Questions and Answers On Proposition HH

Is Proposition HH a Tax Increase?

No. First and foremost, nothing in Proposition HH raises tax rates.

Some suggest that because Proposition HH will allow the state “to keep” additional revenue above the current spending limit, it constitutes an “income tax increase.”

For example, a recent report by the right-leaning Common Sense Institute claims “state taxes will increase by $42.38 billion through 2040.” This is false. The revenue over the Referendum C cap will decrease — as it has in the past with prior voter approval — but the amount of income taxed will not. This distinction is very important. For some of Colorado’s most hardline TABOR activists, this constitutes a tax increase. For many other Coloradans this distinction is subject to debate and perspective.

While Coloradans have recently seen very large TABOR rebate checks, dollars above the Ref C cap – known as the “TABOR surplus” – are not guaranteed to come back to Colorado taxpayers in any specific form. The amounts fluctuate greatly with economic conditions. The legislature is able to direct those surplus dollars as they see fit, with important guardrails. In fact, especially in the first year after Proposition HH, TABOR rebates would be flat and benefit 62 percent of taxpayers in the state.

CSI’s predictions for revenue changes through 2032, let alone 2040, rely on specious modeling of global macroeconomic conditions and the housing market in Colorado. Any long-term macroeconomic prediction contains error margins that will swamp any signal contained in the projection, rendering the information close to useless. Modeling conditions out to 2040 (as opposed to 2032, when Proposition HH’s provisions sunset) is only used for political manipulation. That date is arbitrarily chosen to create a far larger number to mislead voters.

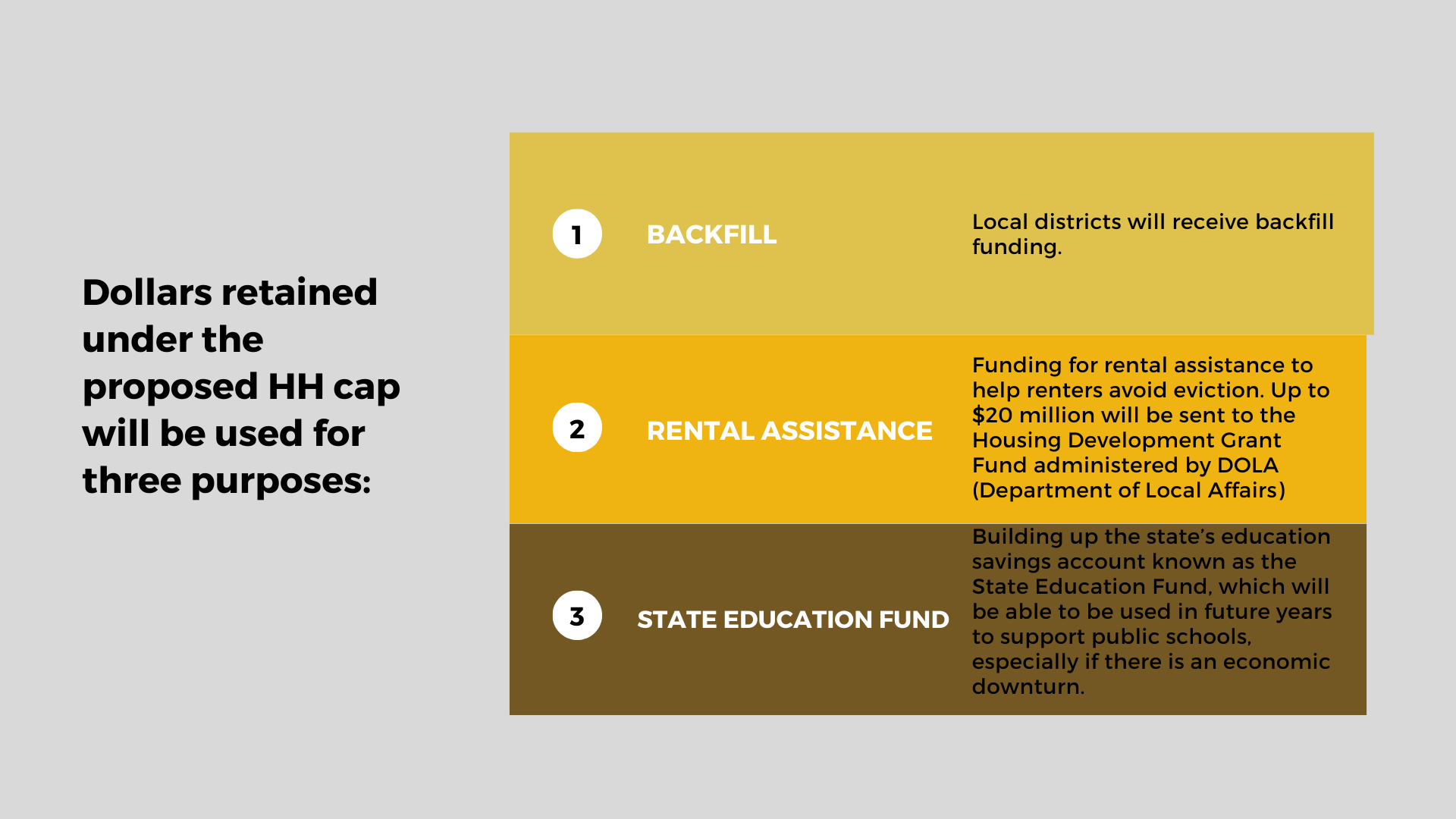

Proposition HH creates a new spending limit and allows the state to use 1 percent of the previous year’s spending. Where is that money going?

What does Proposition HH mean for school districts across the state?

There is no way to separate the needs of schools from a discussion about property taxes. Fifty-two percent of property taxes throughout Colorado go to fund local schools. For years, leaders around the state and in our state capitol have talked about how to slowly increase the local share in residential heavy school districts to relieve the pressure on our state budget. This is, in part, why Gallagher was repealed by voters in 2020.

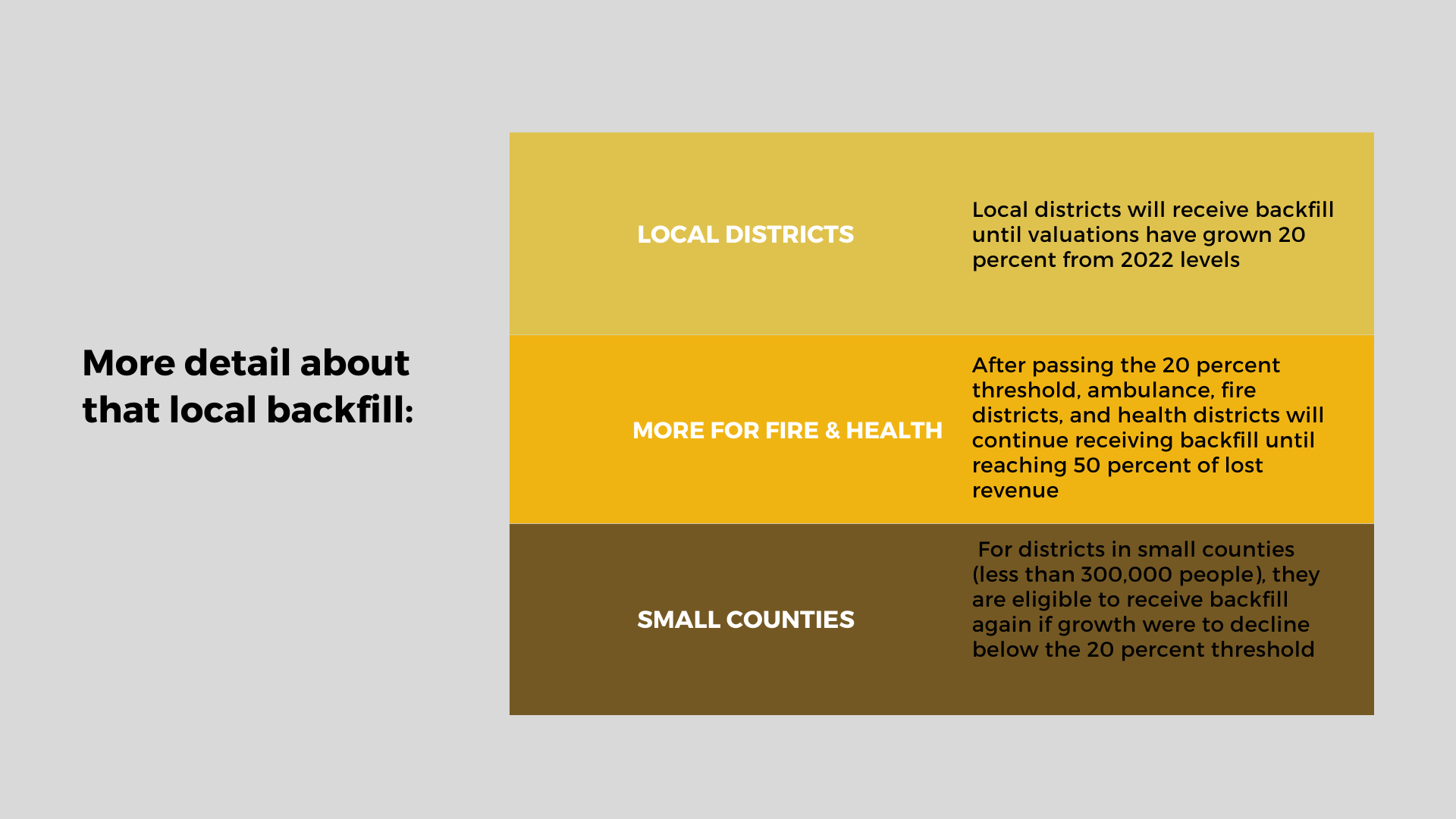

Proposition HH meets the needs of our schools in two ways. Because any reduction in property tax revenues also reduces the “local share” component of school funding, HH increases the state share to compensate local school districts for the loss in revenue.

To raise that state share, Proposition HH asks voters to approve 1 percent of the state’s total spending and allocate it toward local district backfill and into the state’s State Education Fund.

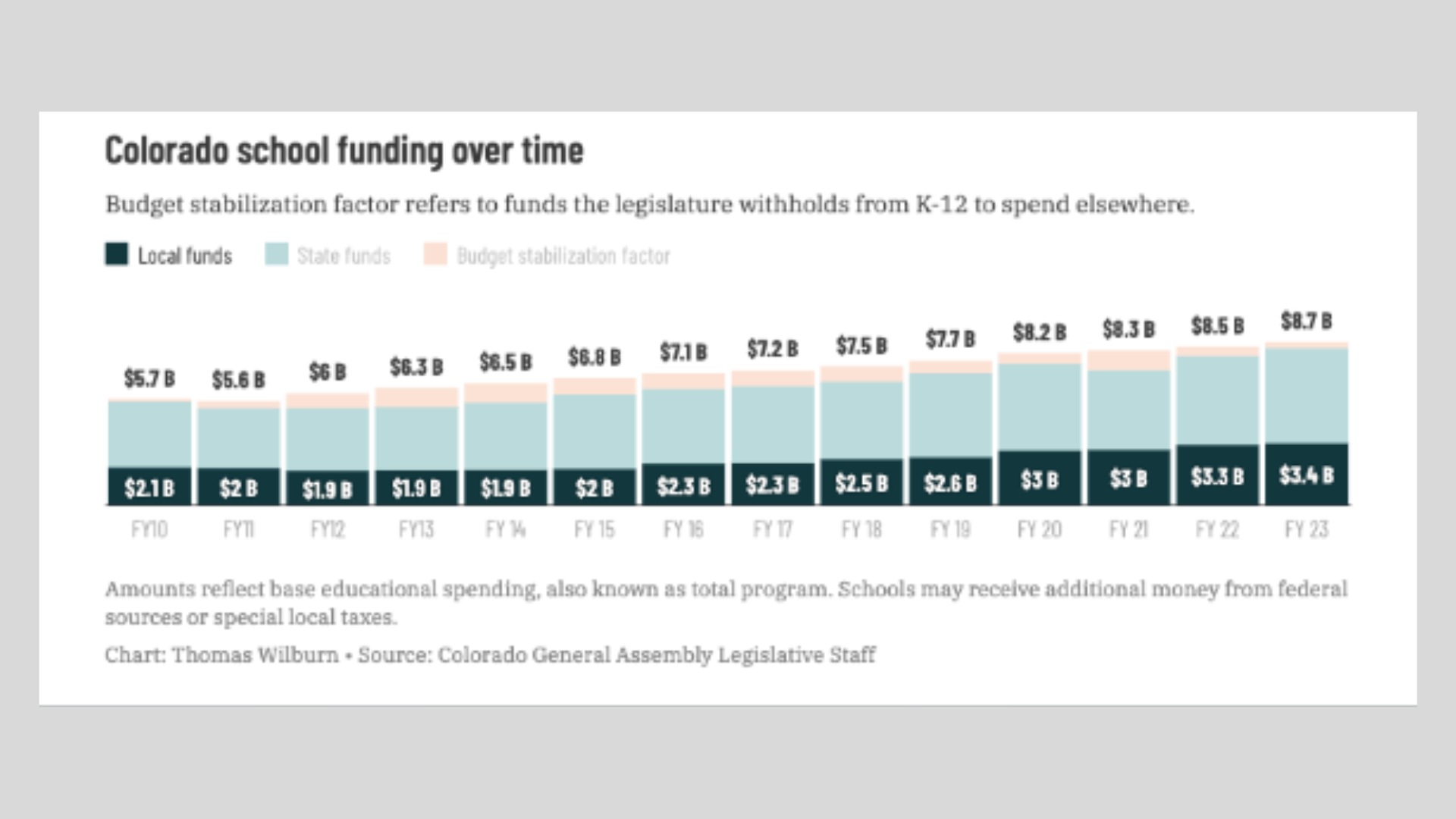

This amount grows over time because the starting balance owed to our public schools is key to understanding the equation. Colorado owes its schools a cumulative $10 billion in IOUs to pay back the money siphoned away from education via the Budget Stabilization Factor (BS Factor). Catching up with this accumulated debt to our schools is considered the floor of adequate school funding, simply catching up to the promise voters made when they passed Amendment 23. The additional revenue for schools under Proposition HH will help Colorado students catch up with their peers across the country. The $2,246 in additional per-pupil funding by 2032, cited by the authors, would still find Colorado in the middle of the pack nationally.

What does this mean for businesses?

For nearly 30 years, residential property owners’ property taxes were artificially reduced under the Gallagher Amendment. Colorado Voters repealed it for two reasons. First, communities nearly completely reliant on residential property tax desperately needed new revenue for fire, safety, and schools. Second, commercial property taxes were artificially increased by absorbing the increase in property values across our state.

By gradually stepping down commercial assessment rates and using TABOR surplus dollars, we can fill the hole left behind when we reduce commercial property tax.

Aren’t there other ways to do this?

There are definitely different ways to meet the moment we’re in. Proposition HH is one of a few different responsible solutions to a big challenge for our state. Unfortunately, superficially simple, yet dangerous, approaches are out there. Initiative 50, on its path to the 2024 ballot, is an example of a hard, irrational, and impractical cap on property taxes that would not only defund communities but put local community decisions in the hands of voters from very different regions in Colorado. Simple hard caps have devastated local funding in states like California. There, Proposition 13, passed in 1978, perverted real estate markets and put nearly all funding on the state, as opposed to the local community. This is why we are urging Coloradans to say no to dangerous measures like Initiative 50.