Tax Bill Mismatched to Our Economic Needs

A simple theory proposed by French economist Thomas Piketty — r > g — suggests returns on property, capital, and investments (r) will always yield more return than the economic growth most people benefit from through their labor (g).

In his acclaimed book, Capital in the Twenty-First Century, Piketty says this dynamic is what’s fueling the massive gap that has opened up between the very rich and everyone else. In his work, he argues progressive tax policies can equalize this equation.

The tax bill being approved by Congress this week seems like it was designed by people who read Piketty and sought to do everything in their power to throw all their weight on the “r” side of the equation and leave the “g” side in the dust.

From the Colorado perspective, a few things are clear about this tax bill:

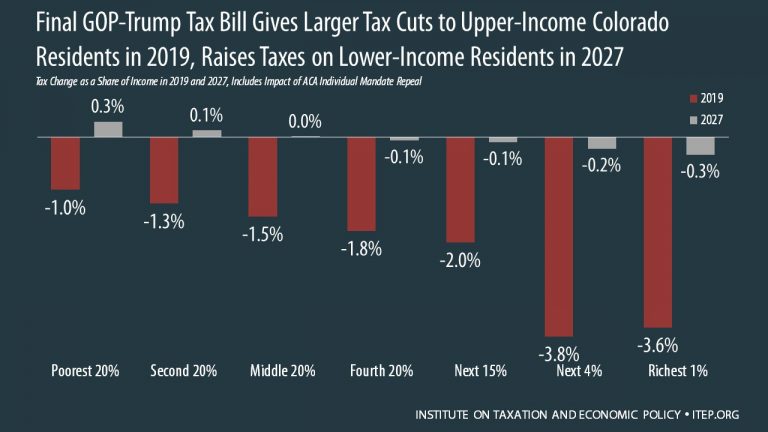

- In 2019, Colorado’s low- and middle-income taxpayers will see minimal tax cuts in their federal income tax. Those making up to $263,000 per year will see less than a 2 percent cut or less. According to IETP, those making above that amount will see cuts closer to 4 percent. Fifty-one percent of the tax relief in this bill will benefit only the top 5 percent of Coloradans.

- In 2027, the lowest 40 percent of Coloradans will see their taxes go up, whereas the top 40 percent will continue to get tax cuts.

- State taxes will likely go up for middle-income taxpayers in Colorado. Because Colorado ties our taxable income to adjusted federal taxable income and many of commonly claimed deductions will be eliminated, the tax base that Coloradans pay tax on will actually go up.

Much of the disparity between the tax impact on the bottom 40 percent and the impact on the top 40 percent is driven by how these groups make their money. Those who already have their paycheck working for them will see greater rewards and those rewards will be more permanent. Those who make their money from a simple, hard-earned paycheck will be left praying for signs of the mythical trickle-down effect used to justify this bill.

It’s not that there aren’t some positive things in this bill for working families; it’s that so much of the benefit is handed to those who need relief the least. What makes this bill so egregious is that it’s exactly the opposite of what our increasingly unequal economy needs rights now. Knowing what you know about the failings of our economic recovery, if you’re going to spend up to $2 trillion to improve our situation, is this how you would spend it?

The only thing worse than this bill is how Congress is likely to pay for it. We’ve already heard murmurs about plans to slash the economic security supports so many low- and middle-income Americans rely upon, like Medicare and Social Security. For Colorado, we’re already faced with dysfunctional tax policies that have starved major priorities like education and roads, but now we will have a fundamental choice to make: Will Colorado continue to stick with the same ideology that spawned TABOR and this tax plan, or will we finally decide we want to pursue progressive tax policies that ensure economic mobility for every Coloradan?