Universal Portable Benefits State Scan

Employer-based benefits are failing to keep pace with today’s changing economy. From the growing impact of automation — a force that puts more than 1 million Colorado jobs at risk — to the rising number of non-traditional employees, there’s little security in how today’s workers access even basic benefits like health care and retirement savings. Simultaneously, slow and inconsistent wage growth is stretching budgets and making families increasingly reliant upon dual incomes.

Yet, workplace benefits systems haven’t adapted to this reality. These collective inadequacies have real consequences, as limited or no access to the essential building blocks of economic security, like health care and paid family and medical leave, makes it more difficult for workers and their families to get and stay ahead.

Recognizing the growing imperative for action, state policymakers are playing a key role in rebuilding fractured benefits systems by advancing new suites of universal portable benefits. Advantageous to both employees and employers, portable benefits offer critical supports which are cost effective, essential for economic mobility, and responsive to an evolving economy.

Colorado has begun exploring how to best update and improve its universal portable benefits system. As we progress, we can and should learn from the work in other states, both about the inherent challenges and opportunities. Below, we explore efforts to create universal portable benefits systems throughout the country, as well as new areas of potential growth.

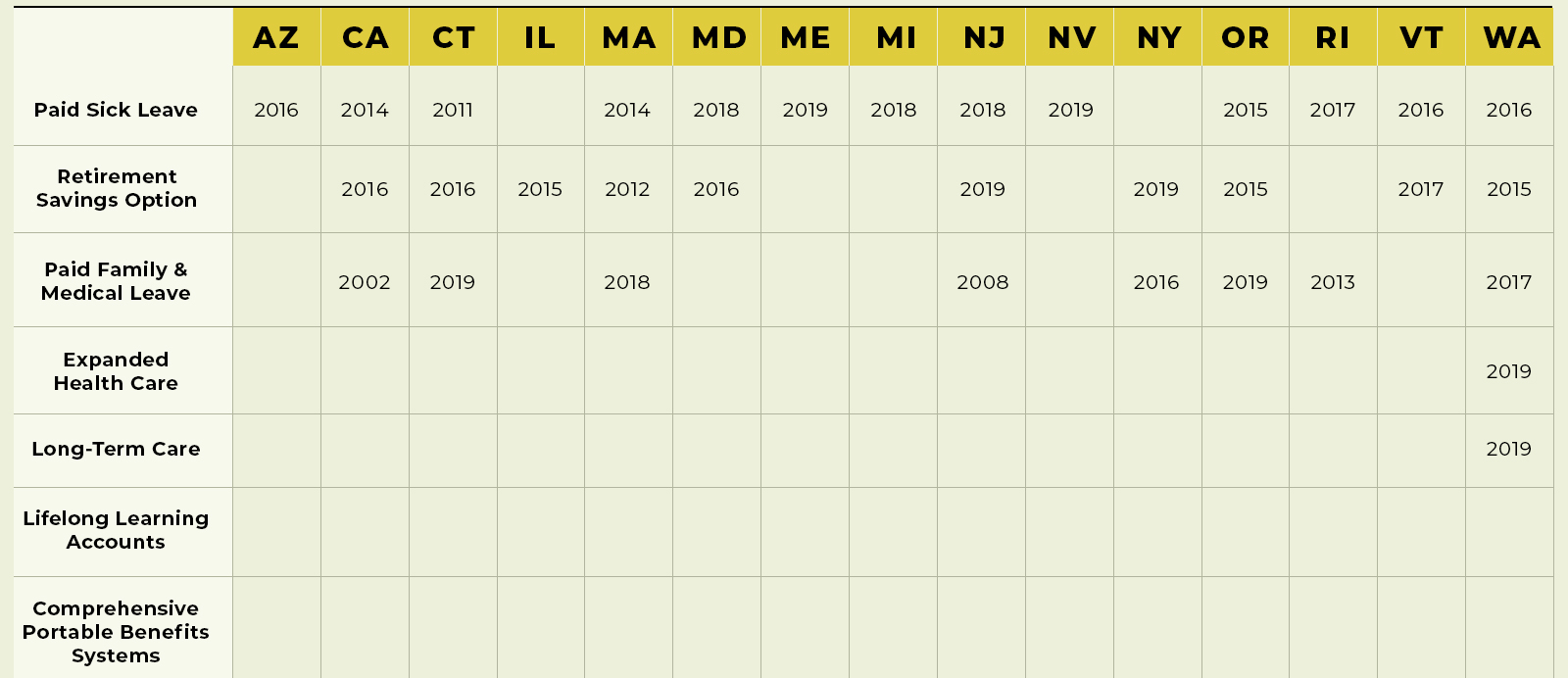

Summary of State Action on Universal Portable Benefits

Universal portable benefits aren’t a new concept. Whether it’s social security, health insurance made possible by the Affordable Care Act, or Medicare/Medicaid, many of us use universal portable benefits on a regular basis. In addition to bolstering existing (often federal) programs, states have been at the forefront of creating new benefits systems. Though gradual and piecemeal, momentum behind these efforts has picked up over the past several years. The chart below shows which states have successfully passed new portable benefits programs, and the year it was done.

While the above chart shows promise and strides toward innovative solutions, it also shows a great deal of work remains in creating a robust and comprehensive system of universal portable benefits. Not only have less than one-third of all states created any type of new benefit, but there has been little success in expanding beyond the most well-known programs despite the need for more expansive offerings, like lifelong learning accounts to help meet the demands of a changing workforce.

While the above chart shows promise and strides toward innovative solutions, it also shows a great deal of work remains in creating a robust and comprehensive system of universal portable benefits. Not only have less than one-third of all states created any type of new benefit, but there has been little success in expanding beyond the most well-known programs despite the need for more expansive offerings, like lifelong learning accounts to help meet the demands of a changing workforce.

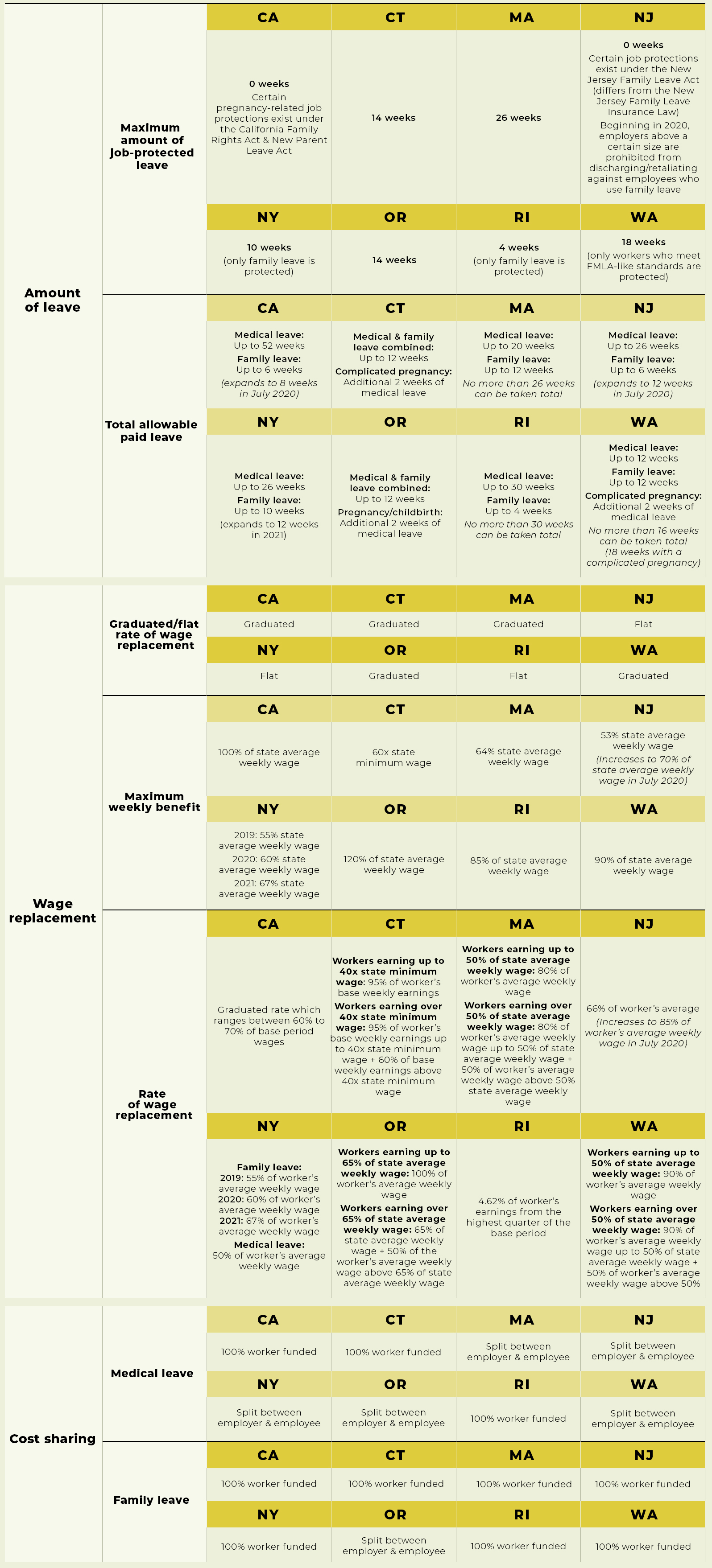

Paid family and medical leave is a cornerstone to any universal portable benefits system. Resulting in a host of benefits — greater workforce participation for new moms, increased worker productivity, and decreased nursing home usage for older adults — paid family and medical leave provides families protected, paid time off when major life events happen. Yet, despite its importance, only 17 percent of civilian workers have access to paid family and medical leave.

Though simple in concept, paid family and medical leave is one of the more complex universal portable benefits to set up and run. As a result, programs look different in each of the eight states where they’ve been passed. Three major differences center on:

- Amount of leave: States offer differing amounts of paid family and medical leave. Notably, differences exist based upon whether a worker is taking medical time off to care for their own personal needs or those of a loved one. Not only do some states limit how much time can be taken off for medical versus family leave, but also whether a worker’s job will be protected if he/she takes leave.

- Wage replacement: In every state with paid family and medical leave, workers receive only a portion of their wages while on leave. The total amount of wage replacement is dependent upon several factors. This includes policymakers’ decisions regarding whether to use a graduated versus flat rate of wage replacement (graduated wage replacement generally benefits low-wage workers by providing them with a greater share of their average weekly earnings), how high to set the maximum weekly payment amount, and the actual rate of wage replacement.

- Cost-sharing: Recognizing workers can’t shoulder the entire financial burden of a new paid family and medical leave program on their own, most programs split premium costs between employers and employees. Some states have specifically assigned cost-sharing responsibility based upon whether the premium covers medical or family time off.

Program differences from across the country are captured below.

More detailed information about each state’s plan can be found at A Better Balance

More detailed information about each state’s plan can be found at A Better Balance

State-based paid family and medical leave programs have evolved significantly since California first implemented its in 2002. Notably, momentum is shifting toward more comprehensive and worker-friendly plans like those passed in Washington, Massachusetts, and, more recently, Oregon. Learning from these newcomers, long-standing programs, like those in New Jersey and California, are updating existing benefits and protections to be more aligned with emerging standards.

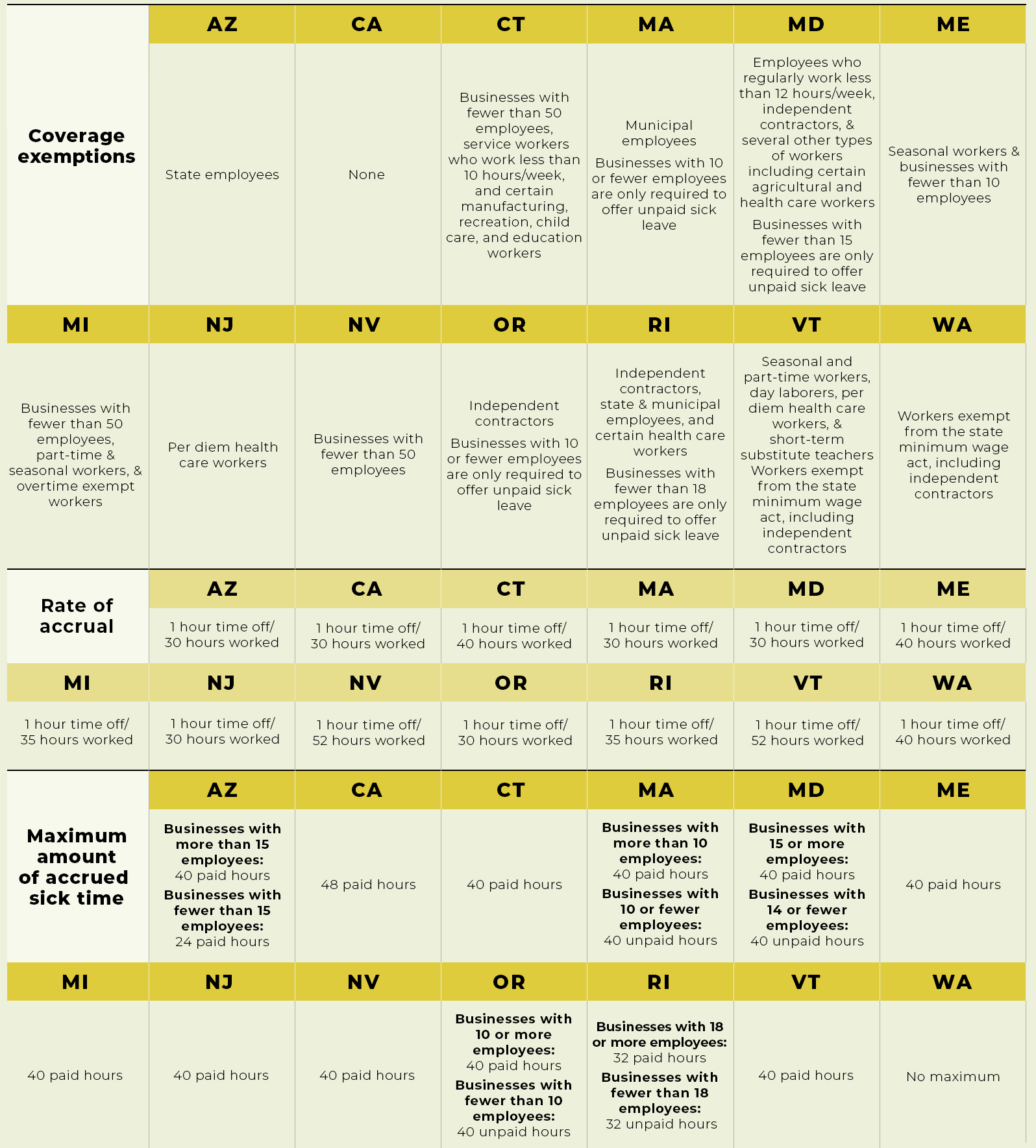

Job-protected and paid time off for when a worker or their loved one is sick has documented health and economic benefits which extend to both employees and employers. Yet it’s estimated one-third of all private sector employees, a disproportionate amount of whom are low-wage workers, have access to paid sick leave. To remedy this, a growing number of states have passed legislation requiring employers offer their workers paid sick time. Each of these programs differ slightly, in part based upon:

- Coverage exemptions: Most states exempt some workers in their paid sick leave legislation. These exemptions are often based upon worker classification or employer size.

- Rate of accrual: No state currently offers automatic paid sick leave to workers. Instead, leave is earned based upon number of hours worked. Rate of accrual refers to the number of hours an employee needs to work in order to earn one hour of paid sick leave.

- Maximum amount of accrued sick leave: Regardless of how many hours an employee works, states regulate how much paid sick leave a worker can accrue in a given year.

Differences in state paid sick leave policies are captured below.

More detailed information about each state’s plan can be found at A Better Balance.

More detailed information about each state’s plan can be found at A Better Balance.

The momentum to pass paid sick leave is growing. Since 2017, six states and several cities have passed new sick day legislation. Conversations about paid sick leave have even reached the national level with the Healthy Families Act. This act would provide up to seven job-protected paid sick days for those working in businesses with 15 or more employees, and up to seven job-protected unpaid sick days for those working for a business with fewer than 15 employees. This positive movement is good news for families, workplaces, and communities across the country.

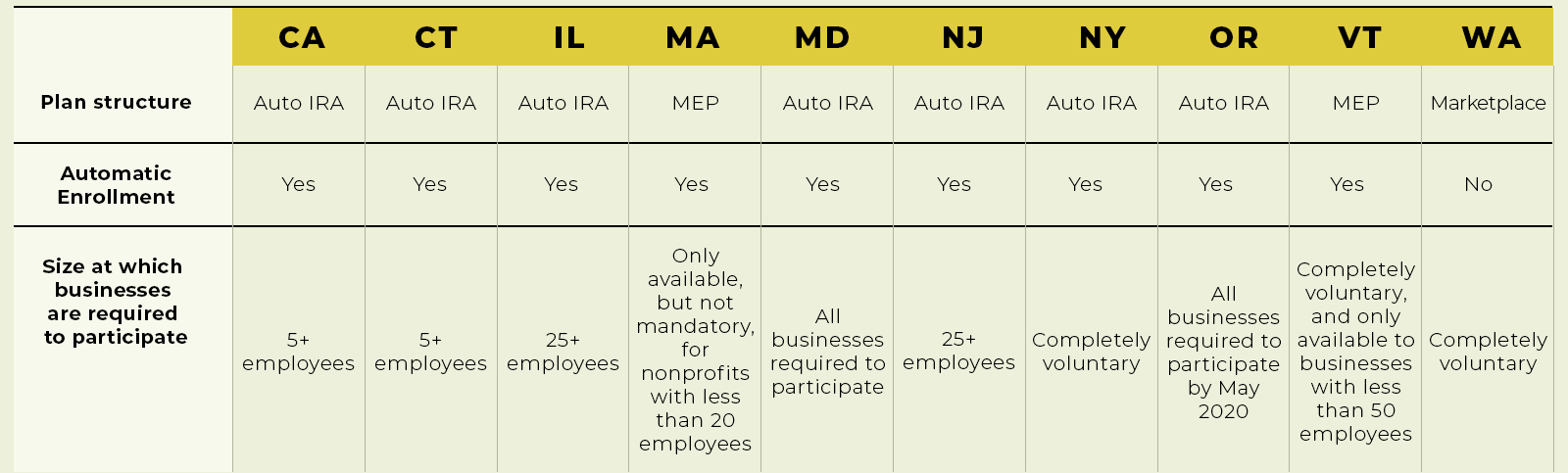

We are experiencing a retirement crisis that puts our collective financial security at risk. Without adequate retirement savings, individuals experience greater levels of financial insecurity in their later years, and as a result, are more likely to rely upon government assistance programs. The lack of easily accessible, workplace-based, portable retirement options fuels this problem. In Colorado alone, almost half of all private sector workers don’t have access to a retirement savings plan through their employer.

States are taking the lead in addressing this problem by creating their own, state-sponsored, portable, retirement option for workers who don’t have an employer-based way to save for the future. States have considered the following factors when building their plans:

- Plan structure: When designing their plans, states have used one of the following three models to help workers save.

- Automatic IRA (Auto-IRA) model: This option allows automatic payroll deductions to be placed into a worker’s individual IRA. Private financial management agencies are chosen by the state to manage these accounts. Due to current federal law, these plans do not permit employer contributions.

- Marketplace model: Similar to the Affordable Care Act’s health care exchange, marketplace options allow participating businesses to shop state-vetted retirement plans and providers and choose the one that works best for their needs.

- Multiple employer plan (MEP) model: MEPs allow small businesses and nonprofits to offer their employees a state-sponsored 401(k) plan. By aggregating the accounts of participating employers, plan overhead and administrative costs are reduced. This option allows employers to contribute to worker savings accounts.

- Automatic enrollment: Research shows workers are more likely to put money into a retirement fund if they are automatically enrolled in a plan. As a result, most states automatically enroll workers and deduct a set amount of money from their paycheck. Importantly however, workers can opt-out and change deduction amounts.

- Size at which businesses are required to participate: Though mandatory for most employers, some states don’t require small businesses to enroll their workers in the state-sponsored retirement plan. Several states with exemptions, however, have created incentives to encourage small business participation.

The chart below captures the different ways policymakers across the country are setting up state-sponsored retirement plans to help workers save for the future.

A growing alternative and contingent workforce coupled with the fact the average person remains at his/her job for just over four years means the way we help workers save for the future needs an update. State sponsored savings plans offer a unique and cost-effective way to meet this need. Though they’ve only been in place for several years, plans in other states are already seeing success, and present an opportunity for others to learn from and model after.

A growing alternative and contingent workforce coupled with the fact the average person remains at his/her job for just over four years means the way we help workers save for the future needs an update. State sponsored savings plans offer a unique and cost-effective way to meet this need. Though they’ve only been in place for several years, plans in other states are already seeing success, and present an opportunity for others to learn from and model after.

As one of the largest pieces of a family’s budget, the high cost of health care is a major obstacle to achieving economic security. Though we often associate affordability challenges with the lack of an employer-sponsored plan, the skyrocketing expense is a universal problem. This is evident by findings the fastest growing group of underinsured individuals are those with employer-sponsored health coverage. Without affordable, quality care, not only are workers skimping on necessary medical services, but also on other essentials for long-term financial security, like retirement savings.

While the Affordable Care Act (ACA) made some progress toward expanding health care access, challenges remain. States have the ability to develop innovative, tailored solutions to address those continuing problems, which could involve universal portable benefits that:

- Strengthen existing ACA provisions: By creating a health care exchange and providing subsidies to individuals without employer-sponsored coverage, the ACA was meant to help decouple health insurance from employment. However, as with any complex issue, all health care problems weren’t solved with the ACA’s passage, as seen through the growing number of underinsured individuals. States can supplement existing provisions in the ACA to help address remaining problems, which might involve providing subsidies to those over 400 percent of the federal poverty line or those in the family glitch.

- Create a public option: A public option is a health insurance plan operated by the state or federal government that individuals and families can purchase into. It’s thought by using existing state infrastructure — in Colorado this could include Connect for Health Colorado, the state employee plan, or the Medicaid system — and providing a health insurance option outside the private market, overall health care affordability, competition, and access will increase. While several states are studying the issue, Washington is the first to successfully pass a bill creating a new public option. As other states have examined whether and how to create a public option, they’ve had to consider what existing state infrastructure to use, whether the state or a contracted health insurance company will administer the public plan, whether all residents will be eligible to buy into the option, and if the state should set provider rates for the plan.

- Develop a single-payer system: A single-payer health system would replace the multitude of private health insurance providers with a single insurance option available to all individuals. This idea is often discussed nationally by advocates like Sen. Bernie Sanders (D-VT), but also at the state level, as seen in Colorado’s Amendment 69 — a failed attempt to create a new universal health care system in the state. Though often touted as a needed overhaul that would guarantee health coverage for everyone, large questions remain about a single-payer system’s cost and its impacts on access to care.

Unfortunately, our ability to get affordable health coverage is still all too dependent on who we work for. Without a quality employer-sponsored plan, too many of us struggle to get the care we need. A universal portable benefit which focuses on worker health care needs offers a unique way to address this issue. With the ability to tailor benefits to state-specific needs and resources, policymakers who prioritize this work can make progress in ensuring workers and their families have a solid foundation which enables future success.

A vital, but often forgotten part of health care centers on the supports needed as we age. These supports, which can include everything from bathing and dressing to services provided in nursing facilities, are holistically referred to as long-term care. Though essential for ensuring healthy aging, too often these services aren’t covered by private insurance, and are far too expensive for individuals who need to pay for them out of pocket.

Physical and financial hurdles grow when we don’t have access to the long-term care we need. However, more than just a problem for individuals and families, when older adults can’t afford long-term care, financial responsibility for these services is often passed to the state’s Medicaid program. This reality is behind a projected $450 million yearly gap between Colorado’s long-term care revenue and expenses. States across the country face similar challenges, so some have begun considering how to make long-term care a universal portable benefit. To do so could include creating:

- New social insurance programs: In 2019, Washington State became the first in the country to create a new state-based long-term care social insurance program. Available to all individuals who pay into the system, each Washingtonian will be able to access up to $36,500 in long-term care services. Funded through a required payroll fee, advocates project the plan will save the state’s Medicaid program close to $4 billion by 2052.

- Long-term care insurance marketplaces: Though not yet debated by any state legislature, there has been some consideration given to developing state-based long-term care insurance marketplaces, similar to those created by the Affordable Care Act. If developed, these marketplaces would provide a one-stop shop of state-vetted long-term care insurance offerings. As a universal portable benefit, states could consider offering individuals subsidies to purchase insurance.

As our communities age, how we pay for long-term care is a growing concern across the country. Too expensive for many families to afford on their own, our growing reliance on the Medicaid system for these services stretches state budgets. A new universal portable long-term care benefit can help address some of these affordability challenges, both for individuals and the state, and give older adults the financial security they need to age in a way they find meaningful.

Automation and technology increasingly necessitate continued worker reskilling and retraining. Research shows when workers have access to these opportunities, they’re more likely to find better paying jobs. Creating lifelong learning accounts —individual education accounts people can use throughout their lives to pay for additional training opportunities — is a practical way to help workers continuously build the skills they need to succeed in a changing economy.

Though the concept of and need for lifelong learning accounts isn’t new, their widespread implementation is relatively unexplored. However, as discovered by programs piloted throughout the country, policymakers should consider the following factors when developing a new lifelong learning account benefit:

- Who contributes: Lifelong learning accounts can’t be solely funded by workers. Doing so disproportionately benefits high-income earners with more disposable income, a result we’ve seen played out with health savings accounts. Instead, lifelong learning accounts should be at least jointly funded by employees and employers — and possibly the state government. Contribution structures could vary, but programs would benefit from setting a matching rate, where employers and/or the government matches at least a percentage of the employee’s contribution.

- Maximum contribution limits: Maximum contribution limits dictate how much workers, employers, and the government can put into a lifelong learning account. Contribution limit considerations are important for several reasons. First, though states have discretion over how lifelong learning accounts will or won’t be taxed, in order to increase participation these accounts are generally conceived of as tax exempt. If tax exempt, then contribution limits that are too high could have noticeable impacts on the state budget. However, if contribution limits are too low and don’t cover a significant portion of a training’s cost, lifelong learning accounts are less likely to be used.

- Qualifying education opportunities: Lifelong learning accounts could be used to fund any number of education opportunities. However, in order to maximize their value, policymakers may want to consider incentivizing or requiring their use on trainings which build credentials for positions which are expected to grow in the coming years. Simultaneously, accounts should only be used to pay for trainings provided by credible, non-predatory institutions.

While no state has successfully developed a sustainable, universal, lifelong learning account program, demonstration and voluntary projects have been supported through the Ford Foundation, and in Maine, Illinois, Washington, and Indiana. By gleaning lessons from these pilots, states can move forward in addressing the growing imperative to support our workforce’s evolving education and training needs.

Universal portable benefit efforts have been piecemeal. States are recognizing their workforce’s emerging needs and cobbling together programs one a time. Clearly, any movement to create quality and equitable benefits should be celebrated as a success. However, there has been increasing thought given to developing new, holistic, interconnected, universal portable benefits systems.

These systems would entail pooling together and offering employees a range of benefits, from paid family and medical leave and health care to less prevalently discussed supports like child care. In theory, doing so would create a system that allows workers to tailor benefits to their own unique needs.

The idea of a comprehensive universal portable benefits system is gaining traction in some states, including Washington, New Jersey, and New York. Washington’s most recent legislative effort in 2019 would have:

- Only applied to “intermediary employees,” a category inclusive of non-traditional and contract workers

- Created a new universal portable benefits system for these workers, funded by employers

- Placed funds into accounts managed by “benefit providers.” Providers would’ve been required to offer a core set of benefits, like health insurance, retirement, and paid time off. In addition to these standard benefits, providers would’ve also been able to offer others, like tax or emergency loan assistance. Workers would’ve been allowed to choose the benefit provider that best meet their needs.

Beyond mechanical similarities, recent legislative efforts to create comprehensive universal portable benefits systems share two important qualities: they have all failed, and they would have only applied to non-traditional workers.

Though innovative, it’s important to remember challenges exist in designing the comprehensive benefits systems described above. To be effective and accessible, employer contributions must be substantial enough to cover a meaningful portion of benefit costs. Additionally, new systems must be paired with worker protections which allow for the use of these benefits. For example, systems which provide funding for paid family and medical must also include job protection for workers who take this benefit.

While efforts to create comprehensive universal portable benefits systems in the United States are fairly new, other countries have had well-functioning systems in place for decades. This includes Denmark’s Flexicurity. Designed to meet the needs of both employers and employees, Flexicurity provides workers with a comprehensive list of supports, including additional skills training and subsidies to those who find themselves between jobs. Among other benefits, the state also ensures access to health care and a pension system.

Progress on Universal Portable Benefits in Colorado

Though other states are farther along in advancing universal portable benefits, Colorado has made some progress over the past several years in developing its own programs. This has involved efforts to implement and support:

Paid family and medical leave: In 2019, Colorado’s legislature passed a bill creating a task force to study the development and implementation of a paid family and medical leave program. The task force will spend the fall of 2019 studying the issue and release a public report with final recommendations in early January 2020.

Retirement savings option: Similar to paid family and medical leave, in 2019, the state legislature passed a bill creating the Colorado Secure Savings Plan Board. This board is tasked with examining several options regarding how the state can best help workers save for retirement. One option the board will study involves creating a Colorado Secure Savings Plan, which would automatically enroll workers into a workplace IRA. The board will release its findings in January 2020.

Expanded health care: In 2019, Colorado’s legislature passed a bill requiring the state’s Division of Insurance (DOI) and Department of Health Care Policy and Financing (HCPF) to study and develop a public health care option. DOI and HICPF’s proposal will be presented to the legislature in the fall of 2019.

Key Takeaways

Recognizing traditional employer-based benefits structures no longer offer a reliable way to sustainably meet workforce and economic needs, forward thinking leaders are looking to universal portable benefits as a way to rebuild failing systems.

Hearteningly, momentum is gaining behind this work. As it does, successful efforts to pass and implement these new programs show us the value of:

- Learning from best practices: As the prevalence of universal portable benefits programs grow, best practices are emerging. Newer programs are increasingly incorporating these lessons into their plans and structures, resulting in stronger, more effective, and equitable systems.

- Tailoring programs to meet state needs: The beauty of state-based universal portable benefits systems lies in policymakers’ ability to tailor programs to meet state needs and leverage existing resources. No two portable benefits systems are exactly alike. Instead, policymakers have been able to learn from others, while simultaneously creating individualized systems which work best for their state.

- Harnessing creativity and innovation: State policymakers are in the unique position of being able to both learn from the best practices of others, while simultaneously playing a leading role in the development and expansion of universal portable benefits. While there’s been a great deal of forward momentum in creating new portable benefits over the past few years, much work remains. As a result, there’s a tremendous opportunity for policymakers to set their states apart by creating new and innovative systems built on well-founded best practices.

- Acting on recognized needs: Leaders in each of the states with new portable benefits systems, in part, took action because they recognized the economy has permanently changed. Policymakers took stock of these changes and explored their consequences. Armed with research and well-developed plans, state leaders acted to fill existent holes, knowing inaction comes with a cost.

Colorado is at a crossroads. The economy of the future is upon us, and we have a choice in how we respond. We’ve already taken some action to develop our own unique universal portable benefits system, but we can, and must, do more. By learning from work in other states and tailoring best practices to create a universal portable benefits system that works for Colorado, we’ll be taking positive steps to help our workers, workplaces, and communities meet the challenges of the future head on.