5 Questions & Answers About Denver’s Initiative 304

With a lot less attention and coverage, odd-year elections often catch us by surprise. But once again, Coloradans are being asked to vote on critical questions that impact our communities. In addition to three statewide ballot initiatives, voters have a lot of questions about local measures on their 2021 ballots.

In Denver, there are a total of 13 questions. One initiative, 304, would reduce the city’s sales and use tax from 4.81 percent to 4.5 percent, and permanently cap the rate thereafter, prohibiting any future increases.

Here are 5 questions and answers to help you understand what’s at stake for Denverites in Initiative 304.

What does Denver’s sales and use tax currently fund?

The majority of sales and use tax revenues — 52 percent — go to Denver’s General Fund, according to city officials. The rest of the money is split on several city programs — all of which were created by voter-approved sales tax increases. Below are the programs and the year of the election in which they were approved:

- Denver Preschool Program (2014)

- Denver College Affordability (2018)

- Healthy Food for Denver’s Kids (2018)

- Caring for Denver Fund — a program for mental health and substance abuse treatment (2018)

- Parks Trails and Open Space Program (2018)

- Climate Protection Fund (2020)

- Homelessness Resolution Fund (2020)

How much would a household truly save in taxes if Initiative 304 passes?

Data from the Colorado Department of Revenue shows an average Colorado family making between $40,000 and $50,000 per year spends about $762 annually in sales and use tax. Mapping that onto Initiative 304, a family making in that income range would save only about $49 per year.

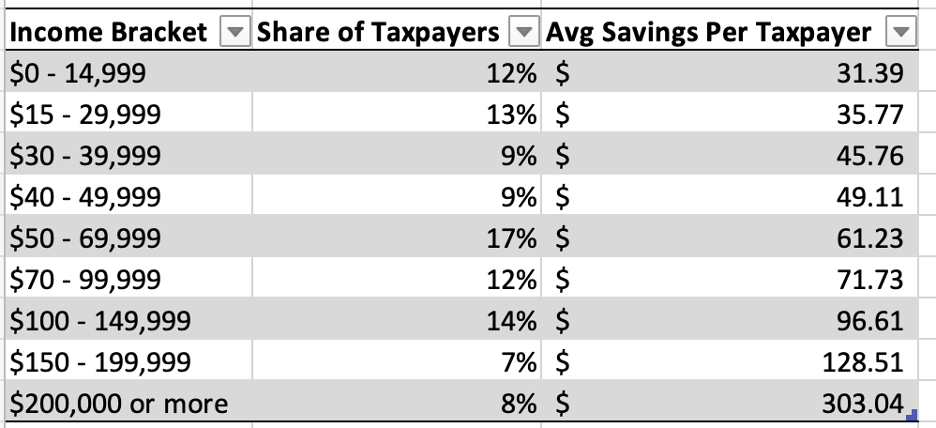

Below is a chart that shows the average annual savings for a Denverite in each income bucket would get under Initiative 304 (based on statewide Department of Revenue data), alongside the percentage of Denverites in each income category, based on US Census data. It shows 52 percent of Denverites would see less than $50 in savings.

What would be the loss to Denver’s citywide revenues because of Initiative 304?

The city of Denver would lose $48 million in revenue in 2022 alone. The revenue loss will grow to $55 million annually within five years.

How would this loss of revenue affect individual Coloradans?

The losses can be measured in individuals and families that depend on the programs listed above. For example, according to the fiscal analysis by the city:

- 161 families with lower incomes, who otherwise would have had access to the Denver Preschool Program, would either have to pay out of pocket or go without child care.

- 291 students who otherwise could have afforded a postsecondary education, will not have access to financial aid.

- 5,000 more at-risk youth would not have access to meals through the Healthy Foods for Denver Kid’s program.

- 8,900 individuals would have to go without mental health and/or substance abuse treatment through the reduction in Caring for Denver funds.

- There would be nearly 100 fewer beds for Denver residents without shelter, due to the reduction of funds to homelessness support services.

Sales taxes are regressive. Wouldn’t reducing sales taxes be good for low-income Denverites?

Sales taxes are regressive, meaning taxpayers with lower incomes pay a greater share of their income in sales tax than wealthier taxpayers. As such, they are the least ideal way to pay for critical services that help families achieve economic prosperity. This is where our statewide tax policies come into play.

Statewide taxes in Colorado are low — in fact, we are 45th in the country in statewide tax revenue. With little help from the state to create innovative programs, like subsidized preschool slots, free mental health access, and college scholarships, local governments are forced to figure it out on their own. Also, our state constitution plays a role in preventing local governments from more progressive forms of taxation by barring different tax rates for different levels of wealth or even instituting a local income tax at all.

These facts have resulted in cities and counties across Colorado increasing property and sales taxes to fund important programs that their residents want. There is no other way for local governments to increase revenues for important services — as Denver residents voted to do in the 2020 election by increasing the city’s sales tax to fund climate change resilience and homelessness support services.

Denver’s future is bound to Colorado’s future. We need a better, smarter tax code that funds the needs of a growing and changing state. In the meantime, ballot measures like 304 offer a very bad deal for working families. And that’s why we urge a no vote on Initiative 304.