Gas Prices in Colorado

Globally high oil prices are impacting the everyday lives of Coloradans who rely upon gasoline to get to and from work, school, and activities for their loved ones. Yet, though gasoline is critical to many of our lives, few of us understand the cost drivers associated with this essential product.

In the following brief, we explore these factors and find that gasoline prices are significantly impacted by global phenomena and markets; more recently this includes COVID-induced disruptions to oil supply and demand. The predominantly global nature of oil markets and supply mean that continued reliance upon this product will always place gasoline prices in Colorado at the whim of larger, external forces.

A COVID-Induced Mismatch in Supply and Demand

At its core, high gasoline prices in the US are the result of extended global mismatches between oil supply and demand—much of which is due to COVID-19.

Historic Drops in Oil Demand

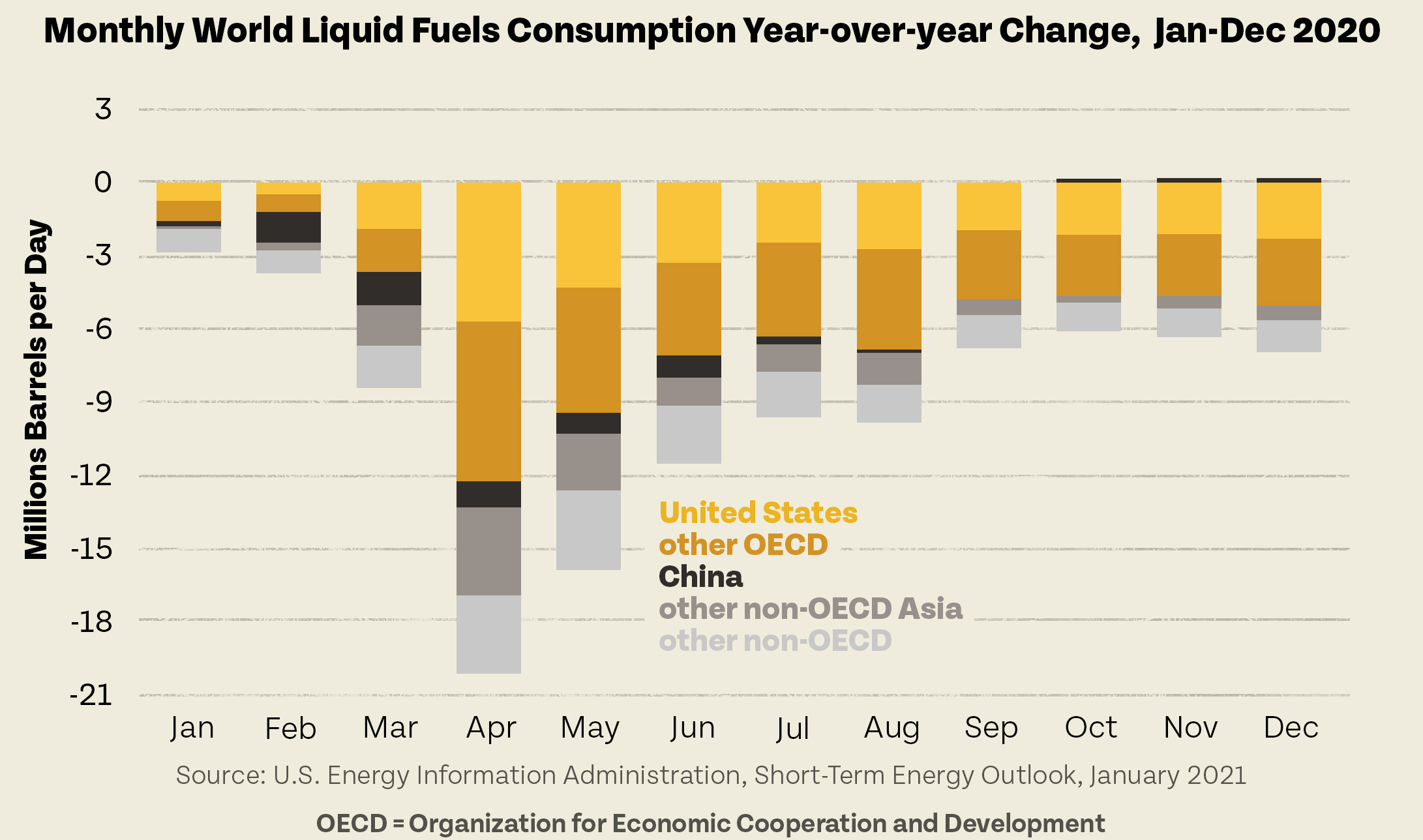

Much of the world closed down in the spring of 2020 as COVID-19 surged in the absence of vaccines. Because so much activity, including travel, stopped, demand for oil dropped significantly, as seen in the chart below. Year over year, April of 2020 saw the largest annual decline in global oil consumption in 20 years.

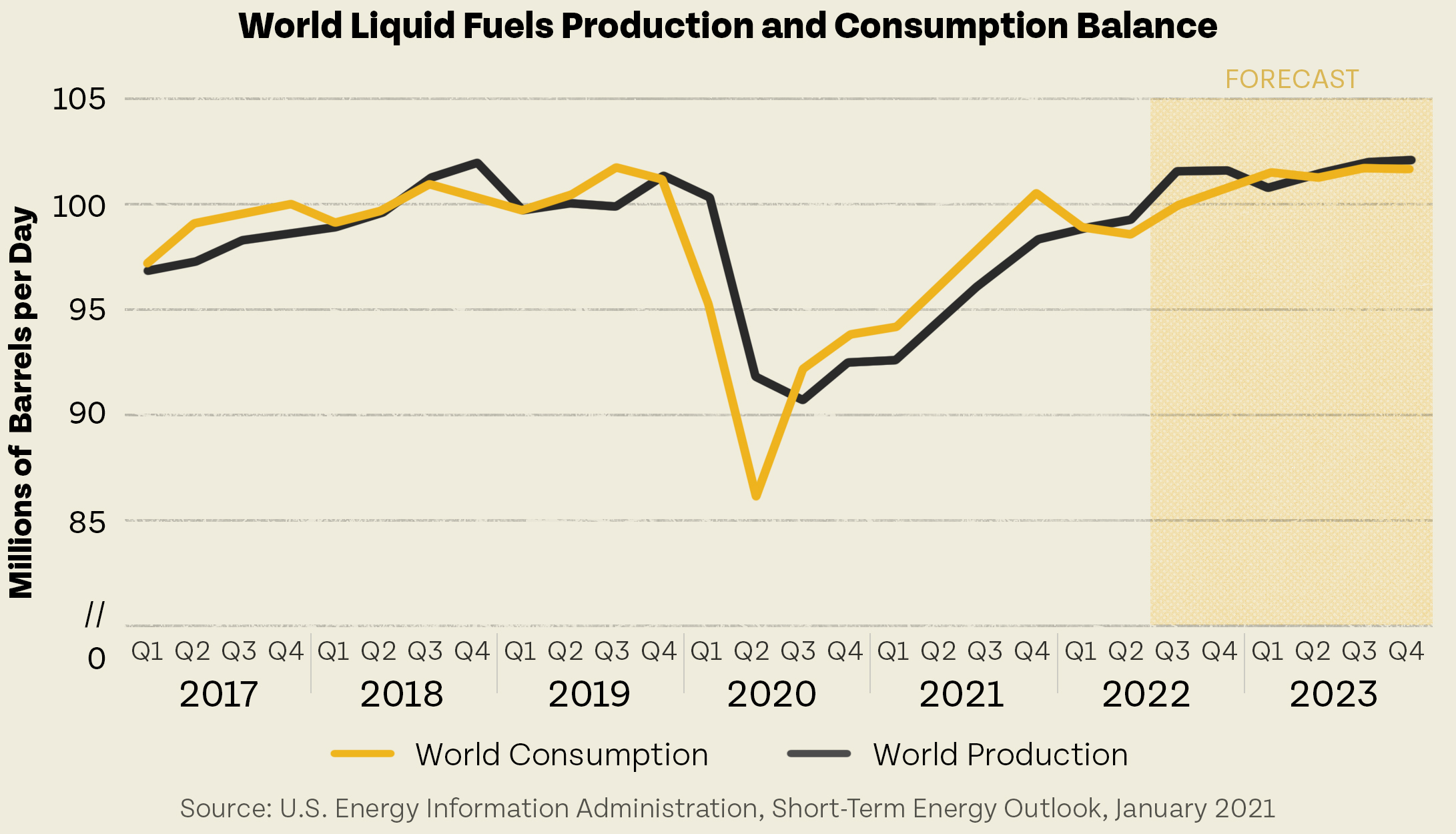

As would be expected, when demand for oil dropped, so did oil prices. Though often forgotten now, in the early months of 2020, the price for a barrel of oil reached record lows—at one point, oil was selling for below $0/barrel. This drop in price was a reflection not only of decreased demand for oil, but also full storage units. These market-driven factors led to a global decrease in production, as it simply didn’t make financial sense to continue extracting and refining a product nobody wanted or could store.

A Resurgence in Demand & Lagging Production

Fast-forward two years, and the world has significantly changed. Thanks to the marvels of modern medicine, which have allowed a resumption of personal and economic activity, many feel comfortable returning to pre-pandemic activities. For evidence, one need look no further than the record levels of passengers traveling in and out of the Denver International Airport.

While a global reopening was welcome news, it left oil producers in a pinch. Despite growing demand for oil, suppliers weren’t able to simply flip a switch and increase production. Instead, returning to pre-pandemic output levels takes time. In surveys conducted by the Federal Reserve, oil producers cite labor shortages and supply chain issues as constraining factors in their ability to ramp up output. Producers note that investor pressure to maintain capital discipline has also been a major driver in restricting production. As highlighted by Wells Fargo, investors have been the impetus behind a shift away from prioritizing higher quantity to “cash generation and shareholder returns”. For investors, this has likely contributed to increased dividends and stock buybacks, as the companies take in record profits.

In addition to production challenges, the broader industry has also been hindered by a lack of refineries, which are needed to transform oil into usable products, like gasoline for our cars. While existing refineries are operating at or close to full capacity, several facilities shutdown during the pandemic when consumer demand dropped. As a result, there are simply fewer refineries available to turn oil into the usable products we need. Notably, building more refineries is neither quick nor inexpensive. Instead, these facilities can take years and billions of dollars to build.

A Compounding Supply Factor: Russia Aggression in Ukraine

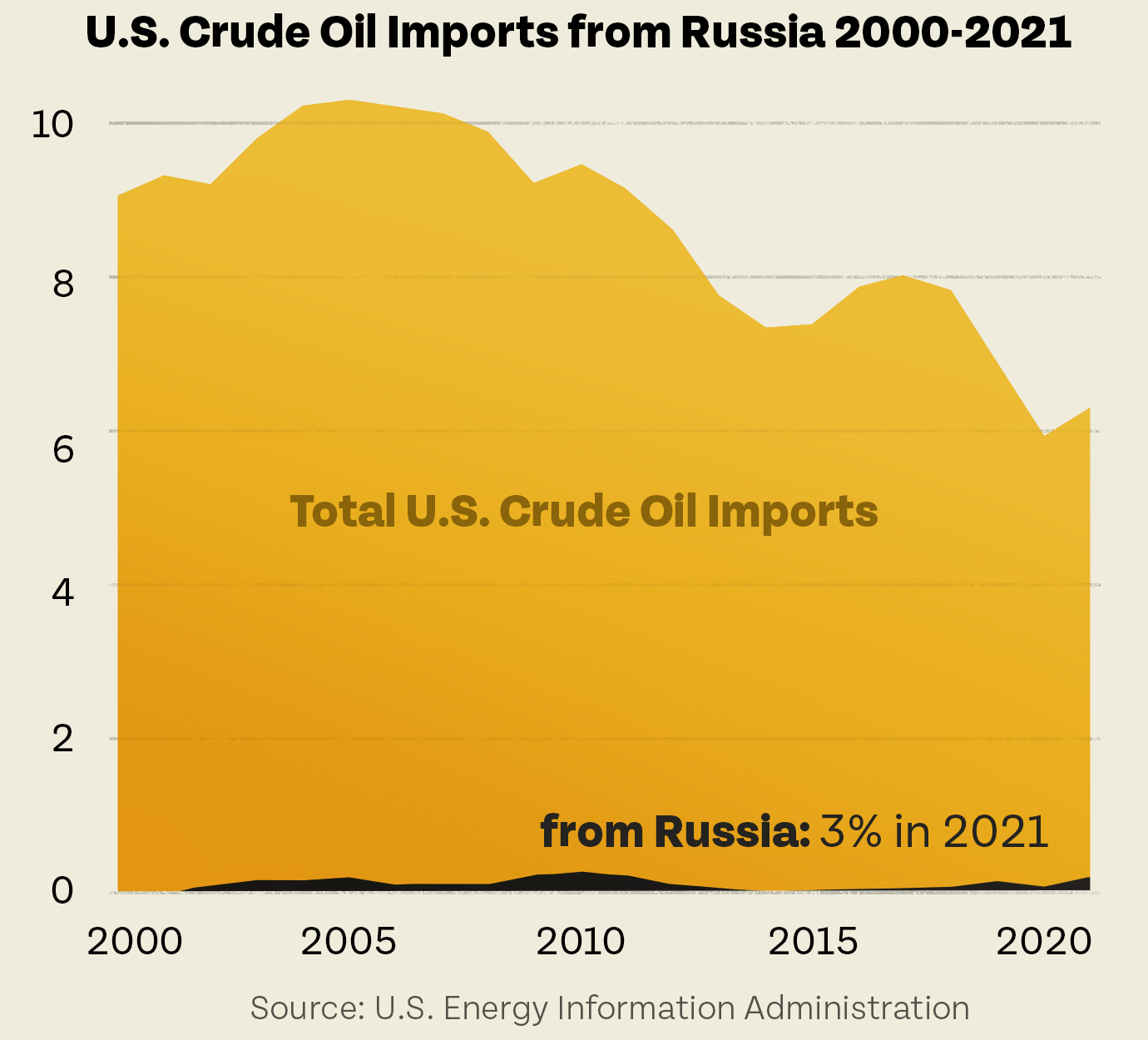

As the world reopened, the oil industry was already playing catch-up to meet a resurgence in global demand. These challenges however were further exacerbated when Russia invaded Ukraine. To sanction Russia, countries throughout the world, including both the EU and the United States, restricted imports of Russian oil, which effectively limited an additional supply source.

In dissecting the impacts of diminished Russian oil, it is important to note that, though Russia is one of the top three oil producers in the world (behind the United States and Saudi Arabia), it accounts for a very small percentage of US crude oil imports, as seen here:

However, oil is sold on a global market. Though we use relatively little Russian oil, the global decrease in supply leads to increased international prices, which in turn impact the US.

Global Takeaways

COVID-19 and Russian aggression have caused massive market disruptions in both the global demand and supply of oil. However, there is evidence that some of these disruptions are beginning to right themselves. For example, projections by the U.S. Energy Administration estimates the US will produce a record amount of crude oil in 2023, up from previous highs in 2019.

A Limited Role for State Policymakers

As detailed above, oil prices are predominantly reflective of global factors. Inherently, this limits state policymakers’ ability to impact the cost of gasoline in Colorado. However, there have been suggestions that state policy—either through rolling back regulations to allow for greater production of oil at home or by reducing the gasoline tax—could play a role in decreasing state gasoline prices. We explore both ideas in more depth below.

Rolling Back Regulation to Promote More Oil Production at Home

Some suggest rolling back oil regulations in Colorado will lead to increased oil production and supply, which will in turn, lower gasoline prices. A few data points suggest doing so is unlikely to have the intended effect.

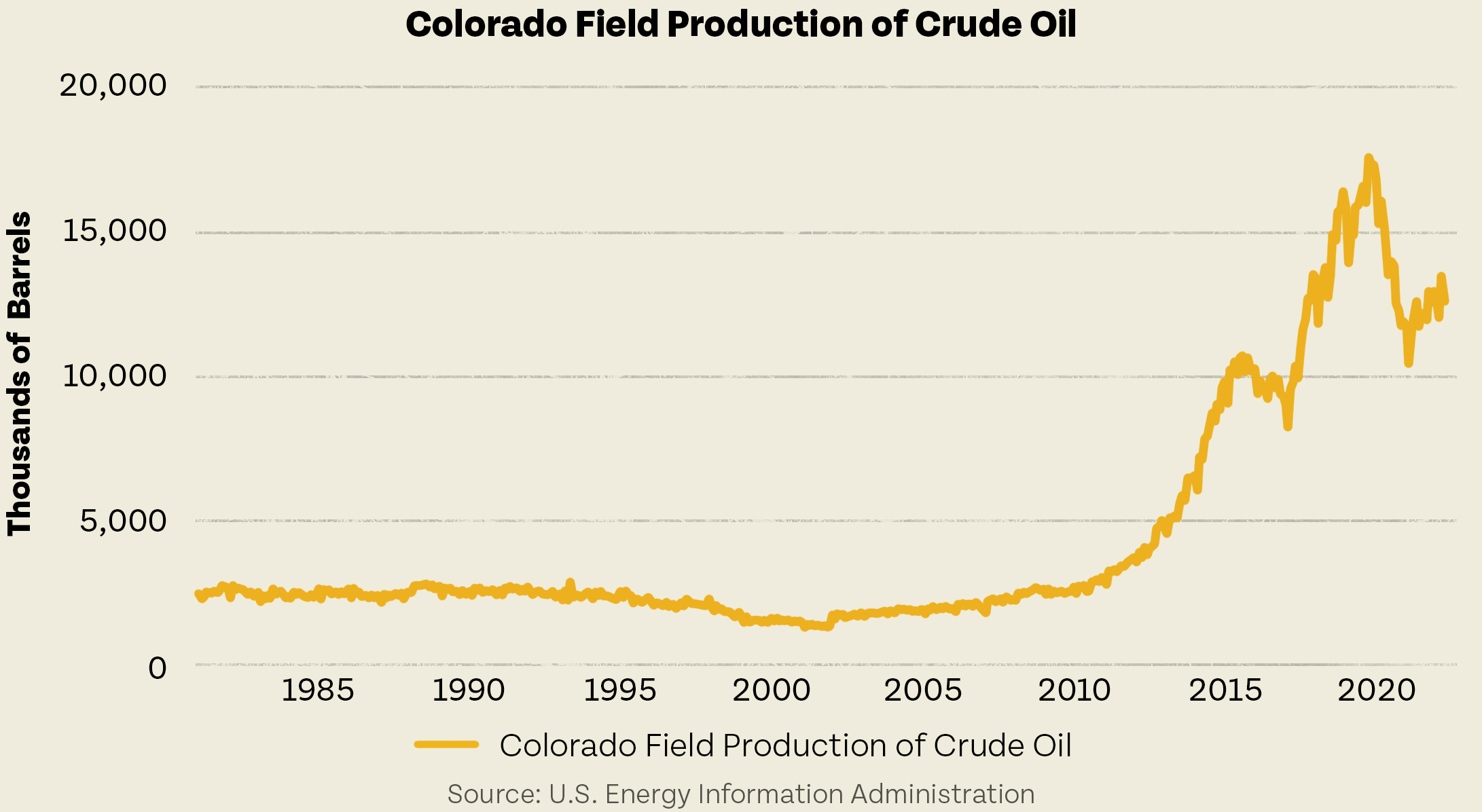

- Though the sixth largest onshore oil producer in the US as of April 2022, Colorado only accounts for 3.6 percent of total US crude oil production. By comparison, Texas produces over 40 percent of US crude oil. As oil is sold on a global market, of which the US provides approximately 14.5 percent of total crude oil, increasing production in Colorado would have close to no impact on global supply and prices.

- Moreover, Colorado producers already have the ability to extract more oil, and are in fact, doing so.

- According to the Colorado Oil and Gas Conservation Commission there are 1,709 wells which have already been permitted, but the owners have yet to start drilling on.

- Additionally, oil production in Colorado has largely followed national trends, falling in the initial months of COVID-19, but rebounding in the following months. As such, we are currently seeing an increase in Colorado oil production. Moreover, surveys of oil producers by the Federal Reserve, find there are strong expectations for future production activity in the 10th District, of which Colorado is a part.

Reducing the state gasoline tax

A separate course of action proposed by some involves reducing the state gasoline tax. Notably however, Colorado already has the 39th lowest state gasoline tax in the country, at just 22 cents/gallon. This is 17 cents lower than the national average. Using the mid-July average gasoline price in Colorado of $4.82, state gasoline tax accounts for approximately 5 percent of the cost of each gallon of gasoline. Notably, state lawmakers have already taken some steps to help temporarily reduce costs by delaying a new fee on gasoline until 2023.

While an initially appealing idea to some, reducing the state gasoline tax poses several potential challenges. First, the gasoline tax is a major source of transportation funding in the state. As a result, reducing this tax will decrease available funding for transportation services and upkeep. Additionally, many economists have pointed out that reductions in the gasoline tax are unlikely to have the intended, direct to consumer impact. This stems from research which shows reductions in gasoline taxes often lead to minimal, at best, reductions in cost, and are more likely to benefit producers than consumers.

A Way Forward

Global markets and forces are driving high gasoline prices in Colorado and beyond. Realistically, there’s little that can be done to change these outcomes, especially by state lawmakers, in the short run. The good news however, is that we are seeing signs that, at least production, is righting itself as COVID-induced pressures ease.

An exploration of the factors which drive gasoline prices make clear that a reliance upon oil does not equate to true energy independence. Even when produced in the US, oil is still bought and sold on a global market, and as a result, is at the whim of international volatilities. True energy independence instead will exist when we’re able to rely upon the renewable sources nearest to us, like solar and wind. By making long-term investments in these technologies, we’ll be fostering the energy independence we aspire to.