Why Coloradans Need Paid Leave & How to Offer it

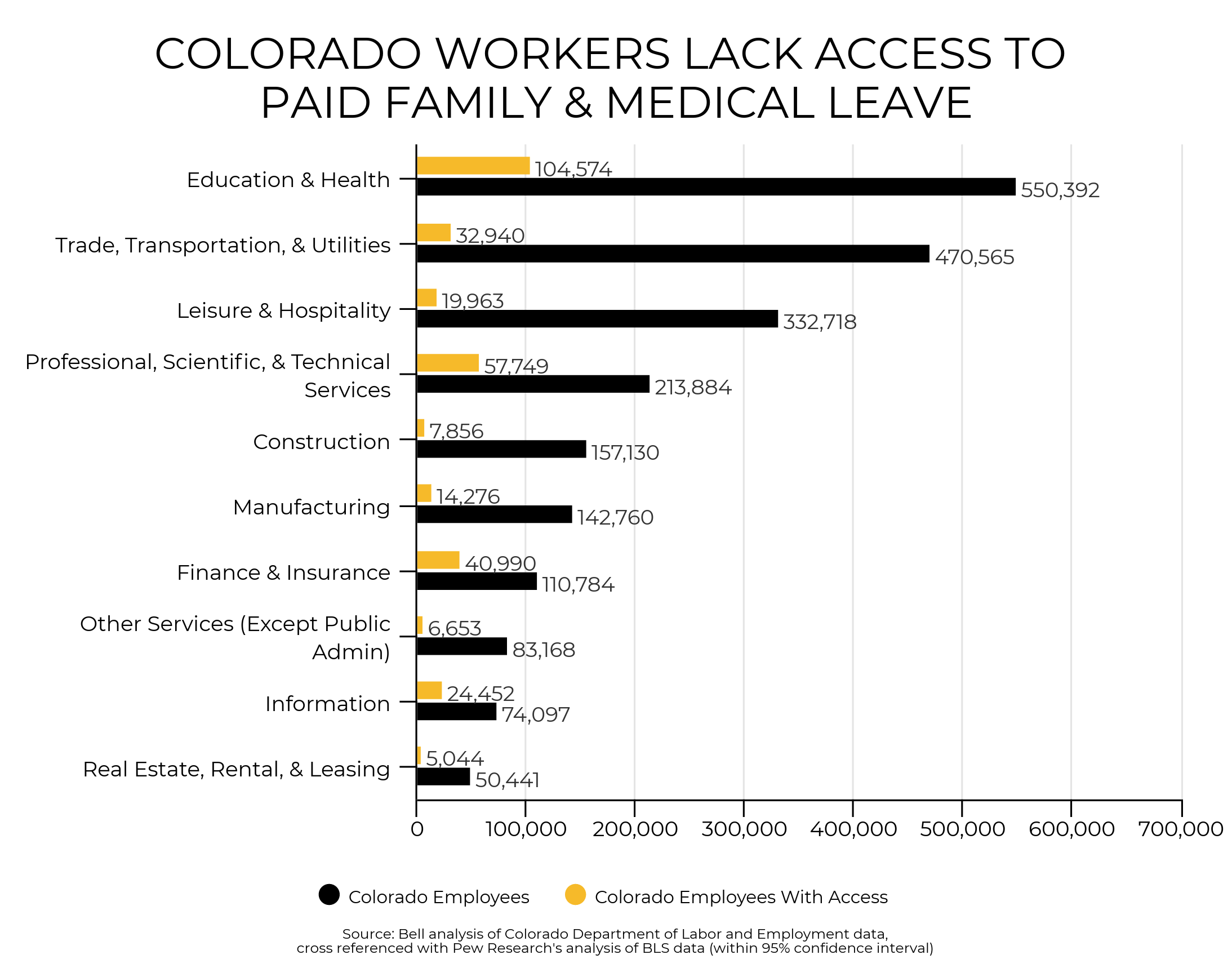

Paid leave is broadly popular and has been successfully implemented across six states and nearly all developed countries throughout the world. Benefits of paid leave include work life balance support, caregiver assistance, increased work morale, and protected income stability, just to name a few. As important as it is, unfortunately, paid family and medical leave is inaccessible for many.

An Insurance Plan for Paid Leave

An effective way to provide more universal family and medical leave is to approach it as an insurance program, which is how current state-based programs operate. Workers, including independent contractors, pay a small insurance premium based on a percentage of their income into a pooled fund. The premiums vary from 1.1 percent of worker wages in Rhode Island to under 1 percent in all other states. The generosity of worker wage replacement varies among states, as do worker eligibility requirements.

Like any insurance program, people can draw benefits from the plan if they meet certain requirements, allowing peace of mind when people inevitably need time to care for themselves or others. State paid leave programs use different financing mechanisms — some are entirely worker-funded, while others require employers to contribute. Treating paid leave like an insurance plan gives more people access, the financial impact is spread among a broad pool of workers, and the playing field is leveled for small businesses who cannot match larger companies’ ability to offer these plans. In fact, a 2017 poll of small businesses shows 70 percent support a paid family and medical leave insurance program. In the last year, at least 19 states, including Colorado, have considered legislation to establish paid family leave programs.

Tax Credits for Employers Fall Short

Some policymakers tout employer tax credits as the way to increase access to paid leave. This approach would allow employers who already offer a paid leave policy, or put one into place, to recoup a small part of the costs of offering a plan. While tax credits are a popular idea to incentivize good business practices, research and experience shows they have a mixed record when it comes to creating broad workplace improvements for workers. For example, Colorado’s Child Care Contribution Tax Credit, which allows businesses to deduct contributions they make to certain organizations, including child care centers and after-school programs, has proven valuable to some businesses and the child care providers who get their donations.

Unlike a social insurance approach, tax credits for paid family and medical leave are untested. The Congressional Republican tax plan passed in late 2017 enacts a pilot program to test and study this strategy, rewarding businesses for offering as little as two weeks paid leave to certain workers, but a recent survey from Ernst and Young shows fewer than 40 percent of employers would offer paid leave if tax credits were put in place. Importantly, small businesses would still struggle with the cost of offering leave, particularly longer leave. Research shows paid leave insurance programs benefit employers. Studies in California and Rhode Island find state paid leave insurance increases hours worked and have positive or no adverse effects on productivity, profitability, turnover, or morale. Colorado should take note, as employers currently shoulder at least half a billion dollars in costs related to employee absenteeism, presenteeism, turnover, and health care for their workers who are also caregivers.

The bottom line: A robust, universal paid family and medical leave insurance program would benefit all of us. Colorado’s changing demographics and the future of work require us to rethink what “insurance” means, and find ways to offer paid family and medical leave to everyone.

To learn more about paid leave and how to offer it, read the Bell’s latest fact sheet.

Paid-family-medical-leave-UPDATED