Housing Financing 101: Affordable Housing in Jefferson County, Colorado

Before housing can be affordable to tenants, it must be affordable for developers to construct. In Jefferson County (Jeffco), Colorado, affordable housing units are lacking, with a deficit of 20,000 attainable housing units. Jeffco residents want more affordable housing, local governments recognize the need and want to fill it, and housing developers are incentivized to fill this gap. The primary actors all have reason to develop affordable housing units, however, prohibitive factors stand in their way, including money. This factsheet will provide an overview of the specific components of development costs, private financing mechanisms, hurdles faced by developers, steps in the development process, and the role of public interventions in addressing affordability challenges in Jeffco and their part of the Colorado housing market.

Overview of Housing Financing

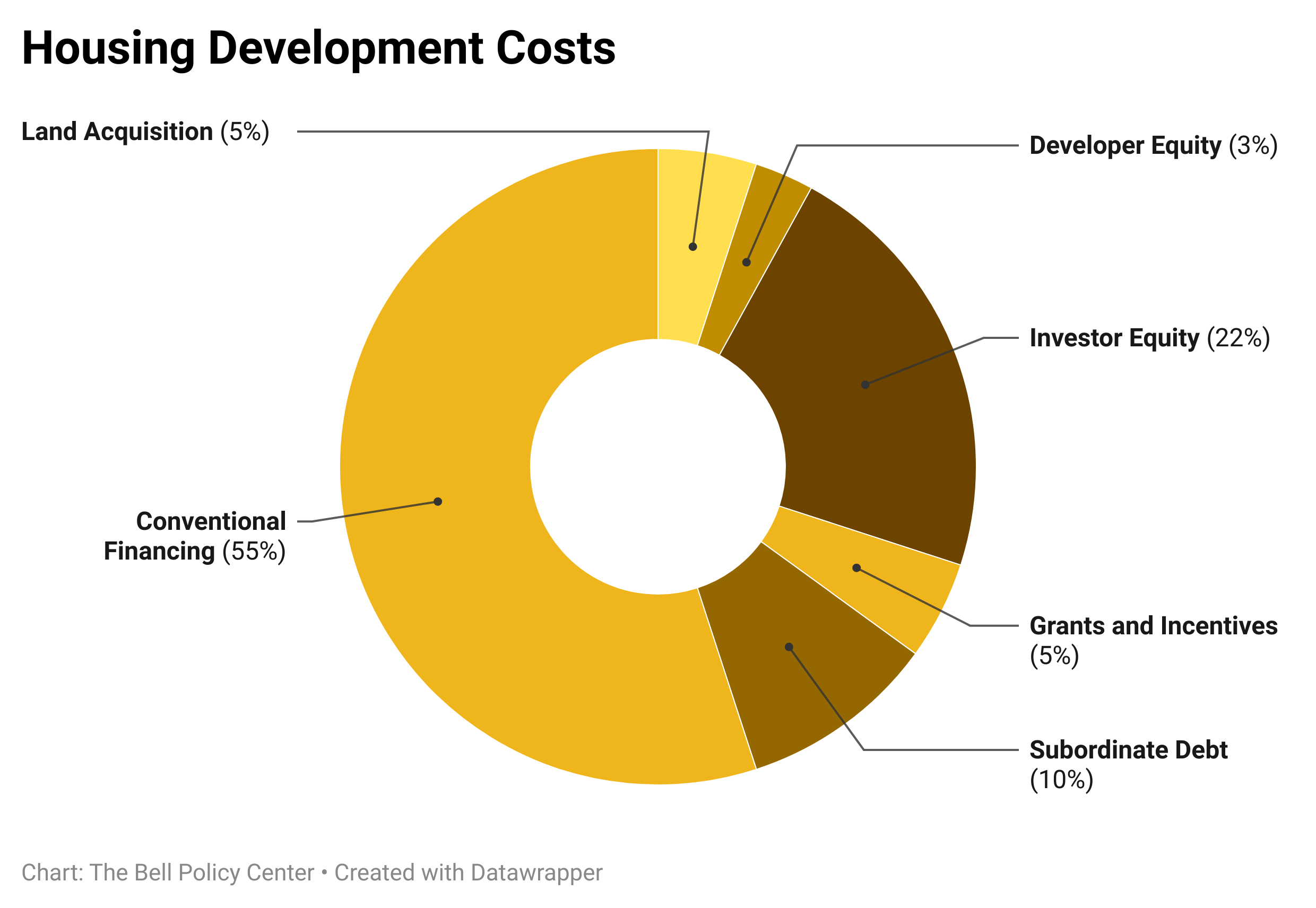

Developing affordable housing involves understanding the local dynamics of cost distribution. Some of these costs can be offset through public sector financing programs. Typically, development costs can be categorized as follows:

- Land Acquisition: Land costs vary significantly based on location and market conditions. Approximately 5 percent of total development costs are allocated to land acquisition, which can be higher in desirable areas such as Golden or Lakewood.

- Developer Equity: Developers contribute around 3 percent of the total project costs as equity. This financial commitment demonstrates their dedication to the project’s success and can attract additional investors.

- Investor Equity: External investors, contributing approximately 22 percent of the total costs, play a crucial role in financing housing projects. Their participation is influenced by factors such as market demand and projected returns.

- Grants and Incentives: Public and private grants and incentives account for 5 percent of financing. They provide essential financial support to developers, helping offset expenses and promoting affordable housing initiatives.

- Subordinate Debt: Subordinate debt, making up 10 percent of costs, involves loans with lower repayment priority but more favorable terms. Accessing such debt instruments can be vital for financing affordable housing projects.

- Conventional Financing: The majority of financing, constituting 55 percent of total costs, comes from conventional loans from financial institutions. These loans typically come with market interest rates and serve as developers’ primary source of capital.

Private Financing for Residential Projects

Private equity is a significant source of funding for residential projects, providing developers with the necessary capital to initiate and complete construction. However, the cost of private equity can be substantial, with interest rates ranging from 15-25 percent. This high interest burden adds significant costs to the project, impacting overall feasibility and affordability.

Development Costs and Hurdles

Developers negotiate further steps throughout the development process. Tap and impact fees, varying based on jurisdiction within the county, represent additional costs imposed by local governments for connecting to public utilities and addressing community impacts. In Jeffco, they generally range from $50,000-$75,000. Minimum lot sizes, density restrictions, and parking ratio requirements imposed by zoning regulations can vary across municipalities, impacting development costs and feasibility. Long approval times for zoning and permitting processes also contribute to project costs. Delays in approvals not only increase expenses but also prolong the timeline for generating revenue from completed units.

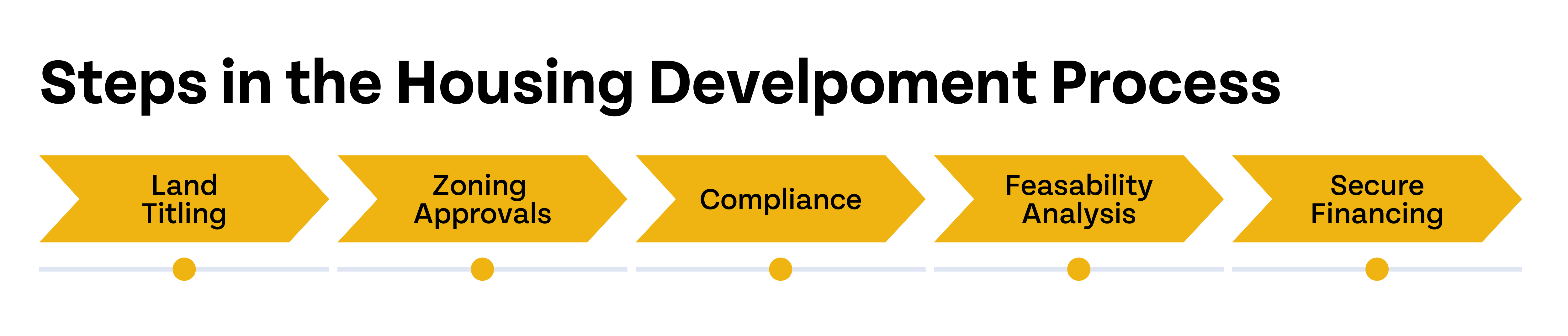

Steps in the Development Housing Process

Before securing financing, the developer must navigate various steps in the development process. Land titling involves legally transferring ownership of land, ensuring clear property rights for development. Zoning approvals and permits from local jurisdictions are essential regulatory steps. Compliance with local land use regulations and building codes is crucial to ensuring the project aligns with community standards and safety requirements. “Penciling in” a project refers to the feasibility analysis conducted by developers to assess whether anticipated costs and revenues align. This analysis is crucial for determining the project’s financial viability and securing financing from investors and lenders.

Recouping Costs for Affordable Housing Development

One of the significant hurdles in developing affordable housing is the difficulty in recouping expenses, especially when rents are set below market rates to ensure affordability for low- and moderate-income households. Affordable housing projects often involve setting rents below market rates to make them accessible to households with limited incomes. While this serves the critical purpose of addressing housing affordability, it also means that the potential rental income generated from these units is lower compared to market-rate housing. The costs associated with developing affordable housing, including land acquisition, construction, and ongoing maintenance, are often comparable to those of market-rate projects. However, the rental income generated from affordable units may not be sufficient to cover these expenses, leading to a shortfall in revenue.

Affordable Housing Financing

Affordable housing financing in Jeffco, Colorado requires a strategic approach considering the local context. Public interventions and governmental support are vital for addressing affordability challenges in the region. Strategies specific to Jeffco include:

- Local Government Incentives: Jeffco can offer fee waivers or reductions, streamline permitting processes, and provide density bonuses to reduce development costs for affordable housing projects.

- State Government Support: The state government can provide tax incentives, allocate subsidies, and establish loan programs to support affordable housing initiatives in Jeffco. This is primarily done by the Colorado Housing and Finance Authority, which has provided $5.4 billion for affordable housing in Colorado.

- Federal Support: Many programs and subsidies exist at the federal level, too, which can help leverage limited local and state dollars. Foremost among them is the Low-Income Housing Tax Credit, which provides a tax incentive for developers to build and preserve affordable housing.

Conclusion

Developing affordable housing requires a collaborative effort between public and private entities. By understanding the local financing dynamics and navigating regulatory hurdles effectively, developers and policymakers can work together to address the region’s pressing need for affordable housing. Through strategic financing mechanisms and targeted interventions, Jeffco can promote equitable access to housing for all residents.