Retirement Security: Learning from Oregon & Washington

Retirement

46.5% of all working-age families don't have any retirement savings

While there are several slow-moving public policy problems that threaten the economic well-being of people, cities, counties, and states alike, one in particular flies a little under the radar: retirement security. According to the Economic Policy Institute, the median retirement savings of working-age families in the United States was just $5,000 in 2013. Data from the Federal Reserve Board shows working families in 2016 who have retirement savings saved a median $62,000. Still, almost half of all working-age families — 46.5 percent — have no retirement savings at all.

Even the most optimistic amount is nowhere near enough for families to enjoy sufficient retirement security. In Colorado, nearly half of all private sector workers — 750,000 people — don’t have access to a retirement plan through work, where most people start saving. People of color and women are even further behind than the average Coloradan, a disparity that will become more acute as communities of color continue to grow in Colorado. Our state is poised to be on the front lines of the fallout if we don’t step up and work on a solution to the problem.

A lack of retirement security poses serious problems for individuals and families, but the larger economy will also be in trouble if the retirement crisis continues. Without enough savings, Coloradans will have to rely on social services to meet their needs as they age. That means local and state budgets will have to grow substantially to address these demands. In fact, a study in Utah finds if retirees in the state with the lowest savings had boosted their savings by just 10 percent, or about $14,000 on average during their working years, taxpayers could’ve avoided $194 million in costs to support them in their later years.

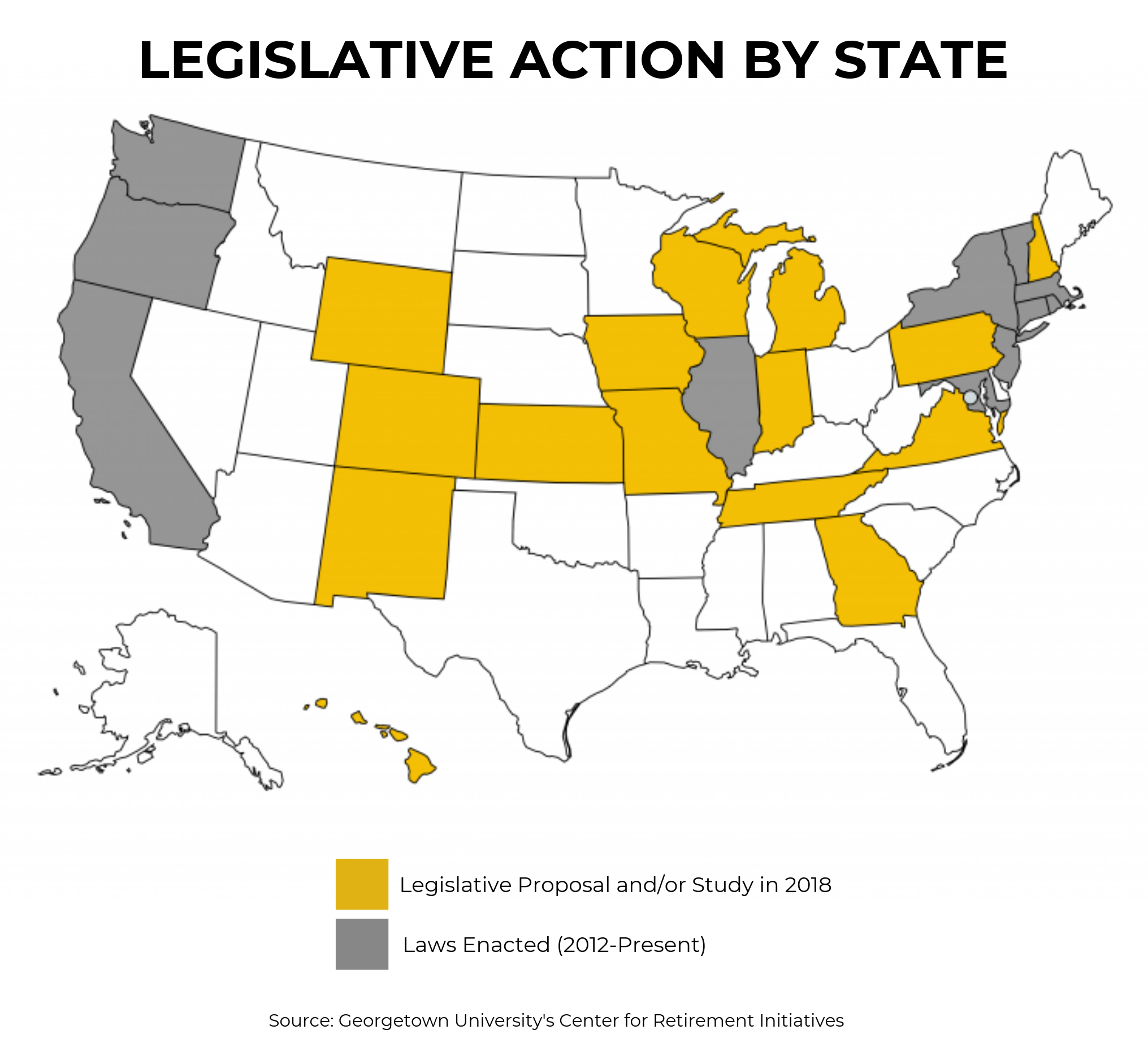

Ten states and the city of Seattle have enacted their own plans to help constituents save for the future. While each have different approaches and varied provisions, Colorado can look to these strategies for guidance on best practices, identify what works, and learn how to create plans that would best help Coloradans’ retirement security.

While their plans differ in some important ways, we should look at how each aim to achieve the goal of boosting retirement savings for those without access to plans, and see how Colorado can apply their best ideas to our approach.

That’s because an automatic system with an opt out, like Oregon’s approach, has been shown to be far more effective at helping people save for retirement. As of November 2018 and still in a pilot phase, over 44,000 people had enrolled in a retirement plan in Oregon. In 2019, the Oregon plan will officially be open to all employers and employees across the state.

While Washington isn’t as far along, its numbers have lagged Oregon considerably because of the voluntary nature of the program. Below are the important details on each of these plans and how both achieve key goals for expanding access to retirement savings. We compare the two plans on four key criteria: universal coverage, automatic enrollment, portability of the plans, and low fees. Additionally, we also show data on the number of workers currently served by each plan and the amount of retirement savings accumulated to date.

- Oregon is gradually rolling out OregonSaves, an automatic IRA plan for all private sector workers who don’t currently have access to one at work. Employers who don’t offer plans must enroll their workers in OregonSaves, and workers can opt out of the plan.

- Washington created a Small Business Retirement Marketplace, an online platform where employers with less than 100 employees and individuals can purchase low-cost retirement plans from participating vendors. Employers can voluntarily decide to purchase plans from the marketplace and employees who aren’t offered a plan at work can sign up voluntarily, too.

- Oregon offers a singular pool managed by a third-party professional investment advisor. In Washington, it’s set up as a marketplace where many financial service firms can offer different plans in a competitive environment. That leaves employers and employees to choose the best option from an array, similar to how the Affordable Care Act marketplace is set up.

- Importantly, Oregon’s plan offers portability for workers, meaning the plans follow the individual, no matter the job he or she has at the moment. Washington’s plans are set up by individual employers, meaning they’re tied to the job and not the worker. This leaves many workers tethered to a job to keep their plan — a big problem in a dynamic job economy.

- Similarly in both states, there is direction to keep administrative fees as low as possible, with Washington even waiving those fees for employers who use the marketplace.

OREGON vs WASHINGTON

A COMPARISON ON RETIREMENT SECURITY

Oregon’s plan covers all employees without a current workplace plan.

Washington’s plan covers employees only if their employer decides to purchase a plan from the marketplace.

Yes, there is automatic enrollment in Oregon’s plan, and employees can opt out. Washington’s plan doesn’t offer automatic enrollment.

In Oregon:

- All in, total fees are limited to 1.05 percent.

- Over time, they’re projected to be 0.30 percent to 0.50 percent.

In Washington:

- Total fees are capped at 1 percent.

In Oregon:

- Plans are portable among employers in Oregon who are covered by OregonSaves.

In Washington:

- The plans are set up by individual employers and aren’t portable. Individuals can purchase plans that could stay with them.

In Oregon: 44,000

In Washington: Unknown, but less than 1,000 visitors to the marketplace website moved on to the “Get Started” phase.

• According to a telephone interview with Rick Anderson, policy advisor and director at Washington Retirement Marketplace on December 13, 2018, as well as a presentation by Anderson to Wyoming Retirement Task Force on October 19, 2018)

In Oregon: $10 million

In Washington: Unknown

In Oregon: $114

In Washington: Unknown

In Oregon: 5.2%

In Washington: Unknown

In Oregon: All start-up and operating costs will be paid by those enrolled in the plan.

In Washington: $250,000 per year