Ready for Retirement & Still Grappling with Student Loan Debt

When we visualize the face of the national student loan debt crisis, we tend to think of people in their 20s and 30s struggling to start careers, families, and build a better future. But increasingly, the face of unmanageable student loan debt is also that of retirement-age Americans. While some older borrowers have student loan debts from their own studies, about two-thirds borrowed for a child’s or grandchild’s education. A growing number are defaulting on their loans and many are falling into poverty as a result.

These are among the key findings in a recent report from the federal Consumer Financial Protection Bureau (CFPB), based on its own research as well as on studies by the U.S. Government Accountability Office and the Federal Reserve Bank of New York. Specifically, the CFPB found:

- From 2005 to 2015, the number of Americans age 60 and older with student loan debt quadrupled from 700,000 to 2.8 million.

- During the same period, the average amount of student loan debt owed by these borrowers nearly doubled from $12,100 to $23,500.

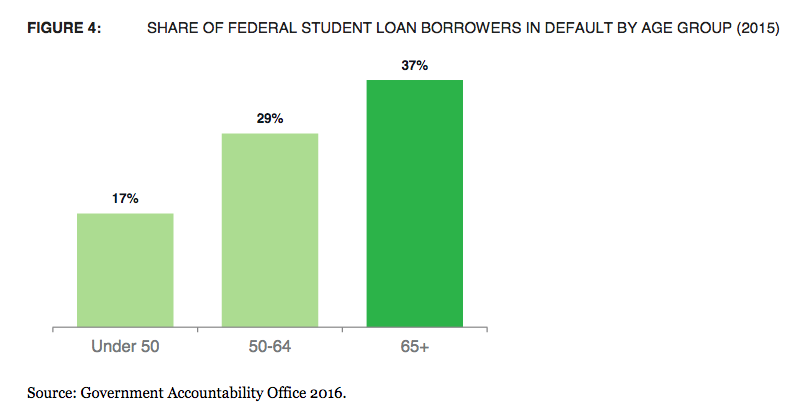

- In 2015, 37 percent of federal student loan borrowers age 65 and older were in default, compared to 17 percent of those under age 50, and 29 percent of those age 50-64.

When older borrowers default, the federal government may “offset” – that is, garnish or reduce – their tax refunds and benefits such as Social Security in order to help repay their federal student loans, even if it means pushing them into poverty. The CFPB also found:

The CFPB also found:

- From 2005 to 2015, the number of borrowers age 65 and older in default who had their Social Security benefits offset to repay a federal loan more than quadrupled, from 8,700 to 40,000.

- In 2015, 16 percent of borrowers age 65 and older in default had Social Security benefits above the poverty line that were reduced below the poverty line by offsets. Another 42 percent of such borrowers already had Social Security benefits below the poverty line that were further reduced through offsets.

This is a very disturbing trend and one with long-term implications for individuals, families, and society. It also represents an important confluence between two of the Bell’s top policy priorities: college affordability and retirement security. We need to tame unsustainable college costs since we know they can harm both students and families with debt that reverberates for decades. Simply put, it’s not just young lives that are harmed by unmanageable student debt.