Colorado’s Rural Communities Will Suffer from the Federal Budget Bill

The recently signed federal reconciliation bill, also known as the ‘One Big Beautiful Bill Act’, will have massive implications for Coloradans. While the legislation affects a multitude of issue areas, perhaps most prominent are its changes to social safety net programs and the tax code.

It’s been widely acknowledged that the bill’s benefits and burdens will be unequally felt. Yet, within these analyses, impacts on the urban-rural divide are often overlooked. As we detail below, the federal bill is likely to worsen the economic well-being of rural Colorado while providing substantial benefit to affluent suburban and mountain resort communities.

Tax Cuts That Disproportionately Benefit the Wealthy

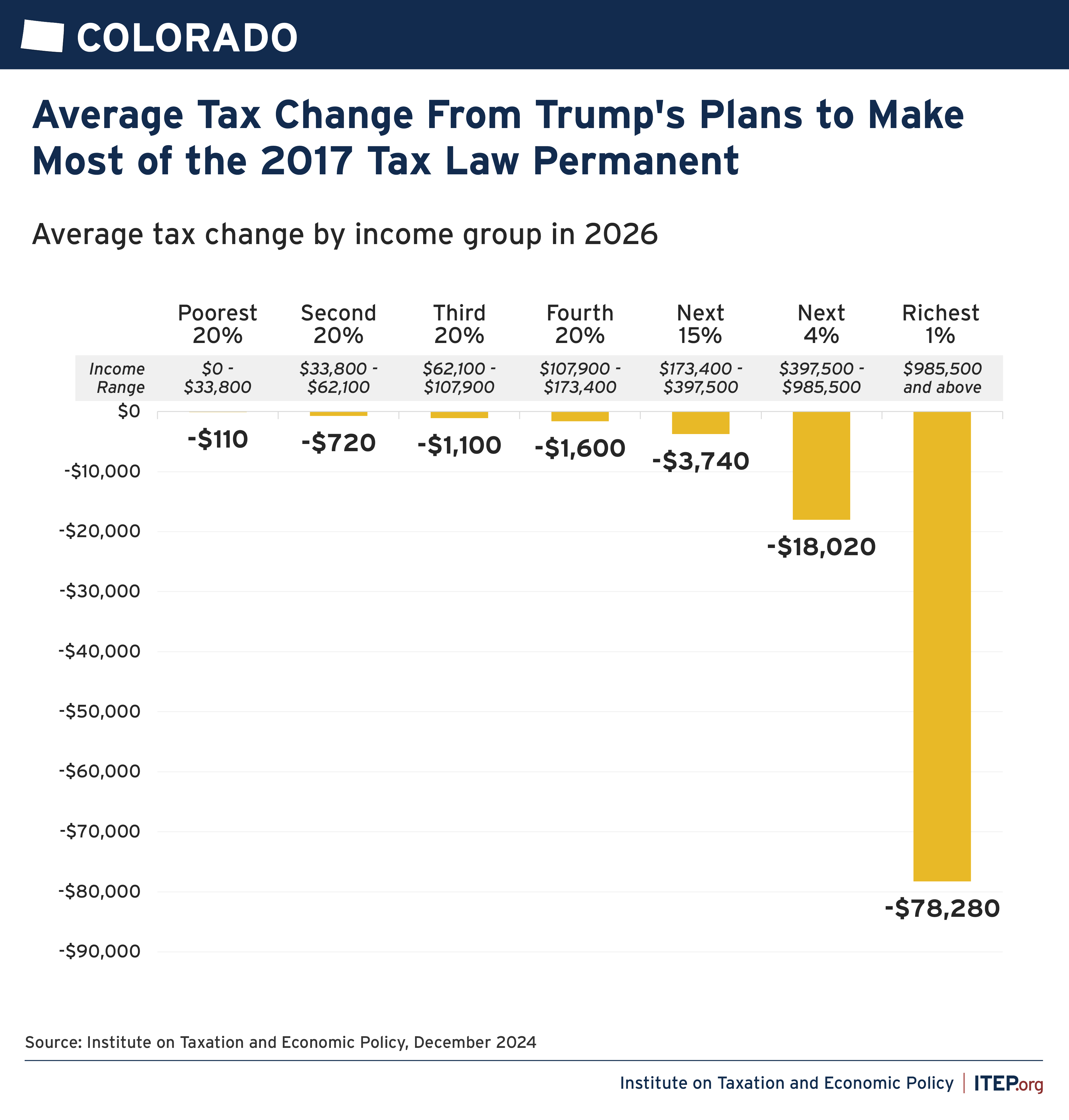

A central aim of the reconciliation bill was to make permanent several provisions of the 2017 Tax Cuts and Jobs Act (TCJA) — including income and corporate tax rate reductions. As with most untargeted tax cuts, analyses have found these rate reductions disproportionately benefit the wealthy. The Institute on Taxation and Economic Policy (ITEP), for example, found that TCJA extensions reduce taxes for the poorest 20 percent of Colorado taxpayers by only $110 per year, but benefit the richest one percent by an average of $78,000 a year.

Average Colorado Tax Change in 2026 from TCJA Extensions

It’s important to recognize that income is not equally distributed across Colorado. Instead, as seen in the map below, some counties, particularly urban, suburban, and mountain resort ones, have high concentrations of upper income families. This stands In contrast to many rural areas, specifically those in southeast Colorado, which are among the poorest in the state. As evidence of these disparities and their magnitude, there is a more than $100,000 difference between the mean family income of the highest (Douglas) and lowest (Costilla) income counties.

Taken together, Colorado’s geographic income disparities and the untargeted nature of the reconciliation bill’s tax changes mean that certain pockets of the state will disproportionately benefit from the new federal law. Specifically, higher income families, who are disproportionately found in urban, suburban, and mountain communities, will see significantly greater benefit than less wealthy, often rural, Coloradans.

Tax Cuts at the Expense of the Social Safety Net

To pay for its tax cuts, the reconciliation bill makes deep cuts to long-standing social safety net programs, primarily Medicaid and the Supplemental Nutrition Assistance Program (SNAP). These changes will impact Coloradans across the state. However, given their disproportionately high utilization of SNAP and Medicaid, rural communities will be particularly hard hit by these changes.

Medicaid Impacts:

The federal bill makes massive changes to Medicaid. These include:

- Imposing work requirements on some beneficiaries. When implemented in other states, this practice led to enrollment reductions as high as 25 percent. Notably, some people lost coverage even though they met the new work requirements.

- Capping provider fees which help states pull down federal matching dollars to support hospitals. This change is projected to have a particularly significant negative impact on rural providers.

- Creating new cost sharing requirements for some Medicaid beneficiaries, who will now have to pay a portion of the cost for certain health care services.

Analysts predict these changes will have significant impacts across the state. The Kaiser Family Foundation projected that a less draconian version of the federal bill would cost the state approximately $11 billion in federal assistance through 2034 and would lead to over 150,000 Coloradans losing health coverage over that same period. A study from the University of North Carolina found that six rural hospitals in Colorado are at-risk for service disruptions, and possible closure, because of the bill’s changes. Additionally, while Colorado’s Department of Health Care Policy and Financing (HCPF) is still conducting its own analysis, it is warning of higher uninsured rates, a rise in health care costs, layoffs in healthcare facilities that have a high percentage of patients that rely on Medicaid, and significant upfront costs for the state to implement new requirements.

While each county has residents enrolled in Medicaid, as the map below shows, rural Colorado has particularly high utilization rates. This reality makes the impending Medicaid cuts particularly harmful in these areas of the state.

SNAP Impacts:

In addition to Medicaid, the reconciliation bill makes changes to SNAP, the food assistance program that over half a million Coloradans rely upon. These changes include:

- Imposing work requirements for certain beneficiaries.

- Requiring states to fund a percentage of the program’s benefits. Previously, benefits were paid completely by the federal government.

As with Medicaid, these changes will have a multitude of wide-ranging effects, from reducing the number of Coloradans who receive food assistance to harming local economies and businesses. Once again, these costs are likely to be disproportionately borne by rural communities because of their higher SNAP enrollment rates.

A Bill with Outsized Costs for Rural Colorado

At the core of the federal reconciliation bill is a tradeoff — tax cuts in exchange for a weakened social safety net. In the map below, we rank how residents in each of Colorado’s counties are likely to fare as a result of this tradeoff. Ultimately, we find that residents in suburban and mountain resort counties — like Douglas, Broomfield, and Pitkin — are more likely to benefit compared to those in rural areas — like Costilla, Otero, and Montezuma counties. This reality stems from the fact that suburban and mountain resort counties have some of the highest incomes, and lowest social safety net enrollment rates. Conversely, rural communities, which often face a myriad of economic challenges, have both lower household incomes and high public benefit utilization rates. Large urban counties, like Denver and El Paso, have both a significant number of upper-income households as well as sizable Medicaid and SNAP populations.

The federal reconciliation bill will shape Coloradans’ lives for decades to come. To pay for tax cuts that primarily benefit the wealthy, many of whom live in suburban and mountain resort areas, we’re likely to see thousands of Coloradans lose health and food benefits, access to local health care services, and even their jobs. Concerningly, these changes will be concentrated in rural areas that are already struggling economically and need more — not less — public support to address already existent wealth disparities.