 111, which passed in 2018 and capped payday loans at 36 annual percentage rate (APR), remains one of the most popular ballot measures in Colorado history.

Industry Attempts to Rollback Colorado’s Progress

Despite our progress, predatory lenders are actively trying to weaken existing consumer protections on supervised installment loans by increasing allowable interest rates and fees. If successful, this effort will rollback years of progress and harm vulnerable Coloradans.

Notably, this isn’t the first time lenders have tried to loosen consumer protections in our state. In both 2015 and 2016, the lending industry tried to pass:

- HB15-1390: Would have increased allowable APRs for mid-size installment loans (for example, raising the maximum APR on a $3,000 loan to 36 percent, up from 21 percent). Though passed by the legislature, the bill was vetoed by Governor John Hickenlooper.

- SB16-185: Would have tied increases in APR for installment loans to inflation.

Industry efforts to increase allowable rates and fees on installment loans however are not confined to our state. Since 2012, OneMain — one of the most prominent supervised installment loan lenders in Colorado — has successfully curtailed consumer protections in at least 10 states, and are engaged in ongoing efforts in places like Nebraska.

Industry Attempts to Take Advantage of Bad Trump Era Policy

The predatory loan industry’s efforts to rollback consumer protections in Colorado are connected to poor federal policies pushed by the Trump administration. Just before leaving office, Trump’s administration promulgated rules allowing certain non-bank lenders to “rent” a bank’s name and sell high-cost loan products across state lines without restriction. Due to their guise as a traditional bank, these lenders are able to bypass certain state level consumer protections on products like supervised installment loans.

In response to the Trump administration’s weakening of banking regulations, Colorado’s attorney general sued and finally reached a compromise settlement with two banks participating in rent-a-bank schemes, allowing them to offer installment loans with interest no greater than 36 percent. Through this settlement, the attorney general prevented these banks from completely bypassing Colorado’s consumer protections and offering loans at any interest rate. Rather than addressing the root cause of the problem (bad federal policy) predatory lenders who’ve long operated in Colorado are trying to take advantage of the Trump administration’s rules to relax restrictions for all supervised installment loans.

Through the Congressional Review Act, which allows Congress to stop rules before they go into effect, the Biden administration and Congress have an opportunity to overturn the poor federal policy that led to higher allowable interest rates. A robust band of advocates is encouraging this action and Colorado’s attorney general must be a national leader in this effort.

Weakening Consumer Protections: The Wrong Answer for Colorado

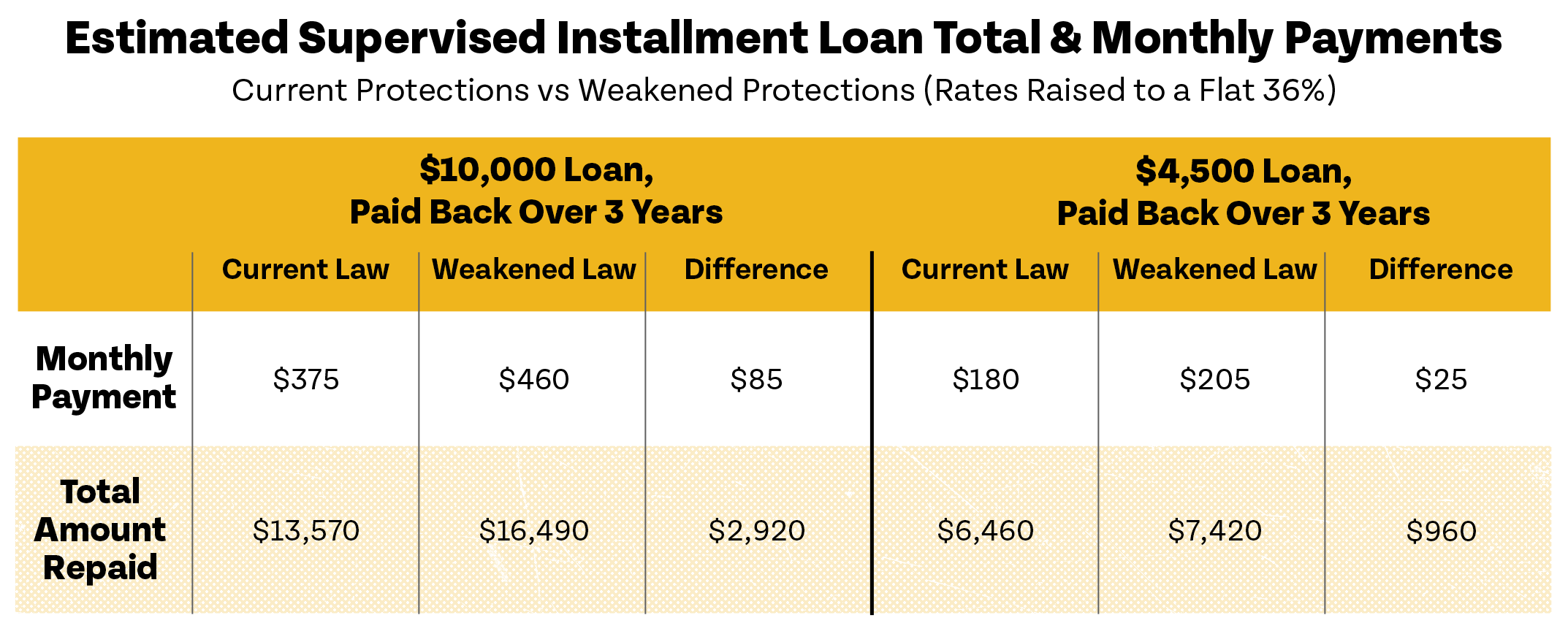

Current lending protections are imperative at a time when 42 percent of Colorado residents report taking on debt to meet daily expenses. As seen in the chart below, weakening consumer protections will negatively impact the lives and pocketbooks of Coloradans across the state.

Just as we know weakening consumer protections will harm Coloradans, it’s also true these actions will grow the predatory lending industry’s profits. As noted in OneMain’s 2019 Annual Report, the company is growing and now has physical locations that are within 25 miles of 88 percent of the American population. More tellingly, between 2018 and 2019, the company saw a 33 percent increase in revenue.

Colorado’s current lending protections are meaningful, valuable, and time tested. Weakening them at the behest of the predatory lending industry will cause irreparable harm across our state. If we are to recover and build back better from COVID-19, we must prioritize the financial well-being of individual Coloradans and their families; maintain strong, community-backed consumer protections; and develop safe and responsible alternative lending options. By embracing this holistic strategy, we can create systemic solutions that allow Coloradans to not just maintain, but build, wealth and well-being.

(Want a copy of this fact sheet? Download your own by clicking here.)