Real Wages in Colorado

Real Wages in Colorado

Report after report have informed us about the effects of persistently high inflation, and they are factually accurate. But what really matters to most Colorado households is how far their wages now go for monthly expenses – their real wages. Real wages are an important indicator of the health of the economy as well as the households that make up that economy. Real wages represent your actual take-home pay. That is, how much your wages are worth after inflation has been factored in. If everything costs (on average) 5 percent more with inflation, then each dollar of your paycheck (if it remains unchanged) is worth 5 cents less. At the same time, if your employer offers a 3 percent raise this year, you’d still be making less in real terms than you did a year ago. That’s because, with inflation factored in, your purchasing power would be 2 percent less lower compared to last year.

Due to a labor shortage and inflationary pressures, many employers have been forced to raise wages over the last year. However, these wages have kept pace with inflation rather than outpacing it. This is in keeping with historic trends. Wage changes have generally tracked with the inflationary environment. While inflation remained low in the past four decades, so did wage gains. Real wages for most workers in the United States have barely budged in decades. This trend has been particularly pronounced for low earners, who have seen their wages stagnate or even decline in real terms.

In March 2023, inflation in Colorado was measured at 5.7 percent. While this is a decline from the peak of 9.1 percent in March 2022, inflation remains persistently high. Notably, even though real wages increased for some workers, purchasing power for all items may not have kept up with the rising cost of goods and services. For example, the cost of groceries rose 10 percent annually. This is especially troublesome for low-income earners who spend proportionally more on basic goods and services, like groceries.

In Colorado, real wages have actually decreased across most income levels. For those earning the average hourly wage of $35.21 in March 2023, these workers saw a decrease of 1.14 percent over the previous year. Those making the median wage in Colorado, which was $25.22 per hour in 2023, saw a real wage decrease of 1.3% over the previous year. This decrease is slightly lower than the average decrease across all income levels in the state, indicating that wage growth is still somewhat unevenly distributed. Mean, or average, wages are likely pulled up by larger gains in wages seen by higher income groups compared to the median, or middle.

Real wage decreases have not been uniform across all income groups. Low- and high-wage workers saw slight increases, but these were not sufficient to raise the average real wage. Coloradans working in business and professional services, who make on average about $90,000 per year, experienced an average increase of 2.25 percent. Meanwhile, low earners, those making less than $25,000 a year, have seen only a minimal increase in real wages, with an average increase of 0.5 percent. Even those earning the minimum wage in Denver have seen real wage increases. Nonetheless, researchers contend that this still falls behind a living wage.

Real wages also diverged across regions of the state, industries, and demographic groups. Over the last year, real wages grew in Denver, Fort Collins, and Colorado Springs while decreasing in Boulder, Pueblo, and Greeley. This trend is particularly troubling in Greeley, where real wages fell most due to increasing price pressures in Weld County.

Further, wage gains were highest for the leisure and hospitality sector, two sectors that are disproportionately comprised of women and Coloradans of color. Conversely, wage gains were lowest for construction and education providers. Workers over 55 dealt with the lowest wage gains of all groups.

While fields that disproportionately employ women and Coloradans from communities of color are seeing wage gains, they are at a different starting point. Keeping with national trends, women and communities of color in Colorado make less for the same work than their white, male counterparts. Real wage gains do not begin from the same point nor reach the same end. This is important to keep in mind as we consider the effects of real wages and inflationary pressures on economic mobility. For example, Latinos in Colorado make .68 cents to the same $1 of work of a white, male counterpart.

Cost Pressures

Day to day, families starting in these different places have to budget for inflationary pressures. Last year, the Bell looked at the living wage in Colorado and the change in monthly expenses from 2021 to 2022. Using the same formula and categories of essential goods and services, we’ve updated these expenses for 2023. A clear uptick in prices is reflected across major metro areas. With real wages decreasing, these price conditions can force households to make difficult decisions, such as taking on additional jobs or foregoing essential services. This is especially true for lower-income households, which spend proportionally more of their income on basic goods and services and have seen a decrease in their real wages.

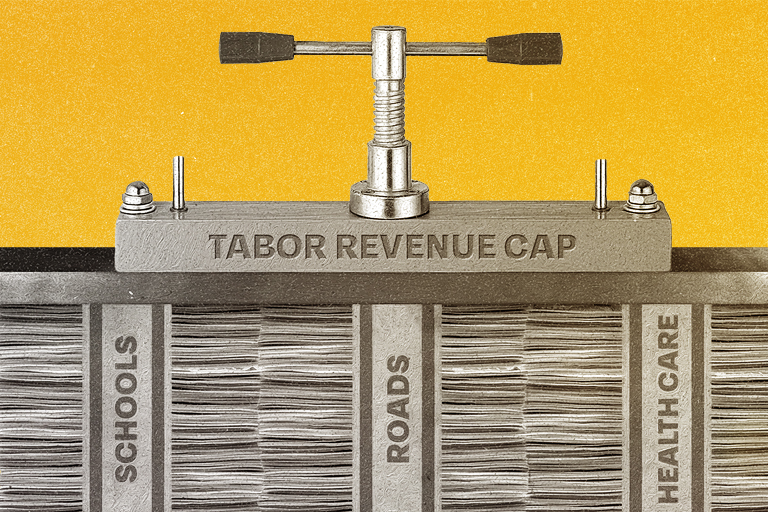

Real wage trends in Colorado in 2023 show that while there has been a modest increase in real wages at the lower and higher ends of the income spectrum, the average worker saw a decrease in their real wage. To address income inequality and ensure that all Coloradans can benefit from the state’s economic growth, wage increases are still necessary for most workers just to keep pace with inflation. The state can do very little to reduce inflationary pressures but can ensure public wages keep up with inflation, particularly for those who need relief most. Further, the legislature can assist working families through relief programs. Flat TABOR rebates, which were approved by lawmakers but are tied to the passage of a property tax relief bill, also could help lower-income households compensate for inflationary pressures, although the effect would be small.