How Inflation Affects Colorado’s Living Wage

Inflation varies across categories and geographies. It affects people in many different ways depending on their needs and their income. Ensuring low- and middle-income Coloradans can earn a living wage requires mitigating inflation. While wages are increasing on average, with many workers seeing wage gains through rising minimum wages and labor market pressures, these gains aren’t enough to offset inflation in many instances.

For policymakers to support families, they must first understand the many ways that inflation is unfolding and evolving over time. Recent inflationary pressures began due to the shocks to our supply and demand caused by the pandemic. Increasingly, corporate power to raise prices due to limited competition is driving inflation in key markets, such as food and gas prices, worsening affordability issues in our state.

What is inflation?

Inflation is the measure of changes in costs over time and is often represented in the aggregate by the “consumer price index.” The last year has been marked by increasing inflation for families and has led to a growing concern amongst Americans about affordability.

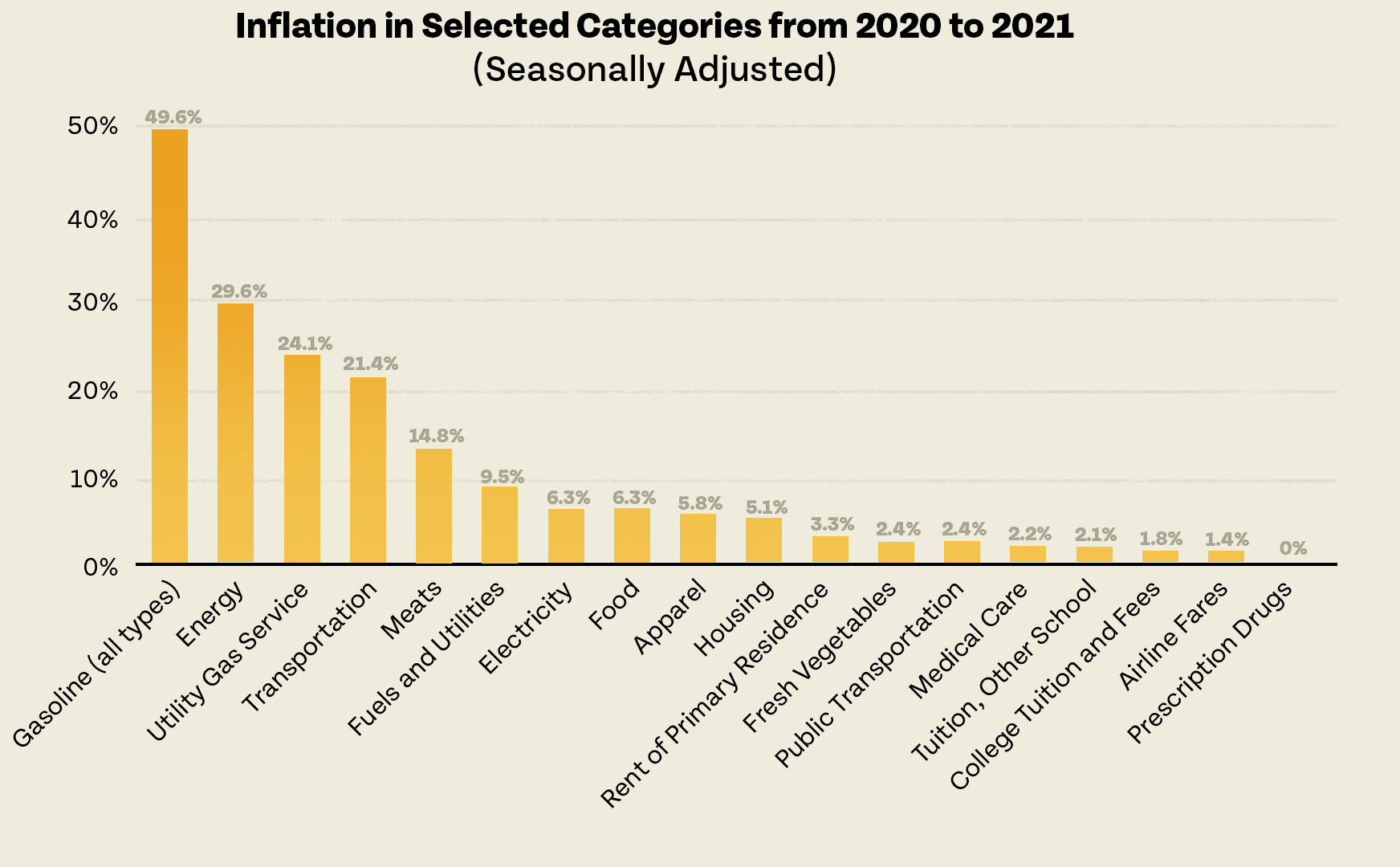

January began with news of a 7 percent topline increase in inflation, which is the largest year-to-year increase the nation has seen since 1982. That 7 percent increase in the consumer price index is an average of the price changes in many categories, including gas, food, housing, child care, cars, books, furniture, clothing prices, and more. Items that tend to be a more significant part of a household’s monthly budget, such as gas prices, are given more weight than less significant items, such as clothing prices. An important caveat to year-over-year inflation data is that 2020 inflation figures include the downward economic shifts from COVID-19 shutdowns, making the year-to-year increase seem larger than a two or three-year comparison would.

Which factors are driving inflation right now?

The largest inflation increases are occurring in fuel and energy costs. Gas prices are up, and as a result, motor vehicle transportation costs are up as well. This type of inflation is related in part to the growth in demand for gasoline compared to last year, as well as some supply-side factors. Notably, gas prices are driven by geography, gasoline standards, the global price of oil, and the global supply of crude oil. While the initial spike in inflation was largely driven by these shifts in supply and demand, persistently high prices are leading to booming corporate profits, showing high prices aren’t merely to offset limited supply.

Another significant component of inflation is the cost of food. While the overall inflation for all food categories is around 6.3 percent, meat prices have risen nearly 15 percent from last year. This contrasts inflation of fresh vegetables, which clocked in at 2.4 percent, near the “acceptable” yearly inflation rate of 2 percent, which provides a balance between positive economic growth without placing undue cost pressures on families.

Inflation in meat is due to a different set of factors than gas inflation: labor shortages in the meat industry and the high costs associated with transportation. An additional inflationary driver may be the shift towards grocery shopping for home cooking and away from eating out at restaurants during the pandemic.

The meat industry is also one, like other sectors of the economy, with consolidated corporate power. Over 80 percent of beef production comes from four major meat processing companies. This reality creates an additional challenge for inflation. Given their significant share of market control, they can artificially take advantage of real inflationary pressures to keep meat prices higher than required from supply chain issues alone. Increasingly, the lack of competition in key sectors of the economy, from meat, agriculture, grocery stores, energy, and more, is harming consumers. A high degree of concentrated corporate power means that a few companies are seeing huge increases in profits by passing off higher costs to consumers while blaming inflation.

These two examples serve to illustrate that while inflation is talked about as one issue, there are various drivers of inflation in different areas. As policymakers strive to mitigate inflation, they must consider different approaches to address the myriad causes of inflation. Critically, they must also consider which populations to target relief to. This is because different segments of the population experience inflation differently.

How does inflation affect a living wage?

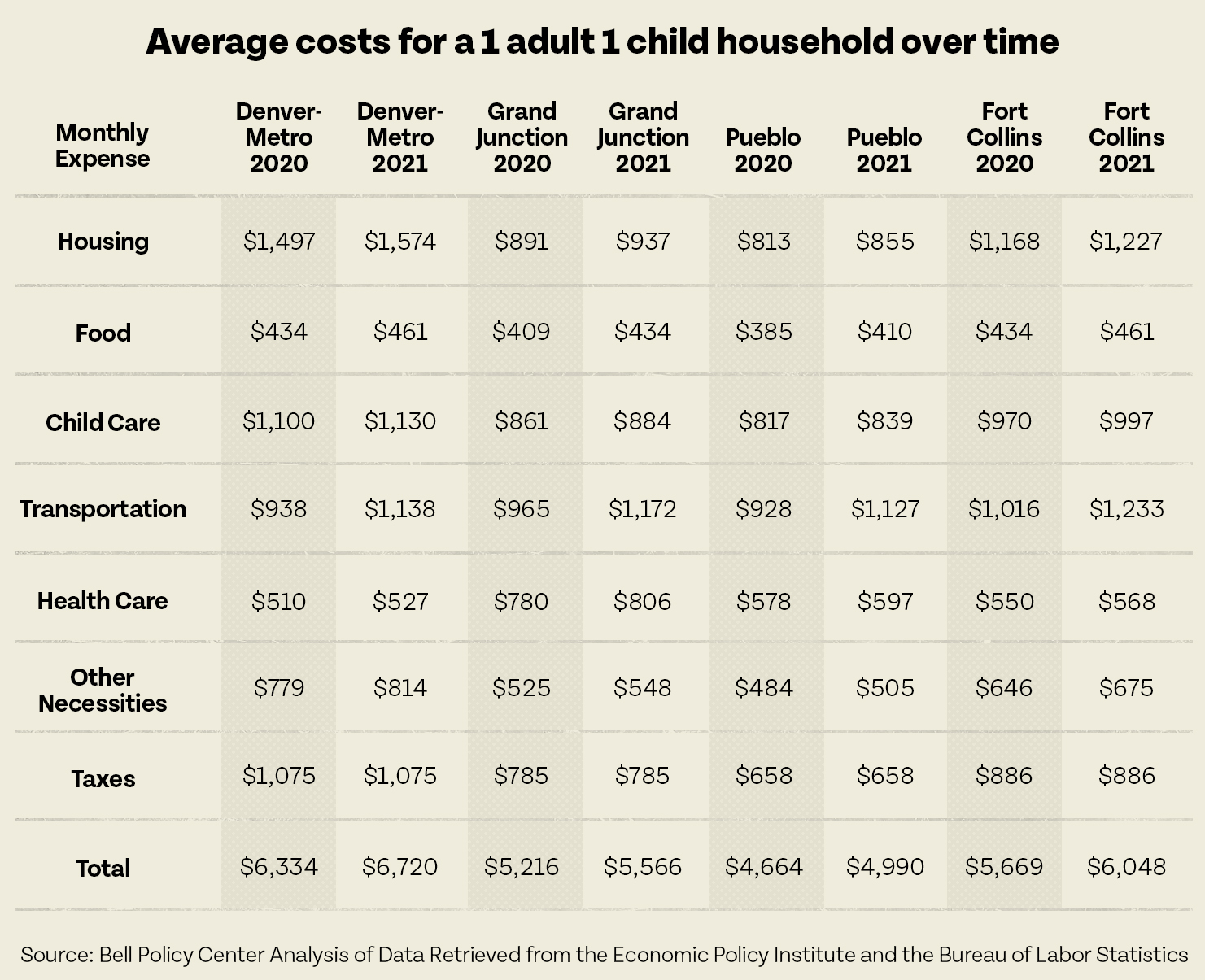

These diverse inflationary pressures make it harder to earn a living wage. The table below shows average costs for a household comprised of one adult and one child. As it shows, geography affects average costs significantly.

However, as our current inflation shows, adjusting for aggregate changes in broad categories like “food” and “transportation” hides a significant amount of variation. If someone drives an electric car, they may be seeing a smaller increase in transportation costs than someone who drives a gas car. Driving distances in the metro area are going to be shorter on average than driving distances in less densely populated areas. Food costs are also going to vary. A vegetarian will be less affected by current cost changes than someone who eats meat every day. Thus, inflation varies significantly based on one’s lifestyle, including where they live, where they work, and their ability to purchase alternatives to their habitual choices.

On average, the standard for a living wage has gotten higher in the past year due to inflation. This is concerning insofar as current average wages are unable to compensate for the increases in costs. While wages have been growing on average, they have not kept up with the increases in inflation, and with big-budget items like rent, in particular. In such an environment people are forced to make hard choices to save their bottom line. Someone with a child may opt to only pay for a few days of childcare, or drop out of the workforce entirely, to try and reduce costs.

Inflation is not a single issue. Nor are the economic conditions driving wages and employment. For policymakers to address the affordability issues that inflation is causing, they must first pay special attention to the causes and drivers of inflation. Waiting for supply and demand pressures to level off ignores the role of corporate profiteering at the expense of low- and middle-income families. Assuming a blanket 7 percent inflation overall ignores the greater burden that some families will face over others, depending on their lifestyle.

While the problem of inflation is more properly dealt with at the federal level, policymakers in Colorado need to pay attention to inflation hurting families’ bottom line. That means using short-term dollars within our state’s budget to help families get by. While this inflationary period is expected to be “temporary,” the pain for low- and middle-income families is very real. Policymakers should look at targeted relief for those who need it and help Colorado’s families get through this tough economic period.