Testimony: Support HB17-1290 to Create Colorado Secure Savings Plan

Rich Jones, the Bell’s Director of Policy and Research, testified in the Senate State, Veterans, and Military Affairs Committee.

The Bell Policy Center strongly supports HB17-1290 to create the Colorado Secure Savings Plan, a public-private partnership to offer workplace retirement savings plans for private-sector workers without access to one. In a 2016 study, we found almost 900,000 Colorado private sector workers in their prime working years are not participating in any type of retirement savings plans at work. More than 80 percent — or 753,972 Coloradans — work for employers that do not offer a retirement savings plan, making lack of access the top reason that Coloradans have a hard time saving for retirement.

It is clear from this data that far too many Coloradans lack access to the most effective way to save for retirement while they are working. Today’s workers will likely face significant economic challenges in retirement when the lack of access to workplace plans is combined with the low balances held by those households that do have retirement savings accounts. When people retire without adequate savings, it is likely that they will turn to government programs for support. If we want all Coloradans to experience a financially secure retirement as a just reward for a life of hard work, we need to ensure there are appropriate mechanisms in place to help them save. If we do not, the retirement crisis we already face will get worse and taxpayers could suffer as a result.

In Colorado, low-wage workers, members of minority groups, young workers, and those working in small businesses are the least likely to have a retirement savings plan at work.

More than three-quarters of the workers in the bottom 20 percent of earnings, or those making $22,000 a year or less, work for employers that do not offer retirement plans. Eighty-one percent of workers in firms with fewer than 10 employees and 63 percent of those in firms with 10 to 49 workers have no workplace retirement plan. Blacks, Hispanics, and Asian/Pacific Islanders are less likely than whites to be offered a workplace retirement plan, with Hispanics being the least likely to have access to retirement plans. About half of workers aged 25-29 are not offered a workplace retirement savings plan.

National studies show most people are not financially prepared for retirement

America faces a retirement crisis as a substantial number of working families are not saving enough to meet their needs in retirement. Several national studies show anywhere from half to two-thirds of working families are at risk of not being able to maintain their pre-retirement standard of living. Low-income working families are most at risk.

A 2015 General Accountability Office (GAO) analysis determined that 52 percent of households age 55 and older have no retirement savings in a defined contribution plan or IRA. This same study found that lack of a workplace retirement savings plan is the major barrier limiting workers, particularly low-wage workers, from saving for retirement. However, if offered a plan, most workers participated with almost two-thirds (63 percent) of workers in the lowest income level and three quarters of (74 percent) of those in the second lowest income level participating.

The lowest-income retirees in Colorado currently depend on Social Security for 80 percent of their income even though it is designed to replace about 40 percent of their income in retirement. Increasing the retirement savings of Colorado’s lowest-wage workers could save money on social services. When people retire without adequate savings, it is likely that they will turn to government programs such as Medicaid and SNAP (food stamps) to help make ends meet. A study conducted in Utah by economists at Brigham Young University determined that if the one-third of that state’s retirees with the lowest savings had increased their savings by just 10 percent over their working years — or about $14,000 — the state would have saved $194 million in federal and state government spending over 15 years. A study completed early this year by economists at the University of Maine, found that increasing retirement income by $1,000 per year for the lowest income retirees would save Colorado taxpayers $155 million in state safety net spending over 15 years.

States are acting to address retirement woes

In recent years, over 30 states considered legislation or took executive action to expand retirement savings coverage for private-sector workers. Five states — California, Connecticut, Illinois, Maryland, and Oregon — have enacted legislation to provide workplace retirement plans for their private-sector workers who do not have access to them. These states are in various stages of establishing public-private partnerships to create and run voluntary, low-cost, automatic enrollment workplace retirement savings plans.

California, Connecticut, and Oregon have completed detailed market and financial analyses that determined their plans, as currently designed, are financially sustainable under a variety of economic scenarios.

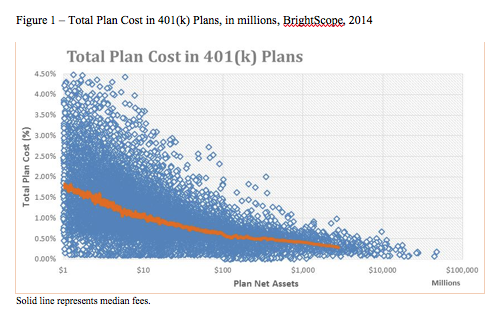

Over the long run, each plan is estimated to have enough participants and economies of scale that they can be operated for fees of about 0.5 percent. This is a substantial saving over the fees currently charged to small businesses for 401(k) plans. A 2014 study found the smallest plans, as measured by the number of participants or amount of assets, had the highest fees. Those plans with less than $1 million in assets had median fees of 1.48 percent, with a range from 2.66 percent on the high end to 0.68 percent on the low end. Paying 0.5 to 1.0 percent more in fees, when compounded over 20 to 30 years, significantly reduces the amount of money workers will have in retirement.

While none is operating yet, Oregon will begin to enroll workers as part of a pilot in July 2017 and the state will roll out the program with larger employers in January, 2018. California, Connecticut and Illinois are expected to begin enrolling workers in 2018.

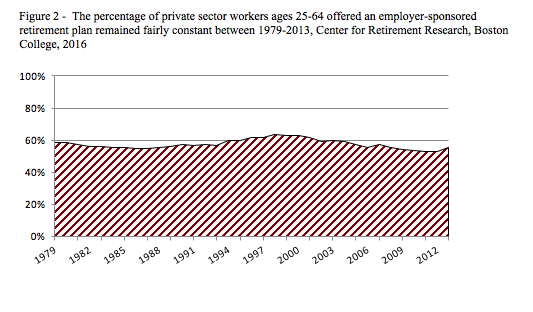

Over the years, there have been many attempts to make it easier for businesses to offer retirement plans. But these efforts have failed to increase coverage as evidenced by Figure 2. As the Center for Retirement Research at Boston College observed, these efforts have not worked in the past and are unlikely to work in the future.

Coloradans take great pride in our willingness to innovate and craft solutions that are uniquely designed to meet the challenges we face. Creating the Colorado Secure Savings Plan is an opportunity to creatively address the challenge of helping workers save more of their own money and providing retirement security for more Coloradans.

We thank Senator Donovan and Senator Todd for bringing this bill to you today and thank the committee for the opportunity to share our thoughts with you.