Secure Savings: How the Racial Wealth Gap Manifests for Older Coloradans

Colorado, like the rest of the nation, continues to face a retirement crisis. Research shows nearly half of Colorado’s private sector workers have no retirement savings plan through their employers. Without easy access to retirement plans, many Coloradans put off saving until it’s too late, then have too little to live on during their retirement years. We must do more as a state to ensure every worker has access to a strong and easy option to save for the future.

The racial gap in retirement savings is both a product of and a cause of the racial wealth gap. As the Bell’s research on the racial wealth gap shows, Coloradans of color are more likely to be impoverished and have significantly less wealth than white Coloradans over the course of their lives. Larger disparities in access to retirement savings through employers also compounds the racial wealth gap at retirement.

Since 1989, the disparity in retirement savings has increased fivefold. As of 2016, white families had six times more in average liquid retirement savings than black and Latino families.

Racial Impacts of the Retirement Crisis

Nationwide, 3 out of 4 black households and 4 out of 5 Latino households have less than $10,000 in retirement savings, compared to one 1 out of 2 white households. Additionally, among near retirees, the average retirement savings balance among households of color is one-fourth that of white households — $30,000 versus $120,000. Across all age groups, households of color with at least one earner are half as likely as white households to have retirement savings equal to or greater than their annual income.

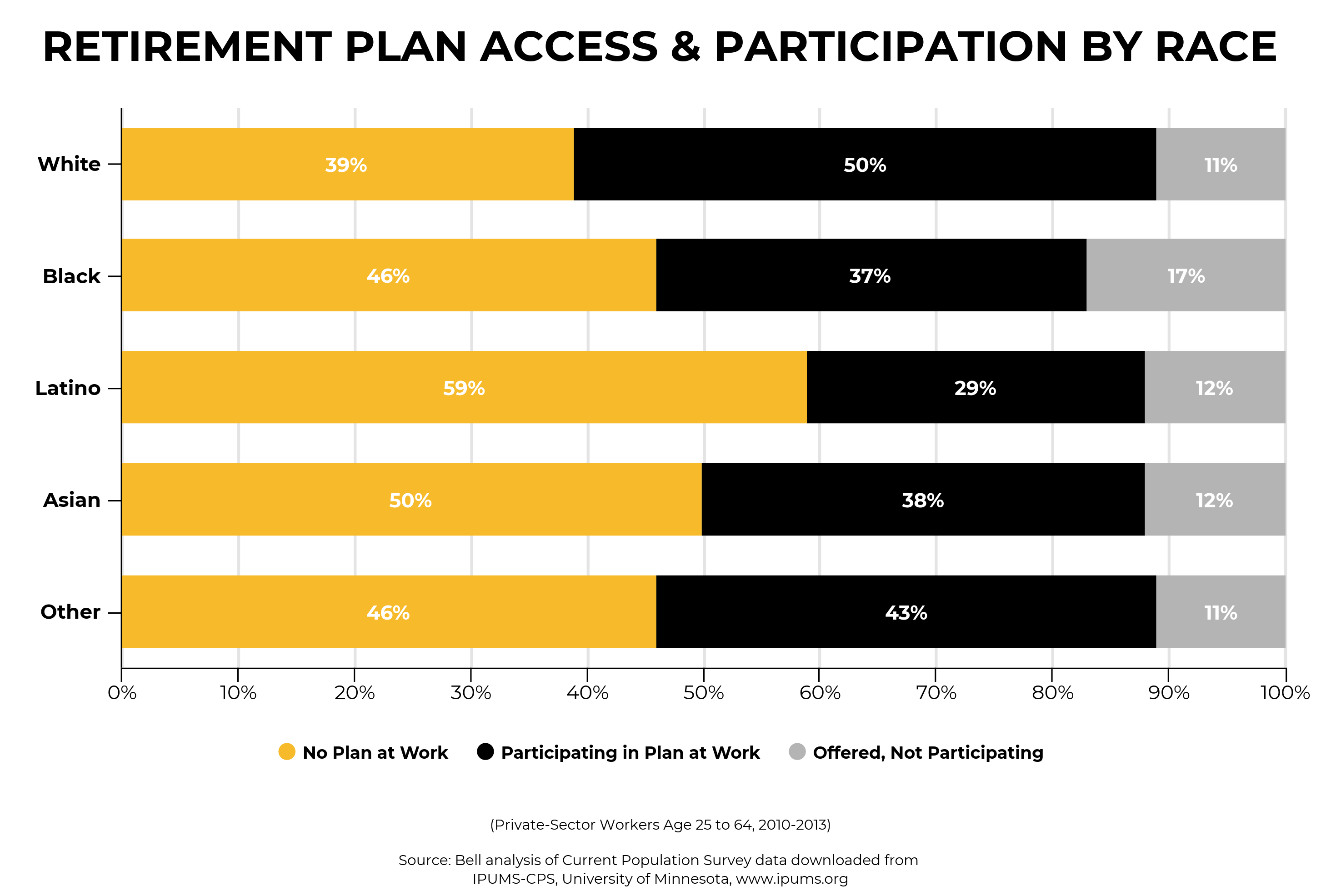

The Bell’s research on Colorado’s retirement crisis shows black and Latino workers in Colorado are the least likely groups to have access to a workplace retirement plan, with 46 percent of black workers and 59 percent of Latino workers lacking access to a workplace retirement plan. This data shows a lack of access to a workplace retirement plan can maintain and facilitate Colorado’s racial wealth gap among our older adult populations.

How Does Secure Savings Address the Problem?

Our research finds a state-facilitated, automatic-enrollment Secure Savings plan that’s accessible to all Coloradans will strongly benefit workers who are younger, black or Latino, low income, and/or working for small businesses.

Last year, the Bell worked with the Financial Equity Coalition, stakeholders, and state legislators to pass SB19-173, which established an advisory board tasked with studying how Colorado can best address this issue and the costs we’ll face if we maintain the status quo. The Bell and the Financial Equity Coalition believe whether you can retire shouldn’t depend on who your employer is — it should be easy for every hardworking Coloradan to automatically invest in their future. Workers should also be able to easily take their retirement savings with them when they change jobs or if they work multiple jobs.

A state-facilitated, auto-enroll IRA retirement plan that stays with individuals — not their employers — and allows workers to opt out is the best way to set people up for a secure retirement. Research also shows if you have a retirement savings contribution automatically deducted from your paycheck, you are 15 times more likely to save for your retirement. That’s why the Colorado Secure Savings Plan Board recently voted to recommend the legislature create a retirement savings program with automatic enrollment for all Coloradans who don’t have a plan at work.

While Secure Savings alone will not close Colorado’s racial wealth gap, it will go a long way toward building assets and security for all Coloradans — particularly Coloradans of color — in retirement. Furthermore, an IRA retirement plan is an investment portfolio, meaning Coloradans who would otherwise have no investments and very few assets will now be growing their wealth in tangible and exponential ways without needing to hire an investment advisor or knowing how to invest. This is a plan for the future that seeks to bring all Coloradans along to share in Colorado’s growing prosperity.

How Can You Get Involved?

If you’re interested in endorsing Secure Savings as an individual, business, or organization please fill out the endorsement form here. If you’d like to get involved in the coalition to Secure Our Savings, please email blackford@bellpolicy.org.