Don’t Be Fooled: Initiative 50 is not the answer

Initiative 50, a proposal from a conservative dark money group called Colorado Action Rising, would require voters to approve the retention of statewide property tax revenue that exceeds 4 percent over the preceding year. If voters do not approve this revenue retention, these property taxes would somehow be refunded to taxpayers.

Why Initiative 50 will cause serious problems:

- The first glaring problem is Colorado has no statewide property tax. Property taxes are local taxes, representing over 3,000 districts around the state. Schools, fire stations, and water districts are among the most common, and each relies on its own tax to generate the revenue that provides our public services and investments. Cutting across each of these districts’ diverse needs to set a 4 percent cap would be administratively burdensome, if not impossible. A cap would force local communities to a further state mandate like TABOR.

- Imagine a district in Lamar experiencing negative growth, but a Lakewood district sees double-digit growth. Combined, the two districts are over the 4 percent cap. What happens? These local communities with different needs and economic conditions shouldn’t be subject to the average between them. Each of these individual districts would have to adhere to this arbitrary cap. The Lakewood district might have already budgeted for a higher growth year in order to pay for bond-driven investments planned the year previously.

- Further, a 4 percent cap doesn’t keep pace with inflation. In recent years this cap would amount to a negative revenue growth mandate as inflation has risen well above 4 percent. In more normal times, a 4 percent cap after inflation becomes a 2 or even 1 percent cap. This hardly allows for governments to maintain existing services, let alone respond to public demands for new and/or increased services. This is especially distressing as real wages in Colorado are already decreasing.

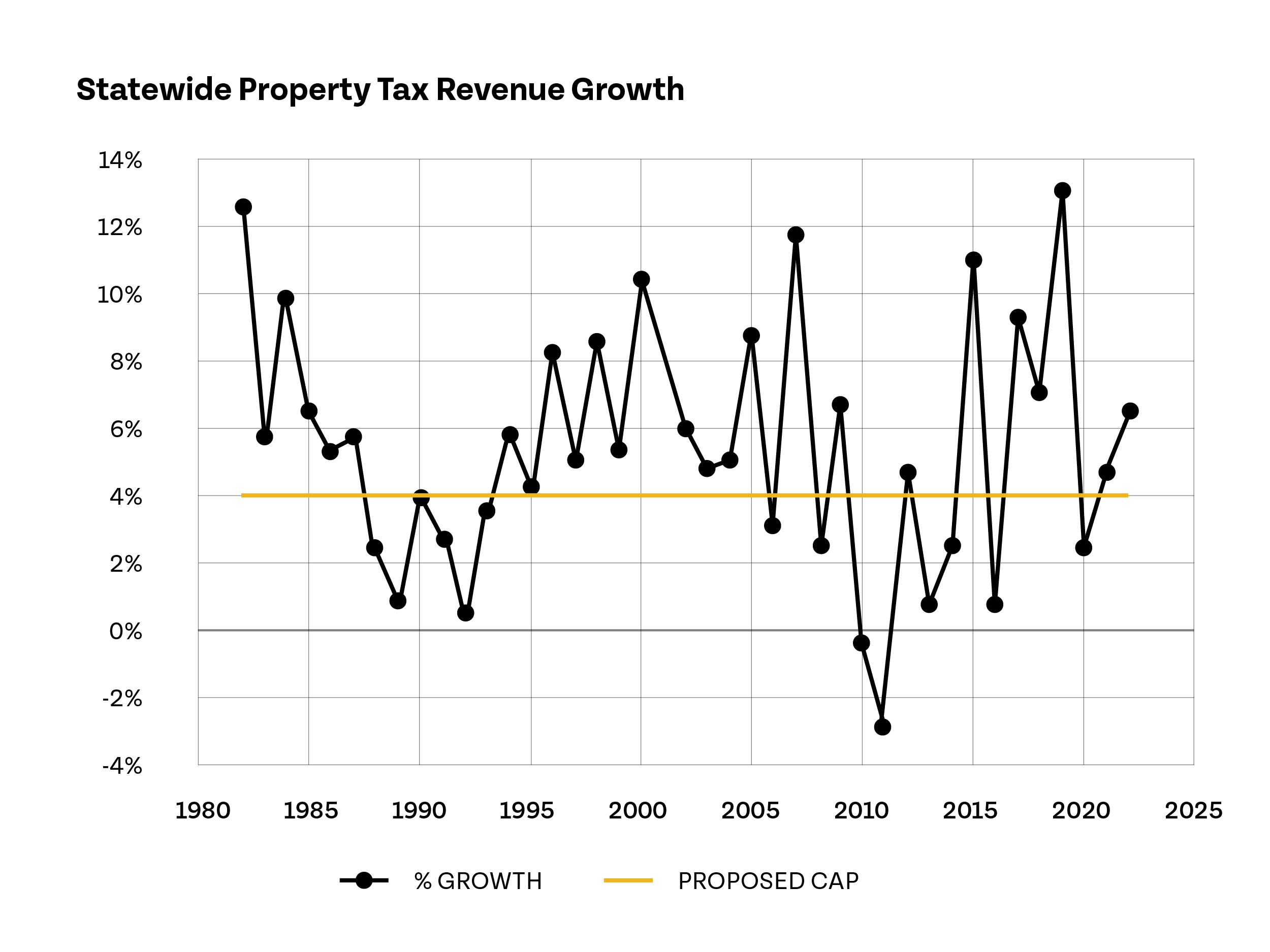

- Initiative 50 would have extremely negative fiscal effects over time. Since 2000, the average growth in property tax revenue has been 6.5 percent, however, that growth has come in peaks and valleys with changing economic times. Crucially, changes in property values have been allowed to accumulate and grow.

- Under Initiative 50, voters would be asked to cap this growth in productive years while suffering the losses in downturn years. Much like the disastrous Proposition 13 in California, fiscal losses would compound year over year. If Initiative 50 makes it to the ballot and passes, legislative council forecasts $115 million in lost revenue in property tax year 2025. The losses quickly compound, though, reaching $550 million in 2026 and over $1 billion in 2027 as the baseline has been permanently reset and gains can never supersede 4 percent.

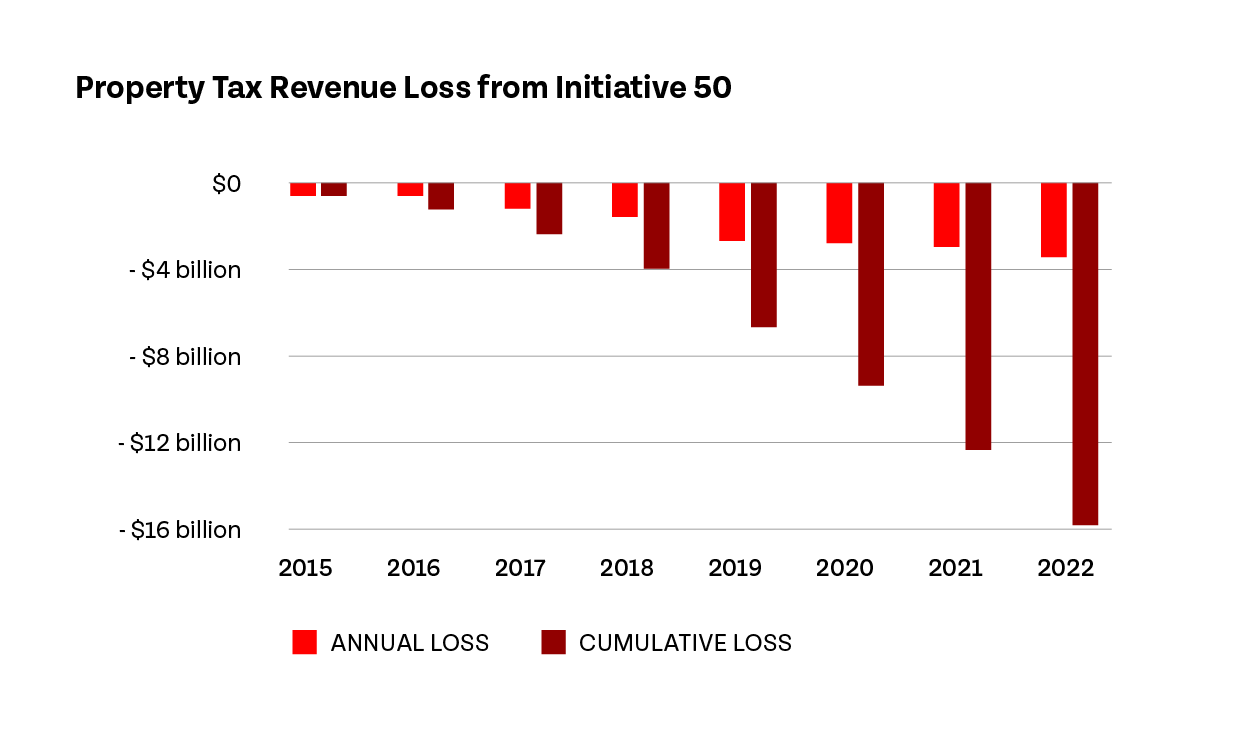

- After recessions, property values generally recover their losses. Peaks are followed by valleys. To demonstrate the devastating impact of Initiative 50, the Bell modeled a 4 percent cap starting in 2015. The years prior saw low growth rates in the slow recovery from the Great Financial Crisis. Once a moderate or high growth year happens, and goes above that 4 percent cap, the recovery stalls. Peaks cannot smooth the valleys, and the permanently reduced baseline compounds the losses over time. Between 2015 and 2022, local districts would have lost $15 billion in property tax revenue. The gap between expected property tax revenue and revenue under I-50 would grow larger every year.

If Initiative 50 appears too simple, that’s because it is.

It offers a simple solution to a complicated problem, giving voters the false choice of property tax relief with the loss of the public services and investments these taxes pay for.