Mayor Hancock Launches Consumer Financial Protection Initiative to Fight Predatory Economy

Last week, the Bell Policy Center along with the City of Denver’s Office of Financial Empowerment hosted an increasingly relevant conversation on the predatory economy. The keynote delivered by Jonathan Mintz, founding president and CEO of the Cities for Financial Empowerment Fund (CFE Fund), zeroed in on the importance of consumer protections, as well as government’s responsibility to protect citizens and enforce rules. In fact, Mintz pointed out 25 percent of U.S. consumers are so behind on debt, they have at least one in collections, while 65 million U.S. citizens operate under a predatory economy.

But what happens if the government isn’t doing its part? That’s the current climate at the federal level. We’ve seen regulations rolled back at the Consumer Financial Protection Bureau (CFPB) and the Department of Education in recent weeks, giving rise to predatory practices that hurt families in Colorado and across the country.

Denver’s Consumer Financial Protection Initiative: “When They Go Low, We Go Local”

That’s why the time is ripe for states and cities step in. Denver Mayor Michael Hancock announced the new Consumer Financial Protection Initiative aimed at protecting Denver residents from predatory financial practices. One of the initiative’s specific focuses — elder financial abuse — is particularly important as Colorado continues to get older, as illustrated in our recent Guide to Economic Mobility. Other areas of focus include wage theft, predatory lending, and predatory housing practices. The new division, which will work in collaboration with ongoing efforts at the city, state, and federal levels, as well as with area nonprofits.

In partnership with Mintz’s CFE Fund and the W.K. Kellogg Foundation, Denver is just one of four cities creating this type of consumer protection entity. As Mayor Hancock put it: “We are ramping up efforts to help residents know their rights, understand their choices as consumers, and achieve economic mobility for all. This new entity is a big step toward the comprehensive system we need to find relief for our residents.” The Bell Policy Center, along with members of the Financial Equity Coalition, will continue to be a part of that mission as Denver seeks to curb predatory practices at the local level with the Consumer Financial Protection Initiative.

Crossing Party, Agency Lines to Fight the Predatory Economy

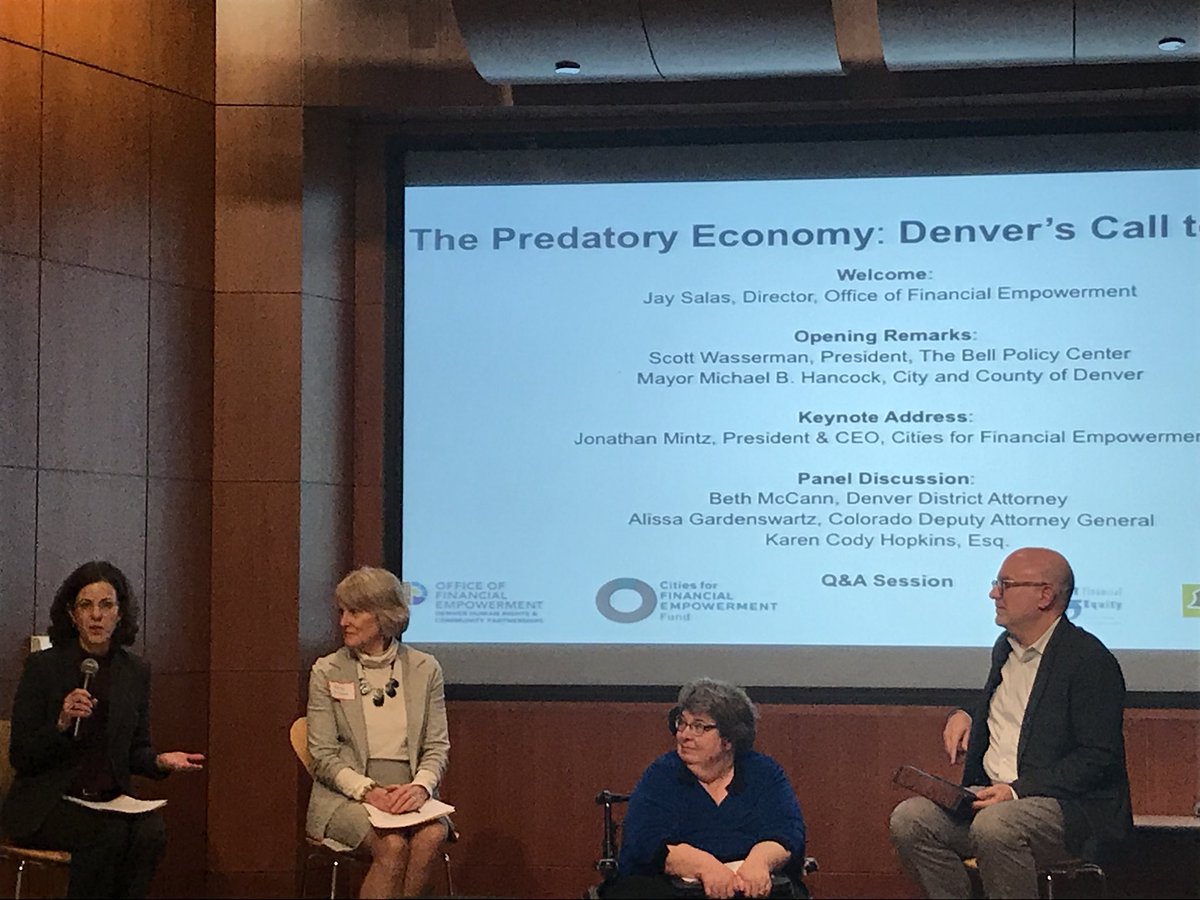

The event’s panel discussion with Denver District Attorney Beth McCann, Colorado Deputy Attorney General Alissa Gardenswartz, and attorney and student debt expert Karen Cody-Hopkins drove home the importance of many of the Bell’s core issues. From rising student debt and consumer fraud scams, to payday lenders and the need for financial literacy, the panelists hit a variety of ways Coloradans are hurt by a predatory economy. As Deputy AG Gardenswartz put it, “We all need to work together to make sure we’re protecting consumers. That crosses party lines, that crosses agency lines.”

The event’s panel discussion with Denver District Attorney Beth McCann, Colorado Deputy Attorney General Alissa Gardenswartz, and attorney and student debt expert Karen Cody-Hopkins drove home the importance of many of the Bell’s core issues. From rising student debt and consumer fraud scams, to payday lenders and the need for financial literacy, the panelists hit a variety of ways Coloradans are hurt by a predatory economy. As Deputy AG Gardenswartz put it, “We all need to work together to make sure we’re protecting consumers. That crosses party lines, that crosses agency lines.”

That’s exactly why the Bell’s work with the Financial Equity Coalition is needed now more than ever. A diverse group of private, public, and nonprofit groups committed to bringing financial security to communities throughout Colorado, the FEC is uniquely able to help Colorado leaders cross those lines to protect consumers in the state. FEC members boast diverse work and perspectives that can inform and craft future change as Colorado fights the predatory economy.

Although Colorado is no stranger to being on the forefront of innovation, this event marked a key moment for our state as a trailblazer on consumer issues. While recent changes in federal policy do little to protect consumers, the collaboration of Colorado elected officials, organizations and businesses, local agencies, and funders makes it clear Colorado will pick up the slack and help ensure economic mobility for every Coloradan.

As Jay Salas, director of Denver’s Office of Financial Empowerment, said when closing out the event, “The work starts tomorrow.” For the Bell and the Financial Equity Coalition, the work has already begun. We’re excited to see what we can accomplish together.

To see what we’ve done already and keep up with what we’re doing, be sure to follow the Bell and the FEC on social media and sign up for email updates.