2020 Policy Proposals: Harris, Warren, & Booker on Housing

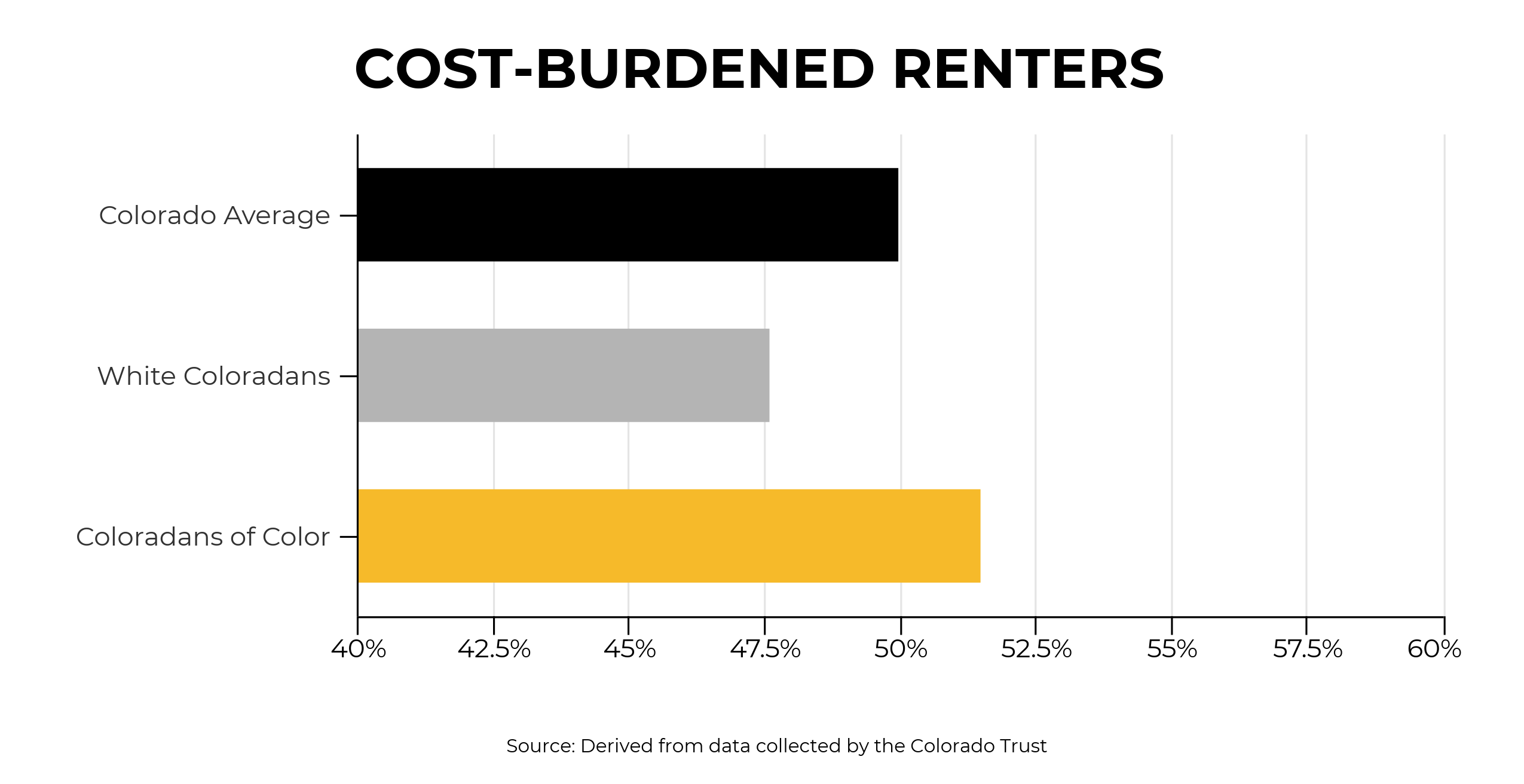

Renting and homeownership have become more expensive in Colorado than almost any other time in our history. Half of all Colorado renters spend more than 30 percent of their take-home pay on rent alone. Even though this past legislative session was one of the most significant sessions for housing issues in Colorado, a large gap in access to housing still exists in Colorado and the nation.

A number of candidates for the 2020 Democratic presidential nomination have announced plans to alleviate these pressures and help the populations who are most likely to experience them. Their proposals look to close the wide racial gaps in homeownership, which are caused by historic policies such as redlining, as well as predatory lending within the subprime crisis. They also address barriers such as the cost of down payments and lack of access to credit. Additionally, the plans begin to address the growing eviction crisis by giving financial and legal assistance to renters, who are often individuals and families of color.

As the Colorado economy continues to grow, it’s important we take steps to make sure everyone is able to enjoy the benefits. We should seek to address the barriers to homeownership, increasing rental burdens, and threats of eviction that help create an unequal and, at times, predatory economy.

Proposed Solutions for Housing

While almost all of the 2020 Democratic candidates have plans on housing affordability, most have borrowed from the plans and bills introduced by Senators Harris, Warren, and Booker.

Sen. Kamala Harris (D-CA)

Senator Harris has proposed the Rent Relief Act, the LIFT the Middle Class Act, as well as a specific plan to shrink the racial wealth gap through black homeownership. Her plan includes:

- Providing renters making less than $100,000 a year with tax credits to cover the difference between 30 percent of their income and total rent

- Refundable tax credits, given as a monthly payment, to most middle class households to help with costs such as child care

- Providing downpayment and closing cost assistance up to $25,000 to people renting or living in historically redlined communities

- Requiring credit scores to include rent, phone, and utility payments

Based on our review of the LIFT the Middle Class Act, we know this bill would overwhelmingly benefit the bottom 40 percent and middle 20 percent of Coloradans. Harris’ Rent Relief Act would help roughly 250,000 Coloradan renters who spend more than 30 percent of household income on rent and 125,000 Colorado renters spending more than 50 percent of income on rent. Requiring credit scores to include rent, phone, and utility payments would also go a long way toward leveling the playing field for Coloradans who don’t have access to credit by keeping track of expenses that show creditworthiness.

Sen. Elizabeth Warren (D-MA)

Senator Warren has proposed the American Housing and Economic Mobility Act. Warren’s plan includes:

- Investing $470 billion over the next 10 years in the Housing Trust Fund to provide states with funding to create affordable housing for extremely low-income households

- Creating an incentive fund for local cities and towns to remove zoning restrictions that prevent affordable and workforce housing

- Extending Fair Housing Act protections to LGBTQ+ communities, low-income families of color, Native American populations, and Section 8 recipients

- Creating a downpayment assistance program to help first-time homebuyers in low-income communities and communities of color in historically redlined neighborhoods

Progressive think tank Data for Progress estimates 3 million new homes would be created through Warren’s investment in the Housing Trust Fund, which could bring new affordable housing to Colorado.

Sen. Cory Booker (D-NJ)

Senator Booker has proposed the Housing, Opportunity, Mobility, and Equity (HOME) Act as well as ‘Baby Bonds’, and an investment in the Housing Trust Fund. Booker’s plan includes:

- Providing renters making less than $100,000 a year with tax credits to cover the difference between 30 percent of their income and rent

- Expanding access to legal counsel for renters facing eviction by funneling money to state and local governments that commit to enacting a right to counsel

- Baby Bonds, which would establish a federally funded savings account with $1,000 for every American child at birth, with continuing contributions determined by family income

- Invest $40 billion annually in the Housing Trust Fund

According to Booker’s campaign, Baby Bonds would give low-income children access to nearly $50,000 by the time they’re 18, which could be used for putting a downpayment on a home. Senator Booker proposes funding Baby Bonds by restoring 2009-era estate tax rules and closing loopholes that allow wealthy households to avoid paying taxes on investments held in estate.

Why These Proposals Are Important to Colorado

Homeownership is an undeniably valuable aspect of building and accumulating generational wealth. Unfortunately, due to various barriers such as the cost of down payments and lack of access to credit, not all Coloradans have an equal opportunity for homeownership. Additionally, a significant portion of Colorado renters face ever-increasing rent costs, threats of eviction, and struggle to find affordable housing under restrictive local zoning laws that effectively ban the construction of new apartment buildings.

White Coloradans are almost twice as likely as black Coloradans to own a home. Although Colorado’s Latino population is our fastest growing population, less than half own a home, just slightly higher than Native Americans in Colorado. Renters of color are uniquely impacted, with more than half of all black, Latino, and Native American renters experiencing cost-burdened housing.

Evictions in Colorado are well above the national average, and renters of color in Colorado are more likely to experience eviction, oftentimes contributing to displacement and gentrification. Between 1 percent and 3 percent of tenants facing eviction in Colorado are represented by counsel and, in most cases, evictions are executed because of unpaid rent that amounts to less than $200.

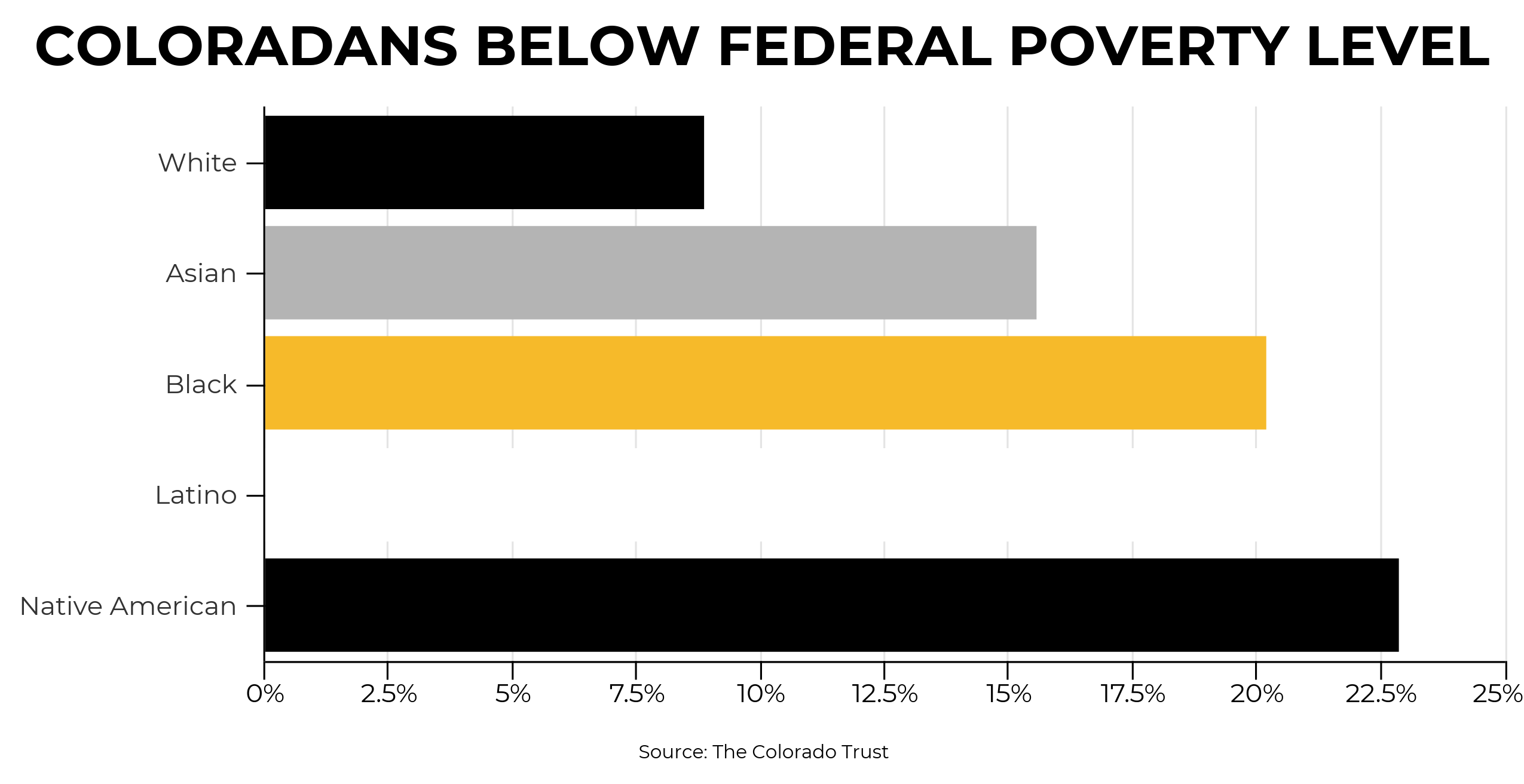

Unemployment and poverty also impact Coloradans of color at a disproportionate rate. Unemployment and poverty are tied to homeownership because buying a home requires access to loans, which require access to credit. Additionally, many renters must pass a credit check to qualify for tenancy. The Consumer Financial Protection Bureau found in 2015 a strong correlation between income level and both “credit invisibility” and “unscorability” — that is, a lack of a credit record altogether, or having an insufficient credit history to generate a credit score, respectively.

The CFPB also shows “credit invisibility” and “unscorability” are strongly correlated with race. For unemployed and impoverished Coloradans of color, many of whom are “credit invisible” and “unscorable,” good loans and quality affordable housing are inaccessible, encouraging their reliance upon the predatory economy and exposing them to environmental hazards.

Continued Work on Housing in Colorado

Last session, the Colorado legislature approved the largest ongoing investment in housing in state history. In addition, it also passed the Residential Tenant and Safety Act — which holds landlords accountable and give tenants options to remedy deficiencies in their unit without fear of retaliation — along with a bill limiting rental application fees.

Our elected officials are clearly committed to increasing access to affordable housing for Coloradans, but ending the housing crisis and ensuring equity in homeownership will require our state to continue innovating solutions that target these issues at their roots. Any of the above plans will take significant steps to that end, and our state will need to meet these efforts with a continued commitment to addressing housing inequity. You can expect the Bell to be at the forefront of these conversations.