Property Tax Ballot Initiatives: Three Shades of Red

With a shortage of housing and land values rising across the state, the value of properties has grown dramatically. In turn, residential and commercial property tax bills will soon rise, too. Facing the prospect of elevated tax burdens, several groups have proposed state ballot initiatives for the November 2022 election to address rising property taxes. Bell Policy Center President Scott Wasserman recently analyzed these initiatives and their impact on revenue sources.

The initiatives that the Bell is monitoring closest are those being proposed by the business group Colorado Concern. Originally, the group aimed to place an artificial property value cap, limiting the growth rate of property assessments to 3 percent. Multiple states have implemented similar measures to address rising property taxes but have led to taxpayer inequities, less local control, and a drastic loss of critical revenue.

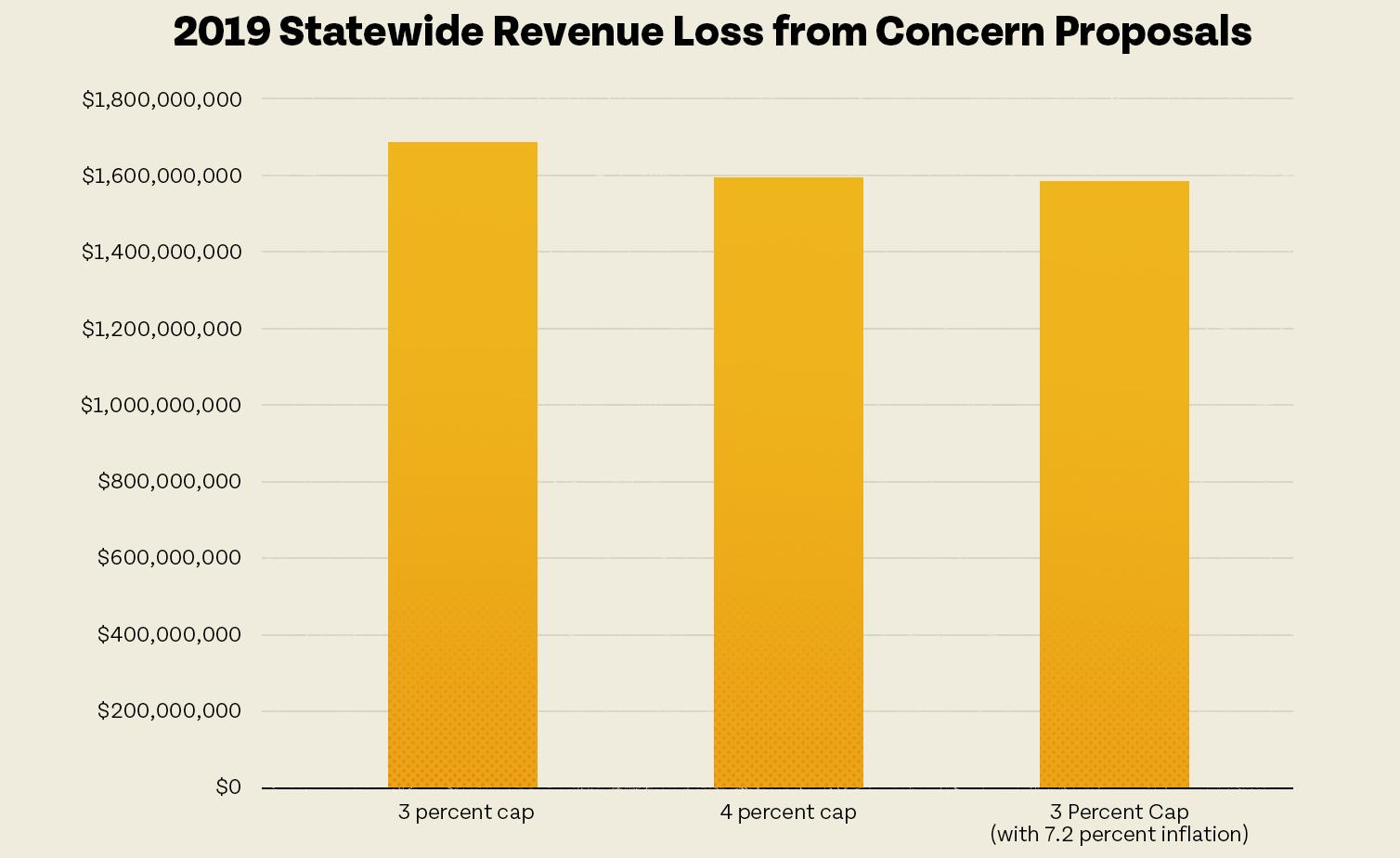

We should be concerned about these property caps. For instance, had Colorado had a 3 percent cap in 2019 (the last assessment year prior to the pandemic-induced rate freeze), local communities would have lost an estimated $1.68 billion.

In response to troubling fiscal projections and rising inflation, Colorado Concern introduced eleven new proposals, Initiatives 140-151. They might look different, but Coloradans shouldn’t be fooled; these initiatives result in the same outcome — massive revenue loss for local communities. These proposed initiatives come in three buckets.

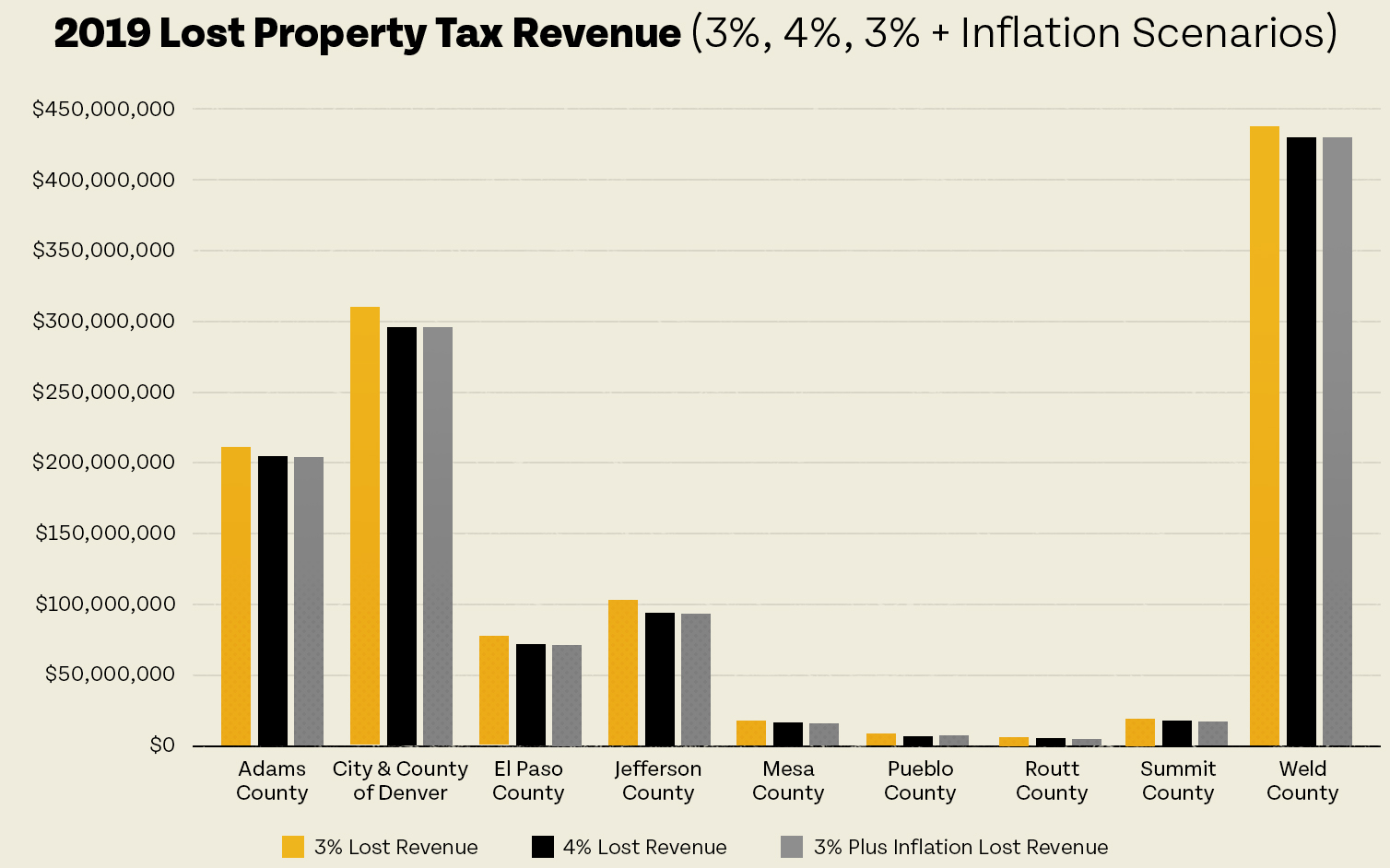

Under the first bucket, like initiatives 74 and 75, newly proposed initiatives 140, 147-148, and 151 would cap home value growth at 3 percent. Statewide revenue loss in this scenario would have been $1.68 billion in 2019. County-level losses are also shown below, with nearly every county losing millions from its revenue baseline.

The second bucket includes initiatives 145-146 and 149-150. Under this scenario, the 3 percent baseline cap remains unless inflation exceeds 5 percent. This would have resulted in $1.59 billion in revenue loss to local communities in 2019. Finally, initiatives 141-144 likewise employ the 3 percent baseline cap unless inflation exceeds 5 percent. When inflation reaches this level, local county commissioner boards could approve a higher cap, whereby home values could grow by no more than 3 percent plus the 50 percent of the inflation rate exceeding 5 percent. That is, if the 2022 inflation projections of 7.2 percent by the Governor’s Office of Planning and Budgeting are correct, then the cap would grow to 4.1 percent ((7.2 – 5)*.5)+3)). Once more, the revenue loss to local communities in 2019 would have been $1.59 billion.

Coloradans should be wary of the use of inflation-adjusted caps. Concern’s new proposals only trigger an increase in the home value growth cap when inflation exceeds 5 percent. The last time Colorado experienced inflation over 5 percent was in 1983. While monetary authorities reckon with inflation rates not seen in forty years and the possibility of stagflation, current economic forecasts do not expect inflation to exceed 5 percent for more than the next two years. Under all initiatives, the 3 percent baseline is the most likely yearly cap; further boxing in our state with permanent fiscal restrictions based upon temporary economic conditions. Even under novel inflation, a 4.1 percent cap still results in high revenue loss to the counties. Losses the state will have to backfill, often through more regressive forms of taxation.

The extreme revenue loss these initiatives would impose is hardly surprising, as property values statewide grew 21 percent between 2017 and 2019. Capping this growth at 3, 4, or 4.1 percent, respectively, barely makes a difference. Yet, no matter the difference, the cap divorces local home value gains from funding government services. These new initiatives might appear more appealing, however, economics spells a different story. These three artificial caps lead to drastic state revenue loss, produce taxpayer inequities, and hurt local communities that already face longstanding budget shortages. If you squint hard enough at the newly proposed caps, you might distinguish different hues, but in the end, we’re in the red.